Stock warrants are an alien concept to many investors, but for seasoned investors, they can be one of the most lucrative ways to invest in a stock. Like options, they offer leverage on a stock's price. However, unlike options, they are directly issued by the underlying business.

What is a stock warrant?

What is a stock warrant?

Stock warrants are an innovative financial instrument that give holders the right -- but not the obligation-- to buy a stock at a certain strike price. If that sounds like an options contract to you, you're right. Warrants and options are very similar, and we'll discuss the differences in this article.

Warrants are issued by companies as part of corporate transactions, usually to sweeten the deal for investors. For example, a company will issue corporate bonds with a lower-than-market interest rate and attach warrants to the purchase to attract investors. The investors don't quite get the yield they could elsewhere, but the upside of the warrant is attractive enough to convince them to make the purchase.

Warrants have a value, and original investors can sell them on a secondary market or exchange following issuance. Once the warrants trade on an exchange, retail investors can purchase them from brokerage accounts.

Like options, the price is made up of time value and intrinsic value. Intrinsic value is the difference between the underlying share's price and the strike price of the warrant, but never less than $0. Time value is a measure of the market's uncertainty as to whether there will be any intrinsic value in the warrant when the warrant reaches the expiration date. The more intrinsic value there is and the closer the warrant's expiration is, the less uncertainty exists so there is less time value present, and vice versa.

Warrants are leveraged to the underlying stock price, so they can be very profitable if purchased at the right time. Of course, that means they can quickly fall to $0 as well. Let's go over an example.

Bank warrants issued during the Great Recession became very popular investments once the banks started to recover. One of the most popular were Bank of America (BAC -3.78%) A warrants held by the government as part of a massive bailout. The warrants sold by the U.S. Treasury Department gave investors the right to buy BofA stock for $13.30 per share by Jan. 16, 2019.

By July 2013, the price of BofA stock had already breached the strike price of the warrant, meaning every increase would be gravy for warrant holders. On Jan. 16, 2019, the last day to exercise the warrant, the price was close to double the warrant's strike price. Consequently, investors who bought the warrants when they traded in single digits made a killing on a stodgy old conservative bank stock.

The same intrinsic value relationship, time value relationship, and leverage to the underlying stock price exist in stock options, but there are differences between the two financial instruments.

Stock warrants vs. stock options

Stock warrants vs. stock options

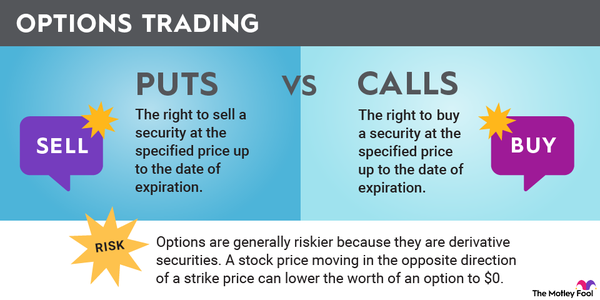

Stock options are contracts between two parties that give the holder of the option the right to buy or sell the underlying stock at a set strike price by a deadline. The seller of call options is often required to hold the underlying stock in their portfolio for the duration of the option.

That certainly sounds a lot like a warrant, so let's explore the key differences:

- Issuer: Most warrants (with an exception we'll discuss below) are issued by the actual business, and when exercised, the business issues new stock for the holder to buy. Options contracts are set up by two parties unrelated to the business, such as a stock broker. When an option holder exercises the option, the shares will change hands.

- Calls and puts: Calls give the holder the right to buy a stock, and puts give the holder the right to sell a stock. Put warrants do exist and allow investors to hedge their investments when buying new issues, but they are not as popular as put options or call warrants. The main advantage of put options is that their price goes up when the stock price goes down. If you buy a put warrant directly from the company and the price goes all the way down to $0, you may not be able to sell your stock back to the company.

- Term: Long-Term Equity Anticipation Securities (LEAPS) are the stock options with the longest terms. Most LEAPS do not offer terms greater than two years. This limits the time value of the option, which means investor upside is capped at a lower number. Warrants, on the other hand, can have a term of up to 15 years. That's a long time for the underlying stock to rise well above the strike price of the warrant.

- Capital: The final difference is that warrants represent future money that will be invested in the company (as long as the stock price stays high enough). When warrant holders exercise their warrant and buy shares, that money goes into the company's coffers.

Types

Types of stock warrants

There are different types of warrants that have subtle tweaks from the type discussed above. Let's go over the different types.

- Traditional: Traditional warrants are calls that give investors the right (but not the obligation) to buy the underlying stock from the company at a set strike price before the expiration date.

- Put warrants: Put warrants operate like traditional warrants but give investors the right to sell their stock back to the company at a strike price. This type of instrument allows investors to hedge their stock position. If the stock price falls below the strike price, they can still sell at the strike price.

- Wedded warrants: Wedded warrants are attached to another security, usually bonds or preferred stock issued by the subject company. If the investor chooses to exercise the warrant, they must also relinquish the bond or preferred stock to the company.

- Covered warrants: Also known as naked warrants, these aren't issued by the underlying company. Instead, they are issued by a financial institution that holds stock of the underlying company on its balance sheet. Covered warrants effectively act like stock options where the counterparty is a major financial institution.

Related investing topics

Warrants can work for some investors

Stock warrants aren't as popular in the U.S. as they once were. Stock options are popular enough that the market for warrants isn't robust, and companies are able to raise capital without the added costs of warrants. That isn't a bad thing for seasoned investors. The less volume and interest in arcane financial instruments, the better because it's more likely that you can find good values. Warrants can be a great investment as long as you pay attention to position sizes and keep in mind how the leverage inherent in the warrant can make it go to zero in a flash.