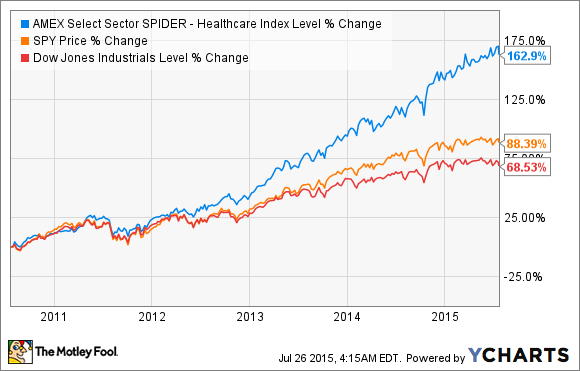

Over the past five years or so, healthcare stocks have been absolutely trouncing the broader markets, leading many to call this unprecedented bull run a "bubble."

A deeper look, though, reveals that most of this hypergrowth in the healthcare sector has been fueled by a massive rise in earnings, especially among big pharma and big biotech companies developing next-generation drugs.

While there's little doubt that the market has been willing to pay a decently sized premium for this double-digit earnings bonanza among drugmakers in general, the long and short of it is that this incredible rise has had a healthy fundamental basis. In other words, it definitely wasn't the result of pure, unchecked speculation, per many of the classic bubbles throughout the history of the stock market.

And that's why last week's second-quarter earnings report for AbbVie (ABBV 1.11%), Biogen (BIIB -0.19%), and Illumina (ILMN -2.48%) are so troubling -- and may indicate that the sun is now setting on this particularly profitable era for the sector. Here's why.

A strong dollar, shipping issues, and weak sales hurt AbbVie's second-quarter revenue

AbbVie missed consensus on revenue by 2% last week, posting $5.5 billion in revenue for the three-month period. Most of this miss can be directly attributed to a 3% miss on Humira sales for the quarter, stemming from a whopping 14.3% drop in international sales to a shipping issue and unfavorable exchange rates.

Making matters worse, AbbVie's hep C cocktail, Viekira Pak, also failed to pick up much momentum during the quarter, generating only $385 million in sales. This pivotal growth product is thus way off its projected annual sales estimates for 2015 of nearly $3 billion at this point. So even though AbbVie's management reaffirmed its annual guidance for an adjusted diluted earnings per share of $4.10 to $4.30, the market obviously wasn't convinced, dropping the drugmaker's shares by nearly 4% in the wake of its second-quarter earnings release.

Biogen lowers annual guidance; shares collapse by 22% in a single day

It's not often that large-cap stocks drop by over 20% in a single day, but Biogen did just that last Friday after reporting weaker-than-expected second-quarter revenues, and significantly lowering its annual guidance to boot. Digging into the details, Biogen reported a 7% increase in revenue for the quarter at $2.59 billion, but the Street was expecting a figure closer to 7.5%, in terms of year-over-year sales growth.

Source: Biogen

What really shocked investors, however, was the company's revised guidance that called for an 8% rise in revenue for the year on the high end. Management's prior guidance suggested that Biogen could see upwards of a 16% jump in year-over-year sales. Per the conference call, Biogen's brass was quick to pin the blame on slowing growth in the U.S. for the biotech's flagship oral multiple-sclerosis drug Tecfidera. The market is apparently concerned that this trend will continue going forward, meaning further downward revisions might be coming down the pike.

Illumina nosedives on second-quarter earnings

Last week, Illumina's shares dropped by 11% in one day after the company missed consensus on revenue by $3 million because of slower-than-expected sales for its high-end sequencer HiSeq X. Although Illumina isn't a drugmaker per se, it does play an important supporting role in the development of next-generation drugs and cellular therapies, making it a key stock to keep tabs on regarding the overall health of the pharma industry as a whole.

The most interesting part, though, is that Illumina still expects revenue and earnings to grow by upwards of 20% for the year. So why did Illumina fall after reiterating high double-digit growth and only a slight revenue miss? The issue is that the market was clearly expecting even higher levels of growth, given that Illumina's shares were trading at a forward price-to-earnings ratio that topped 60 before this drop. Going forward, it's looking increasingly unlikely that Illumina can meet these lofty expectations, suggesting that its share price may have further to fall.

Is the sky falling?

Based on the marked declines in each of these three bellwether healthcare stocks last week, you might think the sky is now falling and it's time to head to the sidelines. But I beg to differ, and think patience is the best course of action for a couple of reasons.

First, Biogen ended the second quarter with $4.5 billion in cash and cash equivalents, meaning it has the resources to go after an acquisition that could immediately affect its top and bottom lines. After the biotech's somewhat disappointing early-stage data release for its closely watched Alzheimer's drug aducanumab last week, Biogen may indeed be gearing up to enter the M&A fray.

AbbVie's growth story also looks far from seeing its last chapter. In fact, the company's $21 billion acquisition of cancer drug specialist Pharmacyclics isn't expected to even begin adding to its earnings until about 2017. Topping it off, AbbVie has a robust clinical pipeline that features multiple experimental drugs with blockbuster potential.

Last but not least, Illumina's only real hiccup during the quarter was the slowing growth of its top-of-the-line sequencing units, which is a market that's far from being fully developed. As cancer-drug giants such as Pfizer and Roche continue to push deeper into the personalized medicine arena, this technology is going to play a leading role. Put simply, Illumina's top end sequencers are a tad ahead of their time, but that situation will eventually change.

All told, the second quarter hasn't been great for healthcare stocks thus far, so the market may decide to cut back on the premium its willing to dole out for these stocks in the near term. A deeper dive nonetheless shows that the industry has multiple irons in the fire, so to speak, that should push stock prices higher over the long term.