Traditional and Roth IRAs are both tax-advantaged retirement accounts. The main difference between a Roth IRA and a traditional IRA is when you claim the tax benefits the account provides. Traditional IRAs provide an up-front tax break when you contribute to the account, and Roth IRAs defer your tax savings until retirement.

There are also other important differences, including eligibility rules, when money can be withdrawn penalty-free, and whether you're required to take money out on the government's schedule in the future.

Let's take a look at some of the big differences between a Roth IRA and a traditional IRA to get a better understanding of how each works.

Roth vs. traditional IRAs: Tax breaks

Roth vs. traditional IRAs: Tax breaks

Traditional IRAs provide tax savings in the year you make the contributions to the account, but you pay taxes when you withdraw the money. If you contribute $1,000 to a traditional IRA in 2024, you may be able to reduce your taxable income by $1,000. If you're in the 22% tax bracket, the contribution could save you $220 in taxes because you don't have to pay taxes on the $1,000.

Roth IRAs do not provide any tax benefits in the year you contribute. If you make a $1,000 contribution to your Roth IRA in 2024, your taxable income won't be affected at all. You won't reduce your tax bill this year.

However, you're allowed to take tax-free withdrawals from Roth IRAs as long as you follow the rules for withdrawing the funds. That means that if you take $1,000 out of your Roth IRA as a retiree, you will not owe any taxes on the money then.

By contrast, distributions from your traditional IRA are taxed at your ordinary income tax rate when the money is withdrawn. If you take $1,000 from your account as a retiree, your taxable income will be $1,000 higher, and you'll owe taxes on the $1,000 at whatever your tax rate is at that time.

If you expect you will be taxed at a higher rate as a senior than you are now, you should contribute to a Roth IRA. If you expect you will be taxed at a lower rate as a senior, you should contribute to a traditional IRA. You always want to pay taxes when your rate is lower.

Eligibility for the accounts differs

Eligibility for the accounts differs

You're not allowed to contribute to a Roth IRA if you make more than the income limits. While you can use a backdoor Roth IRA to get money into this account, you cannot directly make a contribution to one.

The rules are different for a traditional IRA. If neither you nor your spouse is eligible for a workplace retirement plan, you can make tax-deductible contributions to a traditional IRA no matter what you earn.

If either you or your spouse does have a workplace plan, you lose eligibility to make deductible IRA contributions at a certain income threshold. You can still make non-deductible contributions and benefit from tax-deferred gains, but you are not allowed to take a deduction for your contribution in the year it is made.

Withdrawal rules differ

Withdrawal rules differ

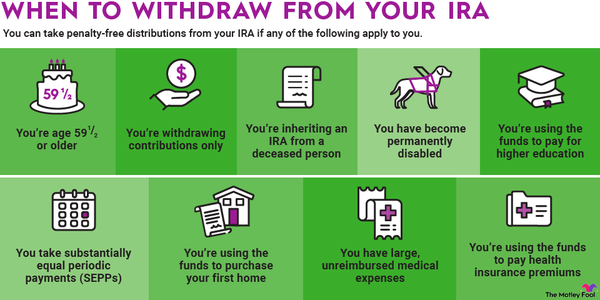

If you take an IRA distribution from a traditional IRA before age 59 1/2, you'll be subject to a 10% tax penalty for early withdrawal unless you qualify for an exemption. This penalty applies regardless of whether you're withdrawing contributions or investment gains.

The rules for Roth IRA distributions before 59 1/2 are different. You can take out the contributions you made at any time without owing this penalty. However, if you withdraw gains, then you're subject to it.

Once you reach 59 1/2, you can take money out of your traditional IRA anytime you want without consequences. If you have a Roth IRA, however, there's an additional rule to be aware of called the five-year rule. While this rule can be complicated, the basic gist is that you must wait at least five years from the tax year in which you first contributed to a Roth IRA in order to make tax-free withdrawals.

Finally, there's one more key difference. You must take required minimum distributions (RMDs) from a traditional IRA after age 73 (previously age 72). These are withdrawals you must take annually, determining the amount using tables developed by the IRS. Failure to take out at least your RMD results in a 25% penalty on the amount you should have withdrawn, though if you take swift action, the penalty may be reduced to 10%. You aren't required to take RMDs from a Roth IRA.

Is a Roth or a traditional IRA better?

Is a Roth or a traditional IRA better?

A Roth IRA is a better choice if:

- You expect to be in a higher tax bracket as a retiree and you want to defer your tax savings.

- You don't want to be mandated by the government to take required minimum distributions from your retirement account.

- You want the flexibility to withdraw your contributions at any time.

A traditional IRA is a better choice if:

- You expect to be in a lower tax bracket as a retiree, so you want to claim your tax break in the year you contribute to your retirement account.

- You earn too much to be eligible to contribute to a Roth IRA.

In 2023, you can contribute $6,500, or $7,500 if you're 50 or older and eligible for catch-up contributions. The 2024 limits are $7,000, or $8,000 if you're 50 or older. You can put this entire amount into a Roth or a traditional IRA, or you can split it however you'd like between the accounts. However, the IRA contribution limit is the total amount you can contribute between the two accounts. You cannot contribute $7,000 to a traditional IRA and another $7,000 to a Roth IRA.

Do you have a Roth or a traditional IRA?

Both traditional and Roth IRAs are individual retirement accounts, which means you open them yourself with a financial institution such as a bank or brokerage firm. Many financial institutions offer both types of accounts, so when you sign up for one, just specify which option you'd prefer.

If you already have an IRA open and aren't sure what type it is, check with the broker or bank you opened the account with. The account may specify its type in the title, or you can contact customer service and ask.