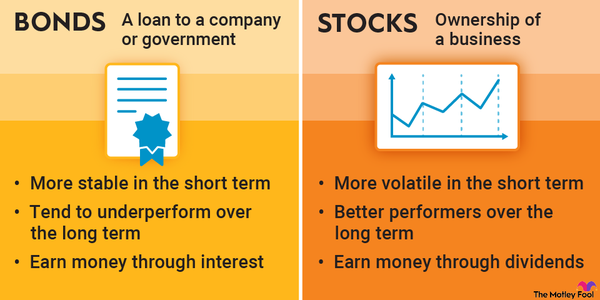

When you buy savings bonds, you're lending the federal government money. Your long-term returns from savings bonds aren't likely to be as high as those from stocks. However, you can be confident that you'll get your principal amount back since savings bonds are backed by the credit of the United States government. Read on to learn about savings bonds, the different types available, how to invest in bonds, and their storied history.

What are savings bonds?

What are savings bonds?

A savings bond is a type of debt security issued by the federal government. When you purchase a savings bond, you are giving the federal government money, which it promises to pay back at some future date. When the bond matures -- or the loan comes due -- the government will repay you the principal amount plus interest. The amount paid back at maturity will vary depending on the type of savings bond you purchased.

Savings bonds can be used to finance education, for supplemental retirement income, or as gifts.

Although savings bonds won't make you wealthy the way stocks and mutual funds can, they can be useful for financing an education. As with Treasury bonds, you can be confident about repayment because they're backed by the full faith and credit of the U.S. government.

Types of savings bonds

Types of savings bonds

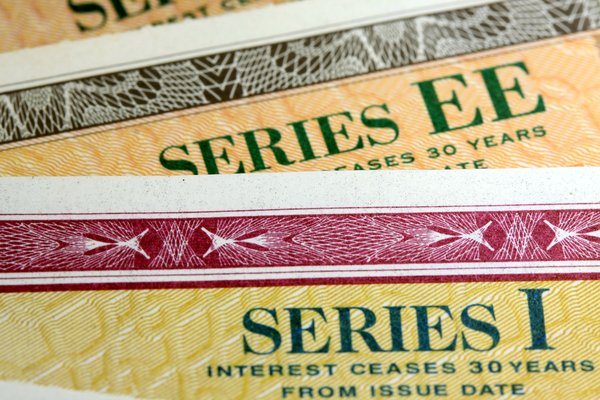

Series EE

Series EE savings bonds issued on and after May 2005 earn a fixed rate of interest and mature in 30 years. After 20 years, the bond receives a one-time adjustment that doubles its initial value. For example, if you purchase Series EE bonds for $5,000, you'll be guaranteed to have a bond worth $10,000 in 20 years. To be perfectly clear, these bonds are guaranteed to double your money in 20 years, regardless of their stated interest rate.

Series EE savings bonds issued from November 2023 through April 2024 pay an annual interest rate of 2.70%, which is added to the bond's value on a monthly basis. If the bonds are used for education, the accrued interest won't be taxable, which can make them excellent choices for college savings.

Series I

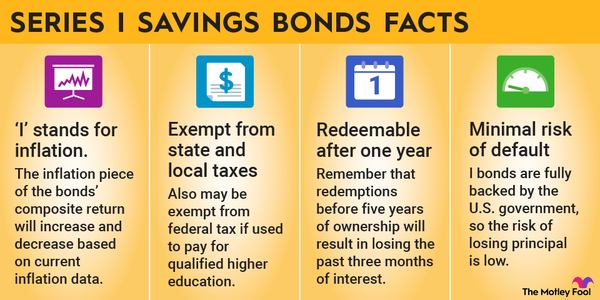

Series I savings bonds are similar to Series EE bonds, but they have their own unique characteristics. Series I bonds are best known for their inflation protection and are more commonly referred to as "I bonds."

They pay a variable amount of interest based upon a fixed rate, as well as an inflation adjustment that changes every six months. For bonds issued from November 2023 through April 2024, the fixed interest rate on Series I bonds is 1.30%, and this will remain the same for the life of the bond. Including the inflation adjustment, I bonds issued from November 2023 through April 2024 have a total interest rate of 5.27%, and this will be guaranteed for six months from the issue date, at which point the inflation component will re-adjust.

Series I bonds are sold at face value, so a $100 I bond would cost $100. Interest is added to the bond monthly and is paid when you cash the bond. You'll need to own the bond for at least a year before you can redeem it. If you redeem it before the end of a five-year holding period, you'll lose the last three months of interest. Similar to Series EE bonds, Series I bonds can be used to finance education -- the one case in which the accrued interest would not be taxable to the owner.

Series E

Series E bonds were the original bonds used to finance World War II. They were discontinued in 1980 and later replaced with Series EE bonds.

Series E bonds were sold at 75% of face value and would pay face value at maturity, typically after 10 years. The bonds, known as "war bonds," were considered zero-coupon bonds and paid no annual interest.

Series HH

Series HH bonds were 20-year debt securities that paid a fixed rate of interest for the first 10 years and then a new rate determined by the U.S. Treasury for the remainder of the bond's term. Series HH bonds were sold at face value and had to be held for at least six months.

The federal government stopped issuing these bonds in August 2004. Bonds that have yet to mature still earn interest and can be redeemed at the discretion of the owner.

How to invest

How to invest in savings bonds

You can buy either Series EE or Series I bonds in electronic form through the Treasury Direct website at treasurydirect.gov. You can also purchase Series I paper bonds with your tax refund after you've filed your annual return.

Depending on the type of bond, you should be able to cash in your savings bonds on the Treasury Direct website or at most major banking locations. There is also a mail-in option for paper bonds, but electronic redemption is likely to become the preferred way to cash out.

Key features

Key features of savings bonds

1. Non-marketable

Savings bonds are non-marketable, meaning they can't be readily liquidated or sold on an exchange. There are minimum holding periods to consider; early redemption often leads to some loss of interest. Non-marketability can be a disadvantage, but it's important to remember that savings bonds are intended as long-term investments that essentially guarantee the return of principal.

2. Purchasing restrictions

You can buy as much as $10,000 worth of Series EE bonds in any given year. Bonds come in denominations of $25 and above in penny increments (for example, you could buy a bond for $50.23). They're sold at face value, which means you pay $25 for a $25 bond. You must own Series EE bonds for at least a year before you cash them, but, like most savings bonds, you'll get the most value if you hold them until maturity.

For Series I bonds, you're also subject to the $10,000 annual limit if you buy electronically and a $5,000 annual limit if you buy paper bonds with your tax refund. Similar to Series EE bonds, they're also sold at face value. Bonds come in denominations of $25 and above in penny increments if bought electronically. If you buy paper bonds with your tax refund, you can buy them in $50, $100, $200, $500, and $1,000 denominations.

3. Interest compounds semiannually

For both Series EE and Series I bonds, interest is added to the bond's value monthly and compounds semiannually. Recall that even though both types of bonds earn monthly interest that compounds twice a year, the interest rate associated with each type of bond is different. Bonds will earn interest for 30 years or until you redeem them.

4. Redemption

Series EE and Series I bonds will pay interest for 30 years or until you cash them, although you must hold the bond for at least a year. Remember, Series EE bonds will receive a one-time adjustment after 20 years to ensure the bondholder receives double their principal. Series I bonds do not have a one-time adjustment but do offer inflation protection and a higher interest rate.

If you redeem bonds before five years have lapsed, you'll forfeit the previous three months of interest. If you redeem bonds after a five-year holding period, you'll incur no penalty and keep all the interest earned.

5. Taxes

Savings bond interest is exempt from state and local taxation except in the case of inheritance or estate tax calculations. Generally speaking, however, savings bond interest shouldn't be a concern at the state or local level for personal tax returns.

Interest earnings are tax-deferred on the federal level, meaning you won't owe tax on any interest as it's paid, but you will owe federal tax once the bond has been redeemed. A federal tax exemption is available if you use the bonds to fund higher education.

An interesting wrinkle here is that the bond needs to be issued in your name or jointly with your spouse if you intend to fund a child's education and want to avoid any taxes due. The bond cannot be issued in the name of the child. If it is, you'll be liable for any taxes on the bond's accrued interest.

History

History of savings bonds

In 1935, on the heels of the Great Depression, President Franklin D. Roosevelt signed legislation that created the first U.S. savings bond to encourage savings and investment. The bonds were also created to stimulate public participation in government financing, specifically by making each one affordable to everyday investors.

As mentioned previously, Series E bonds were originally issued to finance overseas operations, most notably before World War II. These bonds became known as "defense bonds" or "war bonds," given their popularity and effectiveness in raising money to fund military spending.

Related investing topics

Savings bonds vs. savings accounts

Savings bonds vs. savings accounts

Advantages of savings bonds

- Can offer inflation protection

- Encourage long-term investment

- Can be used to fund education in a tax-efficient manner

- Provide liquidity to the government

- Very low risk of principal loss

Disadvantages of savings bonds

- Extremely long holding period required for full benefit

- Non-marketable

- Must be purchased and redeemed according to specific rules

- May fund war operations, which is not appealing to many investors

- Rates of interest are remarkably low (Series I bonds derive most of their return from inflation protection)

Advantages of savings accounts

- Provide immediate liquidity

- Easy to access through most banking institutions

- Increased control

- No required holding period

Disadvantages of savings accounts

- No inflation protection

- Usually very low rates of interest offered

- No long-term upside

- Some banks charge fees for low balances

Savings Account

Are savings bonds right for you?

Are savings bonds right for you?

Savings bonds can be an interesting addition to any diversified portfolio. They have some unique features that you won't find elsewhere, but it's best to do your research to see if they're a fit for you. Be sure to know what you're buying before you dive in.

Savings bonds FAQs

Are savings bonds worth buying?

Savings bonds aren't likely to beat the returns of other investments (especially stocks), but have some good uses. For example, savings bonds are risk-free and their interest is exempt from federal taxes if used for higher education, so they can be great ways to save for college. There is also a type of savings bond (Series I savings bonds) that protects you from the effects of inflation over time.

How long does it take for a $50 savings bond to mature?

Series EE savings bonds mature after 30 years but can be cashed in as soon as one year after issue. However, if it is redeemed before five years, you'll forfeit the last three months of interest.

How much is a $100 savings bond worth after 30 years?

The value of a savings bond after 30 years depends on the type of savings bond and the interest rate it pays. Series EE savings bonds get a one-time adjustment after 20 years that makes the bond worth double its initial value and will continue to earn interest until 30 years after it was issued. Series I savings bonds have yields that adjust with inflation every six months.