Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does AK Steel (AKS) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell AK's story, and we'll be grading the quality of that story in several ways:

- Growth: are profits, margins, and free cash flow all increasing?

- Valuation: is share price growing in line with earnings per share?

- Opportunities: is return on equity increasing while debt to equity declines?

- Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at AK's key statistics:

AKS Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

27.1% |

Fail |

|

Improving profit margin |

(634.5%) |

Fail |

|

Free cash flow growth > Net income growth |

11.1% vs. (146,600%) |

Pass |

|

Improving EPS |

(45,420%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

(84.6%) vs. (45,420%) |

Fail |

Source: YCharts.

*Period begins at end of Q1 2010.

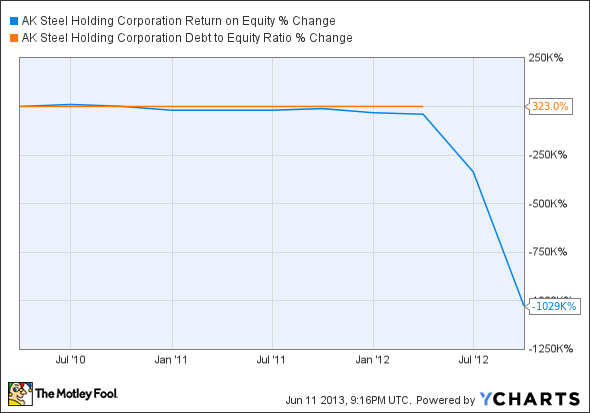

AKS Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(One Million Percent) |

Fail |

|

Declining debt to equity |

323% |

Fail |

Source: YCharts.

*Period begins at end of Q1 2010.

How we got here and where we're going

AK only musters a single passing grade because of a technicality: its negative free cash flow in 2010 was slightly more negative than its negative free cash flow in 2013. Toeing the line between profitability and red ink at the start of the tracking period has produced some of the most ridiculous percentage declines I have ever seen on these tests, including the first-ever million-percent decline on any metric. In theory, things can't possibly get much worse, but reality can be harsh. Is there any hope left for AK today?

Most recently, AK boosted the prices on some flat-rolled steel products and some stainless steel products, which ought to help swing the company back to a profit, as its most recent quarterly loss was a hair above $10 million. Without buyers, however, that won't matter much in the long run. There is actually good news on this front, according to my fellow Fool Daniel Miller -- more than a third of AK's sales went to the automotive industry in 2011, and that industry appears to still be on a cyclical uptrend. The duration of that uptrend could be long enough to make the company worthwhile again, but not if it reverses in the next couple of quarters.

The steel industry has seen all sorts of outcomes in recent years, which makes it a little more difficult to predict industrywide trends:

AKS Net Income TTM data by YCharts

U.S. Steel (X -1.27%) and Nucor (NUE -0.98%) have both improved their earnings during the past three years, but ArcelorMittal (MT -6.57%) has suffered what may be a steeper drop in a real sense, as it actually started from a position of strong profitability before collapsing through 2012. These longer-term trends can mask shorter-term problems -- Nucor's earnings have slipped from last year's levels. It doesn't help that big producers are faced with a glut of steel production from smaller players, holding back any real attempts at price boosts (AK's recent efforts notwithstanding).

AK's rebound, if it happens, may not happen this year. Steel demand requires strong economic growth, and America alone can't power the world economy when so many other countries appear to be heading for a period of weakness.

Putting the pieces together

Today, AK Steel has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.