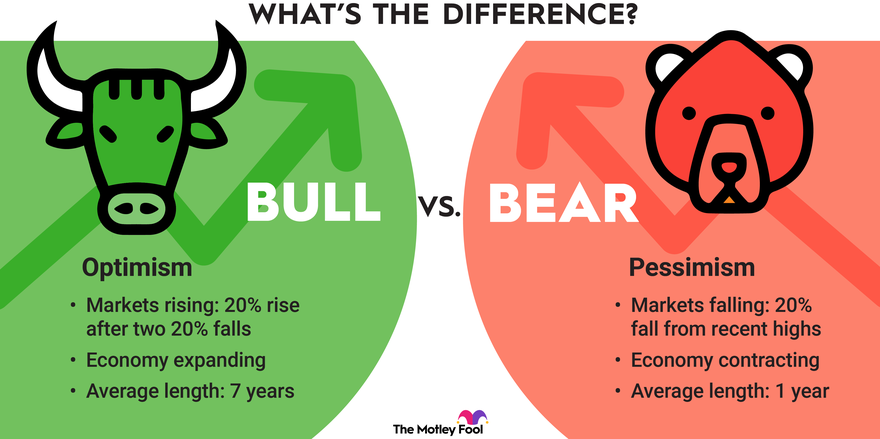

A bull market is occurring when the economy is expanding and the stock market is gaining value, while a bear market is in effect when the economy is shrinking. Let's take a closer look at these two types of markets and their relevance for your investing strategy.

What is a bull market?

According to the formal definition, a bull market takes effect when stock prices have broadly increased by at least 20% since the last market downturn. Bull market conditions can last for decades, and many successful investors have bet very wrongly by trying to predict the end of a bull market.

The U.S. stock market was in a bullish mode after recovering from the 2008 financial crisis until pandemic-related uncertainty caused a market crash in 2020. The chart below shows that, aside from minor market corrections, a bull market persisted for more than a decade.

What is a bear market?

A bear market is defined as starting when stock prices broadly decline by 20% and keep trending lower. Bear markets are characterized by people losing their jobs, gross domestic product (GDP) declining, and the stock market losing significant value. Bear markets almost never last as long as bull markets and can create buying opportunities for investors.

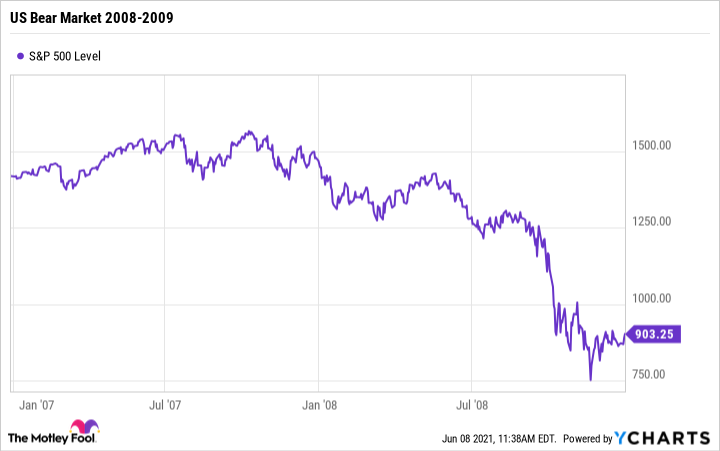

The most recent bear market began following the crash of the housing market in 2008, as made apparent by the chart below:

How do bull markets and bear markets differ?

If you want to know whether a bull or bear market is in effect, pay attention to these factors:

Stock market performance

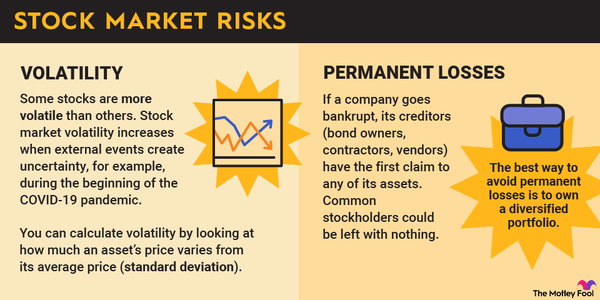

Stock prices are rising in a bull market and declining in a bear market. The stock market under bullish conditions is consistently gaining value, even with some brief market corrections. The stock market under bearish conditions is losing value or holding steady at depressed prices.

Change in GDP

Rising GDP denotes a bull market, while falling GDP correlates with bear markets. GDP increases when companies' revenues are increasing and employee pay is rising, which enables increased consumer spending. GDP decreases when companies' sales are sluggish and wages are stagnant or declining.

Bear markets are closely linked with economic recessions and depressions. Recessions are formally declared when GDP decreases for two consecutive quarters, while depressions occur when GDP decreases by 10% or more and the downturn lasts for at least two years.

Unemployment rate changes

A declining unemployment rate is consistent with a bull market, while a rising unemployment rate occurs during bear markets. During bull markets, businesses are expanding and hiring, but they may be forced to lower their head counts during bear markets. A rising unemployment rate tends to prolong a bear market since fewer people earning wages results in reduced revenues for many companies.

Rate of inflation

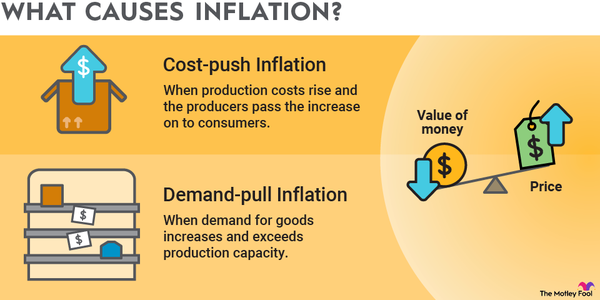

Price inflation may be a problem when the economy is booming, although inflation during a bear market can still occur. High demand for products and services in bull markets can cause prices to rise, and shrinking demand in bear markets can trigger deflation.

Prevailing interest rates

Low interest rates typically accompany bull markets, while high interest rates are associated with bear markets. Low interest rates make it more affordable for businesses to borrow money and grow, while high interest rates tend to slow companies' expansions.

Related investing topics

How should you invest in a bull vs. bear market?

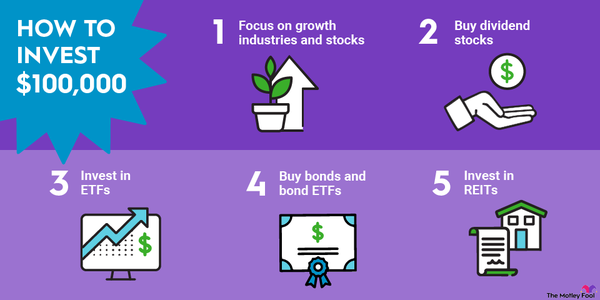

Growth stocks in bull markets tend to perform well, while value stocks are usually better buys in bear markets. Value stocks are generally less popular in bull markets based on the perception that, when the economy is growing, "undervalued" stocks must be cheap for a reason.

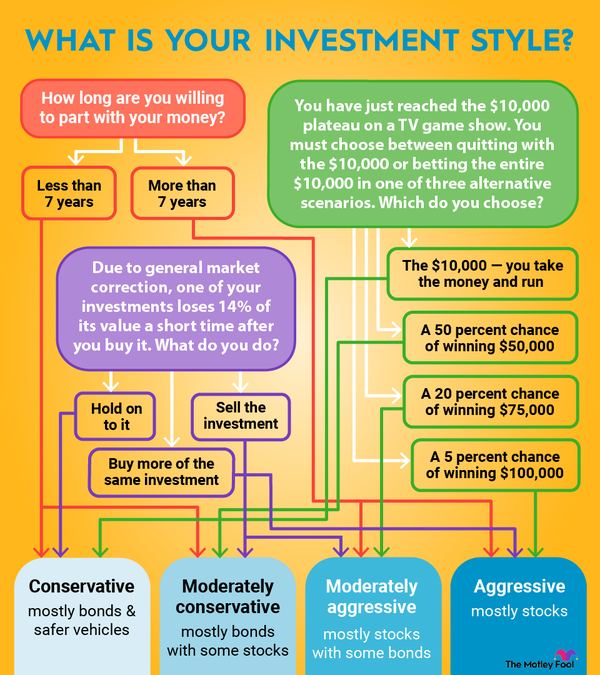

How you invest in stocks in bull and bear markets depends mainly on your time horizon. If you do not need the money for decades, then it matters little whether the market is currently bullish or bearish. As a buy-and-hold investor, you probably shouldn't change your investing strategy based on prevailing market conditions.

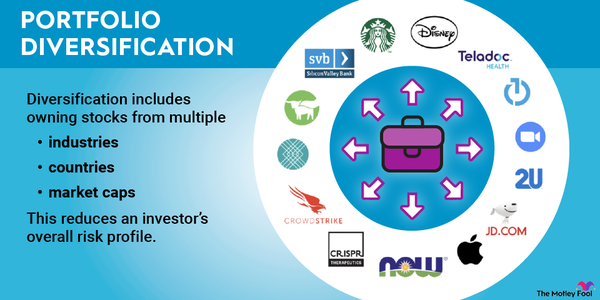

The stock market can be bearish even while bull markets are occurring in other asset classes and vice versa. If the stock market is bullish and you're concerned about price inflation, then allocating a portion of your portfolio to gold or real estate may be a smart choice. If the stock market is bearish, then you can consider increasing your portfolio's allocation to bonds or even converting a portion of your portfolio into cash. You can also consider geographically diversifying your holdings to benefit from bull markets occurring in other regions of the world.

Regardless of the current state of the stock market, it's important to stay focused on the long-term prospects of the companies in which you are invested. Companies with great business fundamentals are likely to produce significant returns for your portfolio over time.