Social media giant Meta Platforms (META +0.32%) is aggressively investing in the buildout of artificial intelligence (AI) infrastructure, including AI data centers, servers, and network infrastructure. The company guided for fiscal 2025 capital expenditures of $70 billion to $72 billion, up from the previous estimate of $66 billion to $72 billion and significantly higher than the $39.2 billion capex in fiscal 2024. Meta expects an even higher fiscal 2026 capital investment in compute capacity and increased spending on compensation expenses for AI talent.

Despite these high levels of spending, Meta can still prove a smart pick for long-term investors with high risk tolerance. Here's why.

Image source: Getty Images.

Robust financials and fundamentals

In fiscal 2025's Q3, Meta's revenue rose 26% year over year to $51.2 billion, while operating income was up 18% year over year to $20.5 billion. The net income, however, was down 83% year over year due to increased one-time, noncash tax payments after the implementation of the One Big Beautiful Bill Act.

NASDAQ: META

Key Data Points

However, the real opportunity for Meta is in the future monetization potential of its AI products and services. The company is building data center and compute capacity ahead of demand to support future AI workloads across its family of apps. Meta is already leveraging AI heavily in its content recommendation engines, ad ranking and targeting systems, and messaging experiences in its applications.

With more than 3.5 billion people using at least one of the company's applications every day, the company's exceptional scale and geographic reach magnify the impact of every incremental improvement in AI capabilities. Hence, if executed properly, Meta's AI strategy can translate into meaningful improvements in user engagement and ad conversion rates, which will then boost top-line and bottom-line performance for several years.

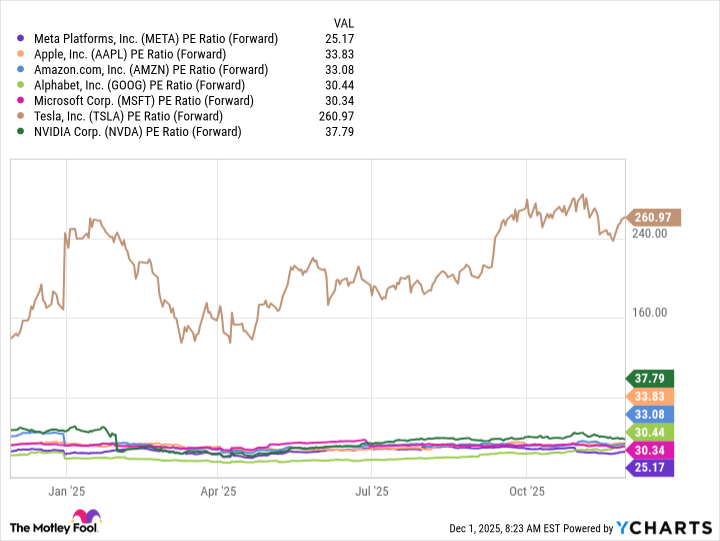

Data by YCharts.

Meta stock trades at around 25 times forward earnings, the lowest among the "Magnificent Seven" stocks.

Hence, considering its multiyear AI-powered tailwinds and reasonable valuation, long-term investors with above-average risk appetite can consider picking a stake in this stock, despite the high capex levels.