[This is the second installment in a series examining index funds. In Part I, we looked at the managed mutual fund market. In this installment, we will look at how an index is calculated and what an index fund is. In Part III, we'll consider how to evaluate index funds and where to buy them.]

In the first part of this series, we saw that mutual funds are the dominant investment vehicle for individuals because they reduce risk through diversification on a scale that individuals cannot achieve on their own. And we mentioned that index funds typically have larger returns and lower fees than managed funds but that investors are largely unaware of their existence.

But why do we have index funds, and what are they?

What is an index?

In order to understand index funds, it's a good idea to understand what an index is. A market index is simply a single number which represents a market and tracks its ups and downs.

The best-known index of all time

The Dow Jones Industrial Average, or the Dow, is probably the best known index today because it has been reported for more than a century by the newspaper which owned it. In the 1880s, Mr. Dow (a reporter) recognized the need for a single number to report the day's activity of the fledgling stock market, so he teamed up with Mr. Jones (a statistician) and calculated the first index. The notion was so successful that the Wall Street Journal, which was owned by Dow and Jones, became America's most respected financial news source.

Calculating the Dow

The Dow is calculated by taking the price of 30 of the most actively traded stocks and dividing them by 30. Simple? Not when you start digging.

To begin with, which 30 stocks should you include? Because the Dow is a simple arithmetical average, a $1 change in the price of a $100 stock in the index will change the Dow as much a $1 change in the price of a $10 stock, even though the first one changed by 1% and the second changed by 10 percent.

Consequently, the Dow requires the prices of its component stocks to be in a fairly narrow price range. The largest company in the world, Apple, was excluded from the Dow until March 2015, when a stock split brought its price into the Dow's range. Berkshire Hathaway, Warren Buffett's company, will never be a Dow component as long as a single share of its stock costs around $200,000.

The S&P 500 -- a more inclusive, more representative index

Despite its notoriety, the Dow represents a tiny fraction of the more than 8,000 stocks that are publicly traded. In 1923, Mr. Standard and Mr. Poor launched their Standard and Poor's 500 index which looks at the total size (market capitalization) of each company. That way, the actual stock price doesn't matter, so it doesn't have to limit its focus. For example, Berkshire and Apple have both been included in the index for many decades now.

Whereas the Dow's 30 stocks cover roughly the top 25% of daily trading volume, the 500 stocks in the S&P 500 cover approximately 70 percent. Therefore, the S&P 500 has become the signature index for the stock market.

As interesting as the S&P 500 may be as an index (or the Dow), it is still only a number just like the index of consumer optimism or any one of the hundreds of indexes out there. You can't buy or sell the number, which means you can't invest in it.

So what, then, is an index fund?

Technically, an index fund is a special class of mutual fund, taking investments from individual investors, then pooling them to buy baskets of securities. However, where index funds differ from traditional (or managed) funds is what they buy.

An index fund buys something created to mimic or reflect an index. You can't invest in the S&P 500 index, for example, so an S&P 500 index fund imitates the index by buying all 500 stocks in the index. When you invest $100 in an index fund, you in effect buy a sliver of all the securities (stocks, bonds, etc.) used to calculate that index.

How index funds differ from managed mutual funds

1. They are not managed by "rock star" fund managers. Rather, they are primarily run by computers, which simply buy and sell securities which make up a given index. The index determines what gets bought, not a fund manager.

For example, when an S&P 500 index fund receives a million dollars in cash on a particular day, it buys a million dollars' worth of the 500 stocks making up the S&P index, in the same proportion, at that day's prices. Likewise, they only sell stocks when the fund withdrawals for a day exceed the inflows, and in that case they again sell stocks in the same proportion as the index. An index fund has no favorites.

2. Their costs are far lower because no highly paid experts are needed to research securities constantly in order to try to beat the average. Typically — though not always — they pass those lower costs on to their investors by charging very low management fees. When you buy a mutual fund, any mutual fund, you will receive the returns of that fund, but they will charge you a variety of fees. Index fund fees are usually lower than those of managed funds.

3. They have greater transparency. You can go on the Internet and see exactly what makes up a given index, so you know exactly what the index fund is investing in. You also know that it plays no games; whereas, managed funds are notorious for window dressing at the end of a quarter (meaning they sell things they don't want people to know they owned for most of the quarter, and they buy things which they deem are "politically correct" in their circles to own a few days before the quarter-end, so it shows up on the quarterly report). Index funds, therefore, are easier for individual investors to understand.

4. They perform better than the vast majority of managed funds. For reasons still hotly debated among experts, something like 75% of managed stock funds consistently fail to beat the S&P 500. Nobody can predict the future; but with an index fund, you know you're likely to be in the top 25% of all funds in terms of performance.

Caveats

Despite the simplicity of the index fund model, all is not so simple in the index fund business, though. Earlier, we mentioned that index fund investing is also called passive investing, because all the fund does is buy and sell whatever underlies the index -- computers do all the heavy lifting.

1. Fiddling. That doesn't mean an index fund has no managers, though. As time passed, a few index fund managers started fiddling with the formulas. Why be satisfied with the S&P 500? Wouldn't it be nice to have a juiced-up version which produces twice the growth?

In fact, that is easily done: Just borrow a dollar for every dollar coming in and buy two stocks instead of one. That is called a leveraged index fund. It still carries the label "index fund"; but it is no longer passive, because you have a manager fiddling with the index's formula. The bottom line is there are hundreds of funds out there which carry the name "index fund," but not all fit the image of the passive fund merely tracking a well-respected index.

2. Pricing. While it's true that an index fund costs less to manage, it doesn't mean they are all priced low. Morgan Stanley, for instance, charges almost five times Vanguard's fees for an identical S&P 500 index fund. Low cost doesn't always mean low price.

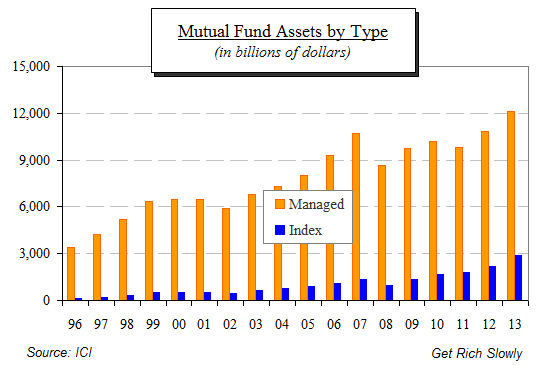

3. Limits. The combination of better performance and lower costs have led to significant growth in the popularity of index funds and their exchange-traded cousins, ETFs (Exchange Traded Funds, most of which are index funds). However, despite their recent gains in popularity, index funds only account for about 20% of all money managed by mutual funds. Why is that?

One would think that index funds would be the most popular type of mutual fund, given their higher returns and lower costs. One would, however, be wrong: Managed funds still dominate the retail investing landscape.

The mutual fund landscape

The following chart shows two things: index funds' share of total mutual fund assets has climbed; but after all these years, despite the victories of Vanguard's two signature funds, index funds as a whole are still small potatoes, comparatively speaking.

We saw in the first installment that many people simply don't know that index funds exist. But now that we understand what index funds are, we'll turn our attention in the third installment to the final questions: Where do you find index funds, and how do you choose among them?

This article originally appeared on getrichslowly.com.

You may also enjoy these financial articles: