3D Systems announced on Tuesday that it had signed an agreement to sell its on-demand manufacturing business.

Many investors liked this news, as the 3D printing stock jumped 11.3% on Wednesday on heavier-than-average volume. A good portion of this pop, however, is surely attributable to short-sellers (those who are betting a stock will decline) scrambling to cover their positions as the stock rose during the day.

3D Systems stock has a high short interest of 23.9%, as of the most recent data (May 14), which means that about 24% of the company's shares available for trading were sold short as of this date. The positive side of this high short interest for investors who are long the stock is that the stock's upward move on positive news will tend to be amplified.

Here's what investors should know about the company's planned divestiture.

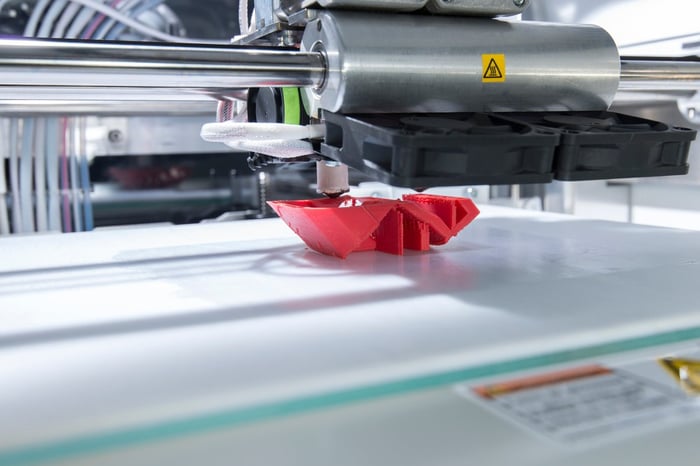

Image source: Getty Images.

The sale details

3D Systems is selling its on-demand manufacturing (ODM) business to private equity firm Trilantic North America for $82 million, subject to certain closing adjustments, it said in its press release. This operation has two facilities in the United States and three in Europe, which Trilantic will rebrand.

The company expects the sale to close in the third quarter of this year.

Why the divestiture?

In the press release, CEO Jeffrey Graves said the company's "sole reason for the divestiture is to enable our entire focus and investment priorities to be on additive manufacturing (AM), where we play a unique leadership role in enabling industrial-scale AM adoption across a range of exciting end markets."

3D Systems' ODM business focuses on the rapid production of components using both additive manufacturing (3D printing) and traditional subtractive manufacturing methods.

Graves -- who came on board in April 2020 -- began divesting non-core assets earlier this year after focusing on increasing efficiencies last year. In January, the company sold its non-core software businesses, Cimatron and GibbsCAM. These businesses were focused on traditional manufacturing, and probably should have never been acquired in the first place.

How big is 3D Systems' on-demand manufacturing business?

The ODM business probably accounts for about 13% to 16% of 3D Systems' total revenue.

The company didn't provide any revenue numbers in the press release. Moreover, it no longer breaks out the revenue for its ODM operation, which is part of its service segment. However, in the first quarter of 2020, the company did break out this revenue. In that quarter, the ODM business generated revenue of $19.7 million, or 14.6% of the company's total revenue of $134.7 million. This percentage hasn't likely changed significantly in just one year.

In the first quarter of 2021, 3D Systems' total revenue was $146.1 million. If we assume the ODM operation accounted for roughly 13% to 16% of total revenue, we get ODM revenue of about $19 million to $23 million.

Why this divestiture is a good move

- It enables top management to focus solely on 3D printing.

- It generates a good chunk of cash -- $82 million with possible adjustments at closing -- which the company can use to invest in more profitable parts of its business, such as its healthcare segment.

- It should help to increase profitability. This move will initially reduce the company's revenue, but it should also help increase its profitability. Historically, the ODM business has generally been a profitability laggard relative to other parts of the company's business.

How does 3D Systems plan to use the proceeds of the sale?

"The proceeds from the sale will be used to further accelerate our investments for growth in our core additive manufacturing capabilities, for which we are seeing rapidly rising demand in new, extraordinary applications ranging from the human body to electric vehicles and space travel," Graves said in the release.

3D Systems can afford to invest in growth initiatives now that its balance sheet is in good shape. At the end of the first quarter, it had $133 million in cash and no debt. Moreover, it's now generating cash from its operations rather than gobbling it up. In Q1, its operating cash flow was $28.5 million.

In the above quote, Graves called out the human body as one application in which the company is seeing rapidly rising demand for 3D printing. Indeed, the company's healthcare segment has been performing very well lately. One emerging area within this broad space is bioprinting, or using 3D printing technology to print animal and human cells to produce three-dimensional, functional tissues.

A major near-term application of bioprinting is in the drug discovery process, while a medium-term application is the printing of body parts such as soft tissue, bones, and arteries. The long-term goal of many working in this field is to bioprint solid human organs for transplant purposes.

In May, 3D Systems entered the commercial bioprinting market via its acquisition of Allevi, which sells bioprinters and bioinks to more than 380 medical and pharmaceutical labs in over 40 countries. Investors can expect Graves to try to quickly ramp up this business.