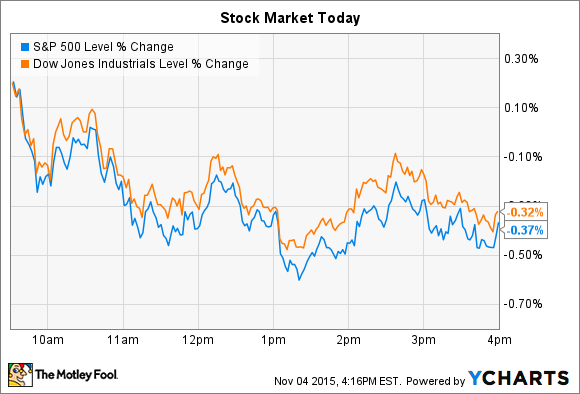

Stocks fell slightly today, as the S&P 500 (^GSPC -0.42%) lost 0.37% and the Dow Jones Industrial Average (^DJI -0.40%) lost 0.32%.

Investors' attention was keyed in on Federal Reserve Chairwoman Janet Yellen's testimony to congress this morning, which included more hints that the central bank's first interest rate hike in nine years might be coming next month.

Yellen said that Fed officials haven't made that decision yet, but if the latest employment and inflation data support it, a December hike is a "live possibility ." The numbers from this Friday's monthly jobs report will likely play an important role in the Fed's ongoing monetary policy debate.

Meanwhile, individual stocks continue to make dramatic moves as investors processed fresh third-quarter earnings reports. Electronic car maker, Tesla (TSLA 9.37%), and luxury retailer, Michael Kors (CPRI -3.97%), both surprised Wall Street with better-than-expected results.

Tesla ramps up deliveries

Tesla's stock popped over 10% after the company posted its third-quarter earnings results last night. Net loss widened – expanding to $230 million from the prior year's $75 million. But Wall Street isn't expecting Tesla to generate positive earnings just yet. After all, CEO Elon Musk and his executive team are making huge investments in energy production capabilities, and in research and development for its growing lineup of vehicles, which now includes the Model X.

The Model X. Image source: Tesla.

Still, non-GAAP revenue rose an impressive 33% to $1.24 billion and Tesla's gross margin improved to 25% from 22% in the second quarter. The company delivered 11,600 vehicles, or slightly above management's October forecast.

But investors likely found the most reason for optimism in Tesla's guidance for the fourth quarter, which, at between 17,000 and 19,000 deliveries, implies growth of as much as 64% over last quarter and 93% over the prior year period. If it hits those figures, the manufacturer will have achieved its aggressive 2015 goal of delivering at least 50,000 cars.

Management said in a shareholder letter that the next few quarters should bring other operating wins in addition to that unit sales growth. The Model X should reach full production speed in the first quarter of 2016, and, together with the Model S, Tesla now expects to deliver as many as 1,800 vehicles per week next year. At the same time, average vehicle sales prices and overall gross margin should tick higher. The development of the highly anticipated mass-market model is also going to plan so far. "We are on track to unveil Model 3 in late March 2016," Musk said .

Michael Kors' minor improvement

With its 7% rise, Michael Kors was one of the best performing stocks in the S&P 500 today. Yet that bounce wasn't enough to push the luxury accessory maker's shares back to where they were just a month ago: The stock is still down roughly 40% from where it began 2015.

The latest quarterly results showed why investors have been so pessimistic about the business. The retailer today posted a 3% drop in comparable-store sales as operating margin sunk to 24% of sales from 29% last year. Sure, total revenue rose. But that's mainly thanks to 116 new locations in the store base – not due to increasing traffic at existing shops .

Yet there were a few bright spots in the results. The 3% comps drop was an improvement over the prior quarter's 5% dive, for one. Kors also succeeded at posting accelerating growth its e-commerce business. And its wholesale sales rose by a solid 8%.

"We are pleased with our second quarter results, which were ahead of expectations and reflected the continued expansion of our luxury brand worldwide," CEO John Idol said in a press release. And while Idol and his team don't see a return to positive comps over the next two quarters, they do expect full-year revenue to rise in the low double-digit range.