A major debate has divided the investment world for years: active versus passive investing.

Active investments are funds run by investment managers who try to outperform an index over time, such as the S&P 500 or the Russell 2000. Passive investments are funds intended to match, not beat, the performance of an index.

While there are advantages and disadvantages to both strategies, investors are starting to shift dollars away from active mutual funds to passive mutual funds and passive exchange-traded funds (ETFs). Why? As a group, actively managed funds, after fees have been taken into account, tend to underperform their passive peers.

This change is relatively recent. In 2013, actively managed equity funds attracted $298.3 billion, while passive index equity funds saw net inflows of $277.4 billion, according to Thomson Reuters Lipper. But, in 2019, investors withdrew a net $204.1 billion from actively managed U.S. stock funds, while their passively managed counterparts had net inflows of $162.7 billion, according to Morningstar.

Want to learn more about the active-versus-passive debate? Read on.

Active versus passive investing

Active versus passive investing

Here are the key differences between active and passive investment funds:

| Active funds |

Are intended to outperform a specific index, called a benchmark Have human portfolio managers and analysts Tend to have higher expenses, which can hamper performance |

| Passive funds |

Are intended to match -- not beat -- the performance of a specific index Are generally automated, with some human oversight Tend to have much lower expenses than active funds |

Pros and cons of active investing

Pros and cons of active investing

Active funds are run by human portfolio managers. Some specialize in picking individual stocks they think will outperform the market. Others focus on investing in sectors or industries they think will do well. (Many managers do both.) Most active-fund portfolio managers are supported by teams of human analysts who conduct extensive research to help identify promising investment opportunities.

The idea behind actively managed funds is that they allow ordinary investors to hire professional stock pickers to manage their money. When things go well, actively managed funds can deliver performance that beats the market over time, even after their fees are paid.

But investors should keep in mind that there's no guarantee an active fund will be able to deliver index-beating performance, and many don't. Research shows that relatively few active funds are able to outperform the market, in part because of their higher fees. The problem: It's not enough to just beat the index -- the manager has to beat the fund's benchmark index by at least enough to pay the fund's expenses.

That turns out to be a big challenge in practice. In 2019, for instance, 71% of large-cap U.S. actively managed equity funds underperformed the S&P 500, according to S&P Dow Jones Indices' SPIVA (S&P Indices Versus Active) Scorecard, a measure of the performance of actively managed funds against their relevant S&P index benchmarks.

And over the past five years? Almost 81% of large-cap, active U.S. equity funds underperformed their benchmarks.

When all goes well, active investing can deliver better performance over time. But when it doesn't, an active fund's performance can lag that of its benchmark index. Either way, you'll pay more for an active fund than for a passive fund.

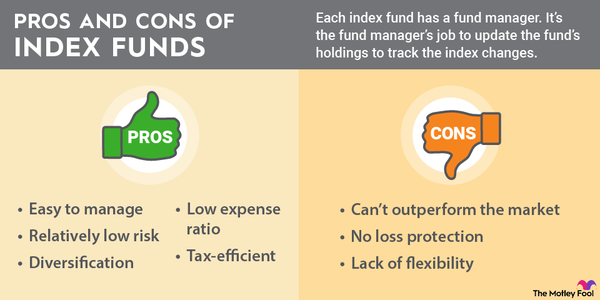

Pros and cons of passive investing

Pros and cons of passive investing

Passive funds, also known as passive index funds, are structured to replicate a given index in the composition of securities and are meant to match the performance of the index they track, no more and no less. That means they get all the upside when a particular index is rising. But -- take note -- it also means they get all the downside when that index falls.

As the name implies, passive funds don't have human managers making decisions about buying and selling. With no managers to pay, passive funds generally have very low fees.

Fees for both active and passive funds have fallen over time, but active funds still cost more. In 2018, the average expense ratio of actively managed equity mutual funds was 0.76%, down from 1.04% in 1997, according to the Investment Company Institute. Contrast that with expense ratios for passive index equity funds, which averaged just 0.08% in 2018, down from 0.27% in 1997.

While the difference between 0.76% and 0.08% might not seem like a whole lot, it can add up over time.

Say you invested $10,000 in each of two funds. One fund has an annual fee of 0.08%, and the other has an annual fee of 0.76%. If both returned 5% annually for 10 years, that lower-cost 0.08% fund would be worth about $16,165, whereas the 0.76% fund would be worth about $15,150, or about $1,015 less. And the difference would only compound over time, with the lower-cost fund worth about $3,187 more after 20 years.

What's the takeaway for investors?

What's the takeaway for investors?

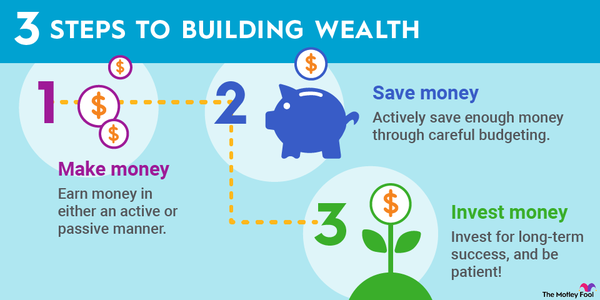

For someone who doesn't have time to research active funds and doesn't have a financial advisor, passive funds may be a better choice. At least you won't lag the market, and you won't pay huge fees. And for investors who are willing to be at least somewhat involved with their investments, passive funds are a low-cost way to get exposure to individual sectors or regions without having to put in the time to research active funds or individual stocks.

But it doesn't have to be an either/or choice. Some investors have built diversified portfolios by combining active funds they know well with passive funds that invest in areas they don't know as well.

Related investing topics

Keep in mind, though, that not all active funds are equal. Some might have lower fees and a better performance track record than their active peers. Remember that great performance over a year or two is no guarantee that the fund will continue to outperform. Instead you may want to look for fund managers who have consistently outperformed over long periods. These managers often continue to outperform throughout their careers.

As always, think about your own financial situation, your life stage, and your ability to tolerate risk before you invest your money.