Quantum computing is one of the more exciting investment trends at the moment. But the company named Quantum Computing Inc. (QUBT +1.36%) isn't the safest way to invest in the trend. In fact, I wouldn't touch Quantum Computing stock with a 10-foot pole.

Don't misunderstand: Quantum Computing -- otherwise known as QCi -- has several things going for it. First and foremost is its approach to quantum computing. Whereas many companies are designing systems that rely on cryogenic cooling, this company is designing computers that operate at room temperature. That may be the more practical long-term solution.

Image source: Getty Images.

Moreover, QCi has the balance sheet to make some waves in this space. Between cash and investments, the company has over $1.5 billion at its disposal. This liquidity will help management run its game plan for the next three years and beyond.

Investors should take a long-term view of at least three years when buying a stock. But in this case, the path forward for QCi is fraught with risk that I'd prefer to avoid in my portfolio.

What are the risks for investors?

The biggest risk for QCi investors today is execution risk. For the third quarter of 2025, the company generated revenue of $384,000, and its total revenue over the last 12 months was less than $1 million. In short, it's a research phase start-up hoping to scale.

NASDAQ: QUBT

Key Data Points

QCi looks to fabricate its own quantum computing hardware. Its current facilities are just for testing processes and delivering prototypes to customers. Management hopes to work out the bugs over the next three years before scaling up production to a commercial level.

Scaling isn't easy, which is why I say that there's execution risk here. But the timetable also amplifies the competition risk for QCi. Many players in the quantum computing space are already scaling production, including some with deep experience in foundries such as Intel.

Waiting three years to meaningfully scale the business is the right choice -- you can't move faster than your technology or manufacturing processes. But waiting three years could put QCi behind, given the rapid developments in the space.

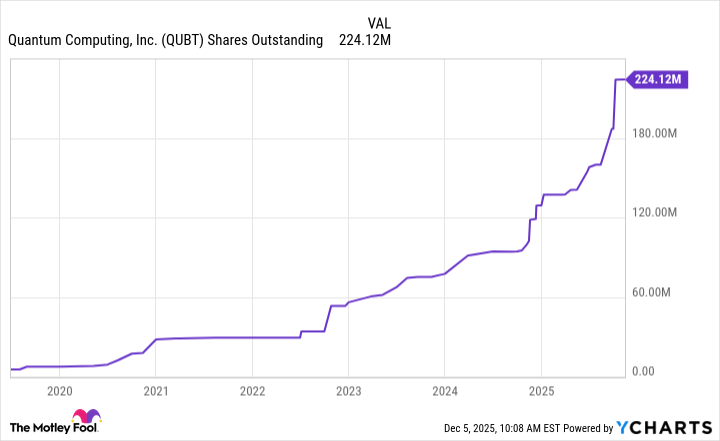

QCi has execution risk and competition risk. But another risk for investors today is dilution of shareholder value. As mentioned, the company has a great balance sheet. But much of its cash position was achieved by issuing new shares. The chart below shows how fast the outstanding share count is going up.

Data by YCharts.

As good as the balance sheet is for QCi, it's possible that it will need more money over the next three to five years, which could lead it to issue shares yet again.

In conclusion, I believe it's too early to invest in QCi. Its technology has yet to gain traction, its business model is still unproven, and current shareholders are being diluted. Over the long term, it's possible that QCi emerges as a leader in the space. But I believe it's best to watch this company from the sidelines until there's a more substantial business here to evaluate.