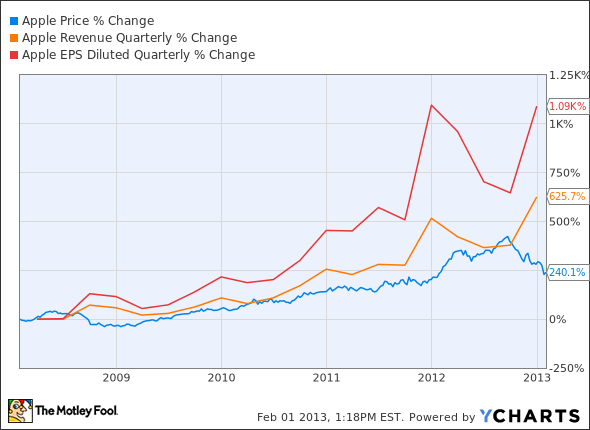

Apple (AAPL -1.66%) has long been a favorite stock for growth investors. It's not hard to see why Cupertino's top and bottom lines have absolutely exploded over the last decade or so, and the stock was bound to follow suit.

But the era of explosive growth appears to be coming to an end. iPhones and iPads are still selling in record numbers and generating record profits, but the upward trajectory isn't quite what growth buyers are looking for these days.

But even if Apple's growth peaked in 2012, the stock could still be a fine vehicle for income investing for years to come.

The 35% share price plunge over the last five months has done wonders for Apple's dividend yield. New investors are treated to a 2.3% yield if they buy in at current prices. Compare this to the measly 1.5% yield you were looking at last summer, when shares traded at all-time highs.

The Dow Jones Industrial Average (^DJI 0.46%) is packed to the rafters with high-quality income plays, as every single one of its 30 components pays a dividend today. These stocks are the cream of the crop, hand-picked for their unique ability to reflect the health of the overall market.

How does Apple's payout compare to this august index? Pretty well, I'd say. The Dow's average yield is a healthy 2.7%. AT&T (T -1.26%) offers the richest payout at 5.2%, with telecom rival Verizon's (VZ -0.86%) 4.7% yield hot on its heels. Wired and wireless communications services are proven cash-cow businesses, where top-line growth may be limited but companies are happy to share their cash with shareholders.

Ma Bell pays out 38% of its annual free cash flows, and Big Red shares 10% of its incoming cash. Here comes the good news for Apple investors: Cupertino doles out just 9.5% of its incoming free cash in the form of dividends. That may look stingy right now, but it leaves ample room for increases in the future.

Growing dividends are a fine substitute for jumping sales and profits. Even stodgy old no-growth companies can beat the market with a steady cash supply. So long as Apple can stabilize its proven success model for the long term, investors should be plenty happy with their quarterly checks over the next decade.