Any investor can make money in the good times when the market is rolling. But it's being able to make money, or simply not lose money, in the down times that sets the best investors apart. Investors must think long-term through the entire business cycle when picking stocks or exchange-traded funds (ETFs) because one bad year can erase three or five years of strong returns.

One of the most difficult environments to invest in is during a recession, when economic activity is contracting, often sending investors to the sidelines. But this ETF can help you weather the storm, based on 30 years of market data.

How to play defense

Investors with a long-term horizon should be prepared to deal with volatility, especially in some of their high-growth names. However, it will also help your overall portfolio -- and likely your sanity -- to have some exposure to defensive sectors that can outperform in recessions, and perhaps even deliver some reliable passive income.

Image source: Getty Images.

Consumer staples have historically been the strongest sector during a recession. These are companies that produce products that consumers consider essential in their budgets. Remember, consumer spending makes up almost 70% of U.S. gross domestic product (GDP). Essential products are things like toothpaste, food, and medicine, things the consumer needs daily and simply can't afford to put on the back burner.

While consumer staples may not yield nearly as high returns as sectors like artificial intelligence in a bull market, they tend to prove sturdy in a recession, as evidenced by historical data. According to data compiled by Bloomberg and iFAST, consumer staples outperformed all other sectors 12 months before and 12 months after the start of recessions dating back to 1990. This includes the early 1990s Recession, the Dot-Com Bubble, the Great Recession, and the COVID-19 pandemic.

In the 12 months preceding these recessions, consumer staples generated an average return of 14%. During the 12 months following the recession's onset, the sector generated an average return of 10%.

This ETF has a 2.71% yield

The Consumer Staples Select Sector SPDR Fund (XLP 0.10%) launched in 1998. Over 31% of the fund is invested in consumer staples distribution and retail stocks, close to 20% in beverages, 18.5% in food products, over 17% in household products, and nearly 10% in tobacco. The fund holds many of the stocks one might expect a consumer staples ETF to hold. Here are the fund's top five holdings by weight.

- Walmart -- 11.05%

- Costco Wholesale -- 9.33%

- Procter & Gamble -- 8.18%

- Coca-Cola -- 6.62%

- Philip Morris International -- 5.77%

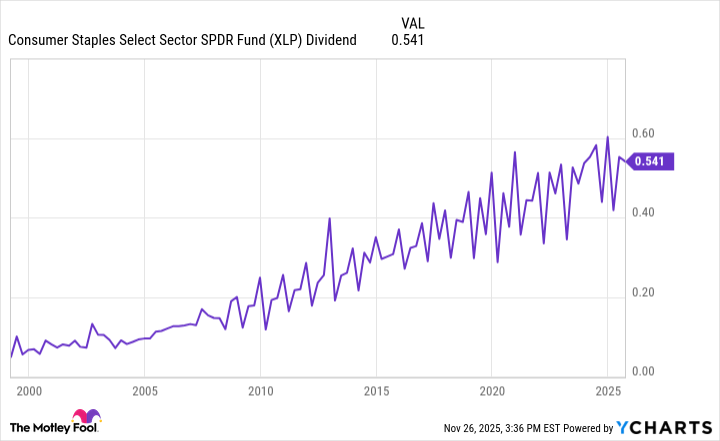

Although returns since inception have been modest, the fund also boasts a strong trailing-12-month dividend yield of 2.71% and a solid 25-plus-year track record of paying and increasing its dividend.

XLP Dividend data by YCharts

Now, because returns haven't been that good over the long haul, investors don't need to put all of their capital into consumer staples. In fact, if you do, you could essentially be losing money if returns aren't keeping pace with inflation. Investors should allocate a portion of their capital to an ETF like XLP and can increase their allocation as they approach retirement, focusing on preserving funds rather than growth as they age.

An ETF may also be a good place to park capital if you are worried about frothy market conditions, like ones apparent today, and don't feel comfortable putting money in the S&P 500 index, which is heavily concentrated by the "Magnificent Seven" and a handful of other high-flying AI stocks. Ultimately, when considering portfolio construction, long-term investors can allocate a substantial portion of their capital to growth sectors while also placing some capital in defensive sectors for a balanced approach.