Organovo (ONVO -2.61%) is a tiny company that is starting to capture the imagination of medical professionals and investors alike. Many are enthralled by the company's long-term goal of printing human organs for transplants. But that doesn't explain the fact that the company's stock is up more than 100% in the past month.

NovoGen Bioprinter. Source: Organovo.

There's been a perfect storm of three variables that have likely helped Organovo shoot higher. As we'll see, however, investors need to tread carefully, and closely examine their investing thesis.

A possible buyout?

In a lot of ways, Wall Street can be like your average fifth grade classroom. Once a juicy rumor gets started, it's hard to stop its spread or dispute its validity. Such is the case in the realm of 3-D printing.

Last month, Hewlett-Packard (HPQ -0.36%) announced that it would be entering the 3-D printing market. Since then, rumors have been swirling that the company could be looking to acquire one of the smaller 3-D printing companies on the market. That has helped push shares of Organovo and its competitors higher.

If the potential for a buyout plays a big role in your investment thesis, however, it's best to stop and take a reality check. While a buyout certainly could be in Organovo's future, the ability to predict it, and the price at which it will happen, is nearly impossible. Like the fifth-grade rumors, you'd be better off focusing on the facts, and not the speculation.

An industry on fire

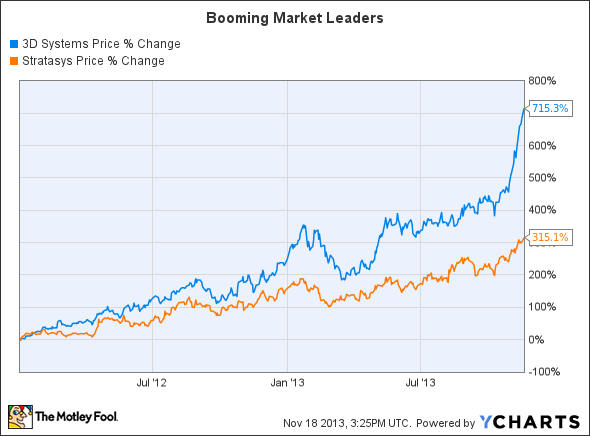

There's no question that 3-D printing is one of the hottest industries of the past few years. The two largest players, 3D Systems (DDD -2.59%) and Stratasys (SSYS -1.61%) have both seen their market value explode since the beginning of 2012.

Though enthusiasm for this new technology plays a role, both of these companies have also done the hard work of proving that 3-D printing is an industry worth investing in. Take a look at the annualized revenue growth each has accomplished since 2010.

Sources: Yahoo! Finance, E*Trade.

But investing in a company simply because it is in a hot industry can be a recipe for disaster. One need only look back to the dot-com bubble at the turn of the century to see that just because a company is associated with a "hot" trend by no means makes it a solid investment.

Remember, Organovo is currently valued just shy of $1 billion, and yet has produced just $129,000 in revenue over the past six months. The company might have potential, but it is by no means in the league of 3D Systems or Stratasys right now.

Real potential

And yet, despite my bearish warnings, I am actually a shareholder of Organovo. But the key distinction I'd like to make is that my decision has nothing to do with buyout rumors or the fact that major 3-D printing players are doing well.

Instead, my investment thesis has to do with what Organovo actually does right now. Specifically, I'm excited about the fact that the company has been able to bioprint liver tissues that can mimic native liver behavior for more than one month. No other company has been able to do this, and it represents an enormous value for pharmaceutical companies.

As it stands now, big pharma spends billions on drugs that will eventually be thrown in the trash because of liver toxicities. Until now, those toxicities didn't show up until human trials began. With Organovo's liver assays becoming available in 2014, these toxicities will become detectable much earlier in the approval process, potentially saving drug companies billions of dollars.