Image Source: Enterprise Products Partners investor presentation.

It's almost impossible to find an energy company nowadays that hasn]'t seen its shares take a huge haircut over the past year. The sight of massive declines and a continuous bombardment of news stories about the trouble many oil companies find themselves in today are enough to keep most investors away from this sector. For those longer-term-thinking investors, though, this decline has put many top-notch energy players on sale, and one name that really sticks out is Enterprise Products Partners (EPD 1.41%). Here are three reasons that investors who have shied away from the energy space should take another hard look at Enterprise as a potential investment.

Plenty of growth in the pipeline

If you were to look around the midstream and pipeline space today, you'll find plenty of companies that advertise massive backlogs of projects that they claim will fund growth for years to come. By comparison, Enterprise's current portfolio of $8 billion in new projects under construction looks almost paltry.

Before overlooking Enterprise for some other companies with those big project backlogs, though, keep in mind that one thing Enterprise has done exceptionally well over the years is build through both new projects and acquisitions. In the past 12 months alone, the company has netted more than $6.6 billion in new assets, including the purchase of Oiltanking Partners, as well as a major gathering and processing network in the Eagle Ford shale formation.

These deals and its suite of projects that have come online over the past 12 months have helped the company boost its EBITDA and distributable cash flow last quarter despite the decline in oil and gas prices that have had a slight effect on some of its processing businesses.

This big pipeline of projects and the prospects of making some further bolt-on acquisitions from distressed companies looking to unload assets for cash should provide Enterprise with plenty of opportunity to grow for the foreseeable future.

High rates of retained cash flow

Unlike many master limited partnerships, Enterprise doesn't have a parent general partner to which it needs to pay the management fee we know as incentive distribution rights. What this means is that unlike many of its peers, the pressure to return almost all available cash to shareholders and the parent company isn't there. This allows Enterprise to retain large amounts of cash flow that it can put toward its growth pipeline rather than needing to tap the debt or equity markets more frequently.

This situation has an immense amount of benefits. First, retained cash used for growth lowers the cost of capital and makes the cost to grow per unit distributions that much easier. As this graphic shows, funding projects through a combination of retained cash flow and debt significantly lowers the spending needed to increase per-unit distribution than by using equity and debt funding, especially as the expected returns of projects decline.

Image source: Enterprise Products Partners investor presentation.

So far in 2015, the company has retained about $500 million in cash to go toward project funding, and it expects that figure to increase, as the company targets cash flow to exceed its distribution payments by 40%.

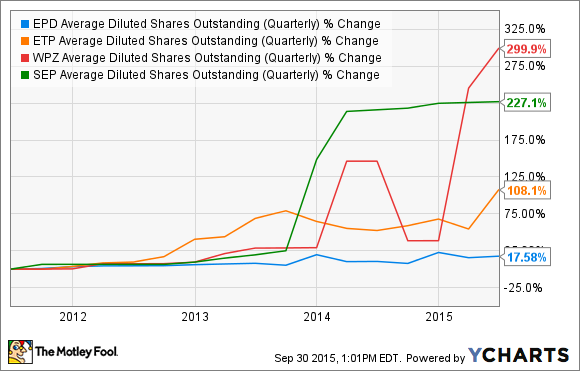

This one-two funding punch of cheap debt and retained cash has allowed the company to keep its equity issuances to a minimum. Over the past five years it has increased its unit count by only 17%, while several of its peers have more than doubled their unit counts over the same time.

EPD Average Diluted Shares Outstanding (Quarterly) data by YCharts

If the company continues this practice of keeping some cash in house and equity issuances to a minimum, it should make it that much easier to grow per-unit distributions over the long haul.

Better bang for your buck

For most investors, the value proposition of a company like Enterprise is that its stock price won't move too much with the swings of the commodity market and will pay out a pretty generous amount in dividends. So when unit prices for Enterprise declines by more than one-third in a year, it sent many of those stability seeking investors running for the hills.

However, that second part of the value proposition is still in play. There doesn't seem to be any immediate indication that Enterprise will need to keep its distribution at current levels or, even worse, cut it. Of course, that's assuming we don't see an even further collapse in oil and gas prices and a proceeding decline in volumes processed and transported in the Enterprise system, but the chances that the market will get significantly worse than today are rather slim.

Based on that assumption, you could argue that today is a great time to invest in Enterprise, as the recent price decline has pushed the company's price-to-tangible book value and enterprise value-to-EBITDA ratios to their lowest points in five years.

EPD Price to Tangible Book Value data by YCharts

At a valuation like that, it's hard to argue against it.

What a Fool believes

It's been a long, long time since a dividend or distribution yield in the 6%-7% range didn't signal big trouble on the horizon for a company. But based on the current projects currently under construction and the high levels of cash generated in excess of its current payout, there isn't much reason to believe that Enterprise's prospects are in question. With shares trading as low as they are today, it's probably time to start looking at Enterprise Products Partners again as a potential investment.