Hedge fund manager David Einhorn criticized the Federal Reserve last year for "force-feeding us what seems like the 36th Jelly Donut of easy money and wondering why it isn't giving us energy or making us feel better." Since that comment, both Einhorn and the Fed have probably lost count of just what number doughnut the market has consumed. But the analogy stands: Prices built on short-term actions, results, or sentiment don't lead to sustainable returns. Is Hershey (HSY 0.09%), the seller of many sugar highs, on its own unsustainable high at a P/E of 30? Or can Hershey keep stuffing enough chocolate into the world's mouth to keep stockholder returns sweet?

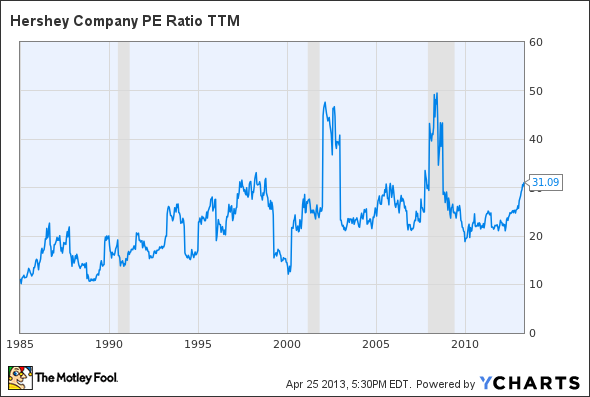

A history of Hershey's valuation

Outside of recessionary blips, Hershey's P/E has never hit above 35:

HSY P/E Ratio TTM data by YCharts.

Of course, past results have no bearing on the future. And Hershey's earnings could very well grow into supporting this P/E while rewarding shareholders. CEO John Bilbrey enlightened investors as to just how that might be achieved in the latest conference call, expecting net sales for the rest of the year growing 5% to 7%, gross margins growing 1.9% to 2.1%, and earnings per share growing 12%. This kind of expected growth puts its forward P/E around 22.

Plans to turn sugar into profit

Hershey is in the midst of what it calls "Project Next Century," in which it is spending $250 million to $300 million to modernize facilities, with annual savings between $60 million and $80 million. The company will be able to cut 500 to 600 jobs in total by the time the project is completed in 2014 as it moves to more automated processes.

Hershey's also is pushing its new Brookside brand, which "artfully combines smooth dark chocolate with exotic fruit juices." It is still early in the brand's launch, but Bilbrey says, "from what we see of the early customer reaction, consumer reaction, offtake, repurchase, we're just awfully encouraged, and we think this could be a very big brand."

Additionally, the company's international operations are seeing some high energy. China, Mexico, and Brazil revenue taken together increased 20% over the past year. In China, the small chocolate Kisses took more than a percentage point of market share recently, for a total near 6% of market share. In Mexico, the company said it was the fastest-growing chocolate brand in convenience stores, while in supermarkets its Kisses sales were up over 16%. In Brazil, the company beat a local branded chocolate bar to take the No. 3 spot in the market.

But is it worth the potential sugar crash?

Hershey's solid profit margins, capital investments, and strong sales performance make it a quality company, but you have to pay up for that quality. A competitor like Mondelez (MDLZ 1.40%) has lower margins, with lower return on assets and equity, but is a little more than half as expensive based a variety of valuations:

| Company | P/E | PEG | P/S | Price to Cash Flow |

|---|---|---|---|---|

| Hershey | 30 | 2.6 | 3 | 22.9 |

| Mondelez | 18.5 | 1.5 | 1.6 | 12.8 |

With Hershey's stock up over 20% this year so far, the phrase "priced for perfection" comes into mind. Depending on how well you think Hershey can execute in the future, it's likely worth its premium price.