Citigroup (C -2.63%)continues to trade at a massive discount even after the rest of the sector has rallied, unearthing one of the best deals in bank stocks right now.

Over the past few months, many banks have outperformed the market significantly. Since October, Bank of America (BAC -3.53%) is up about 21%, Morgan Stanley is up 5%, and JPMorgan (JPM -1.14%) is up 10%, even after the entire sector pulled back significantly over the past couple of weeks.

Unlike the rest, Citigroup(C -2.63%) is down less than 1% as its peers have posted excellent gains. Aside from the fact that it has underperformed the rest of the sector, there are still several compelling reasons to get into Citigroup, as this sale won't last forever.

Reason 1: Improving business

Although Citigroup's latest earnings report disappointed the market, the company still improved its earnings by 21% over last year's. Most of the disappointment was the result of lower bond trading revenues and lower-than-expected equity trading revenues.

However, Citigroup did mention a few things in their annual report that indicate a continuing improvement in its business. Net credit losses in the fourth quarter were 15% less than they were for the same period a year ago. Also, the bank's deposits grew by 4% from last year, and the loan portfolio grew by 7%. As a result, Citigroup's tangible book value per share increased by 8% since last year, indicating that the intrinsic value of its business is on the rise.

Despite the setback of not meeting analysts' expectations, CEO Michael Corbat says the bank's post-crisis turnaround is on track, and it will achieve many of its turnaround goals by 2015. The company has done an excellent job of winding down its Citi Holdings assets (which was the original focus of the turnaround strategy), which have declined by 25% in the past year, and its investment banking division is delivering excellent results.

The company has said that it plans to greatly improve and grow its U.S. retail banking business. The goals reiterated in 2012 call for double-digit loan portfolio growth (which is almost there now) and high single-digit deposit growth by the end of 2014. It look like the company has a pretty good shot at meeting both of these goals.

The fixed-income (bond) trading weakness should be temporary, if interest rates stabilize in the coming year, which should prompt many fixed-income investors to get back into the market.

Reason 2: (relatively) low legal exposure

Perhaps, the best indicator of potential legal liability at various banks is the extent to which the bank participated in the sale of mortgage-backed securities in the pre-crisis period.

Source: Dealbook. (includes acquired companies)

Citigroup has a small fraction of the liability of these banks, issuing just $91 billion in MBS during those years, and is most likely on the hook for a lot less than the other big banks. The company has already settled with Fannie Mae and Freddie Mac for just under $1 billion and $395 million, respectively. With these two settlements completed, and with relatively low exposure, there shouldn't be much more legal drama for Citi (at least related to the mortgage crisis).

Reason 3: It's cheap!

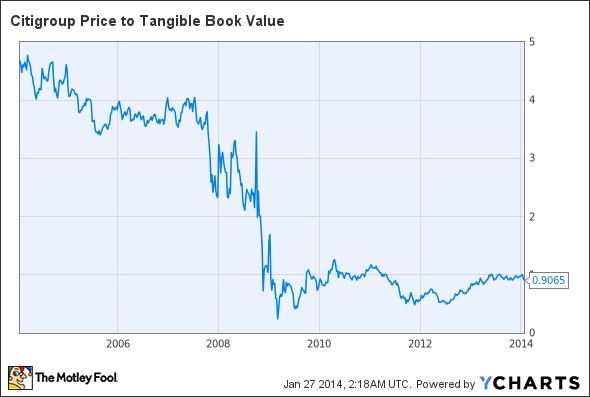

Citigroup is pretty darn cheap right now. Although the opportunity to buy the company for about 30% of its tangible book value (like you could in 2009) is likely gone forever, shares are still cheap on a historical basis.

The current price to tangible book ratio of just over 0.9 is still very low relative to both the company's historic valuation and even its post-crisis ratio. For instance, Citigroup traded for above its TBV for most of 2010, and it's fair to say that the company is much stronger now than it was then.

Now, we may not see price to TBV ratios anywhere near the pre-crisis levels anytime soon, but using Citigroup's peers and return goals as a reference, a ratio of around 1.5 sounds like a reasonable target for the next few years.

Foolish final thoughts

Even though Citigroup is cheap, there is a lot that could still go wrong that could cause trouble along the way. No one knows what interest rates, the housing market, or other aspects of the U.S. economy are going to do, and any economic setbacks could harm Citigroup's profits. Citigroup also has a great deal of international exposure, which is not as much of a risk issue to the other banks mentioned.

However, at the current valuation, the price justifies any risk associated with owning Citigroup. It may take a little while, but Citigroup's turnaround will be a success, and shareholders will be handsomely rewarded once it is complete.