The United States is second only to China when it comes to installed wind power. Image source: Butz.2013/flickr.

Here's my nominee for stat of the day: The American economy added over 8 million jobs from January 2011 to June 2014. Yet despite the shale gas boom, the nation's electric power generation sector lost 5,800 jobs in the same period. It's strange, but true, according to data released by the Bureau of Labor and Statistics and compiled by the U.S. Energy Information Administration.

The job statistics only include employment figures for power generation, which excludes jobs in transmission, distribution, the processing of fuels, construction of new facilities, and installation of distributed generation systems such as wind and solar. A net loss of 5,800 jobs doesn't mean all energy sources saw declining employment, although that would have been true if it wasn't for renewable energy. While electricity generation from fossil fuels (-1%), hydroelectric (-6%), and nuclear (-9%) all saw workforce reductions in the period, renewable energy generation from wind (16%), solar (201%), and biomass (20%) all saw employment gains.

Image source: EIA.

Of course, renewable energy still represents the smallest aggregate workforce in America's power generation sector, which makes it easier to achieve eye-popping growth (i.e. 201% more solar jobs). But that doesn't discredit the momentum in renewable energy stocks and the relative weakness in other energy sources. With that in mind, can investors use growth in renewable energy jobs in the power sector to find better investment opportunities?

Investment indicator or meaningless statistic?

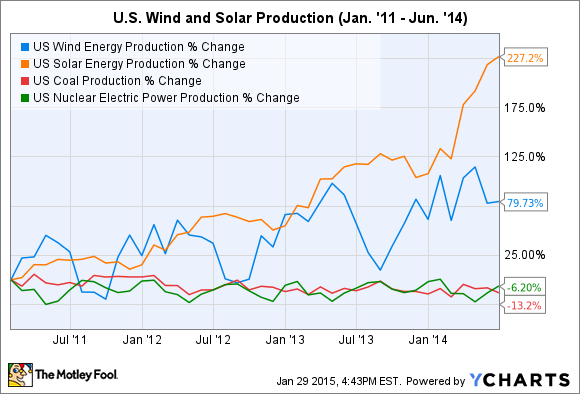

The U.S. power generation industry added over 1,800 renewable energy jobs between January 2011 and June 2014. In the same time period, the United States grew monthly production of wind and solar energy by 80% and 227%, respectively, which easily outpaced a loss of production from coal and nuclear sources. As you can see, percentage gains in production roughly matched gains in job creation.

US Wind Energy Production data by YCharts

You won't find any power generators that depend heavily on solar energy, which generated just 0.23% of the nation's electricity in 2013, but wind energy, which generated 4.13% of electricity in 2013, is a different story. Take NextEra Energy (NEE 0.34%) as an example. The share price of the nation's leading owner of wind power has performed in lock-step with monthly wind production in the period noted above.

US Wind Energy Production data by YCharts

That's not too surprising considering NextEra Energy added over 2,500 MW of effective wind power capacity during that time period. Moreover, its power generation portfolio consists of just 0.2% hydro and 3.5% coal, which have been among the hardest hit energy sources in terms of employment since 2011. While 27% of the company's generation capacity comes from nuclear power plants, it hasn't been tempted to reduce its exposure as other power generators have done.

In other words, NextEra Energy is perhaps the perfect embodiment of power sector job trends in the last several years -- and it has enjoyed amazing performance as a result. In 2014 full-year adjusted EPS grew 6.6% and cash flow from operations grew 7.8% compared to 2013. Zoom out further and there's no doubt that the company's long-term growth has been positively affected by over $16 billion in wind energy investments. But before you try to oversimplify your investment strategy, consider some humbling realities.

Is it really this easy?

After a little retrospective analysis, there certainly appears to be a correlation between trends in renewable energy jobs and NextEra Energy's performance, but good luck trying to use the relationship as a predictor of future results. Why? Job creation is the result of real projects being built in the physical world, not the other way around. That means you should focus on what factors affect capacity expansion decisions, which is what really drives job growth.

When it comes to wind capacity, investment decisions are heavily influenced by government incentives. The Production Tax Credit, or PTC, provides 2.3 cents per kWh of electricity produced for the first 10 years of operations, but only if construction began during a year in which the PTC was active. You may have noticed that the final three months of a given year seem to be the industry's favorite time to build new capacity. That's because decisions on extending the PTC usually occur at the last minute after getting caught up in budget bills. Of course, while tax credits are great in the near-term, NextEra Energy will lose out on hundreds of millions of dollars in tax benefits (nearly all counted as earnings) once a wind farm operates beyond the initial 10-year period.

There are unique circumstances surrounding solar energy, too. There are grid-scale solar projects in operation and in development, but most solar energy will likely come from distributed systems. That makes rooftop solar providers such as SunPower and SolarCity, not power generators, the most likely beneficiaries of growth. It also means most of the solar jobs created won't be reflected in data released from the Bureau of Labor and Statistics, which only tracks power generation jobs. For instance, while the data above show that less than 2,000 solar jobs existed in power generation at the halfway mark in 2014, The Solar Foundation maintains that over 173,000 Americans worked in solar-related positions at the end of last year. That's quite a big difference!

Finally, job creation ebbs and flows from month to month or year to year, even with a healthy stream of generation projects in the pipeline. We here at The Motley Fool like to invest on long-term principles and trends. Unfortunately, gains and losses in renewable energy jobs don't qualify. The need for cleaner, cheaper, and more distributed energy, on the other hand, may be something to consider.

What does it mean for investors?

Investors can watch growth in renewable energy jobs to glimpse industry trends, but job creation is a result of increased interest and investments by companies, which itself is affected by numerous factors, ranging from tax credits to air pollution regulations. Meanwhile, data reported by the Bureau of Labor and Statistics are better suited for tracking trends from traditional power generation occurring in maintenance-intensive, centralized power plants. That doesn't account for the fact that renewable energy generation typically occurs in low-maintenance, distributed systems that aren't always owned by power generators.

So although it appears that NextEra Energy's performance is correlated with renewable energy job creation, investors are better off keeping an eye on the factors affecting the company's investment decisions. It's not as simple as glancing at the monthly jobs data, but it increases your chances of being a successful investor.