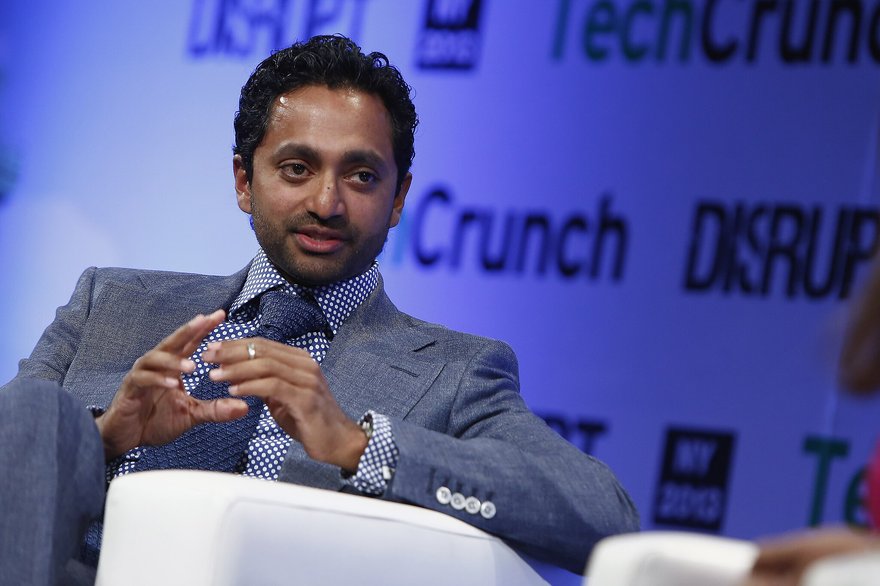

Chamath Palihapitiya is an influencer, venture capitalist, entrepreneur, and part-owner of the NBA's Golden State Warriors. He founded venture capital firm Social Capital in 2011 after making millions by investing in tech stocks. Read on to find out how Palihapitiya -- from humble beginnings -- amassed roughly $1 billion in personal assets and became famous on Wall Street.

Who is Chamath Palihapitiya?

Who is Chamath Palihapitiya?

In 2021, Palihapitiya was rich enough to buy a $75 million Bombardier Global 7500 jet. Just a few decades earlier, he was working at Burger King to help his family get by. In those decades between, Palihapitiya rewrote his story and proved himself a savvy investor and business manager.

Palihapitiya was born in Sri Lanka in 1976. His family moved to Canada in the 1980s, where he attended high school at Lisgar Collegiate Institute. Palihapitiya then went to the University of Waterloo, earning a degree in electrical engineering in 1999.

Upon graduating, Palihapitiya took a job in banking with a starting annual salary of $55,000. He chose the banking industry because the pay was good and he was burdened with $27,000 in student debt.

Around the same time, Palihapitiya began investing in tech stocks -- and sharing his picks with others. One of his directors made so much money that he wrote Palihapitiya a check large enough to repay his student loans.

In 2000, Palihapitiya accepted a business development role at media player start-up Winamp in California. When AOL bought Winamp, it set Palihapitiya on a path up the corporate ladder. In just a few years, at 27 years old, he was running AOL's instant messaging division, AIM.

Palihapitiya left AOL, worked briefly for Mayfield Group Capital Fund, and then went to a young social media start-up to lead its mobile and international strategies. That start-up was Facebook, the predecessor to Meta Platforms (META -2.28%).

While at Facebook, Palihapitiya continued his own investing side hustle. He developed a knack for finding small tech start-ups that would later become acquisition targets. One of his investments was the social gaming company Playdom, which Disney (DIS -0.93%) bought in 2010 for $763 million.

Around the same time, he also turned a profit on his investment in Bumptop, a company that made 3D desktop software. Google, now known as Alphabet (GOOG -1.8%) (GOOGL -1.82%), purchased Bumptop in 2010.

By 2011, Palihapitiya had built a sizable personal fortune. With enough capital to start his own fund, he left Facebook and, with the help of his then-wife, Brigette Lau, launched Social Capital. He put $60 million of his own money into the venture and recruited Facebook as an early investor.

Social Capital began as a traditional venture capital firm, continually raising funds and investing in technology companies. In 2018, the company stopped accepting outside capital and now operates as a holding company. Palihapitiya has said he's positioning Social Capital as a technology version of Warren Buffett's conglomerate Berkshire Hathaway (BRK.A -0.59%) (BRK.B -0.74%).

Social Capital invests in emerging trends in energy, life sciences, and technology. The company favors early-stage companies and entrepreneurs solving significant world problems.

Chamath Palihapitiya's personal stats

- Age: Palihapitiya's birthday is September 3, 1976, making him 47 years old in 2023.

- Source of wealth: Palihapitiya was a vice president at Facebook in its earlier years and reportedly earned a good living. But he increased the trajectory of his wealth journey with personal investments in tech start-ups. His interests in Playdom and Bumptop paid handsomely, allowing him to reinvest the gains and keep the wealth engine going.

- Marital status: Palihapitiya is unmarried. He filed for divorce from Lau in 2018 and is now in a relationship with Nathalie Dompé, CEO of biopharmaceutical company Dompé Holdings.

- Residence: Palihapitiya lives in California with Dompé.

- Children: Palihapitiya has three children with Lau and one child with Dompé.

- Education: Palihapitiya earned a degree in electrical engineering from the University of Waterloo in Ontario, Canada, in 1999.

Chamath Palihapitiya's investment approach

Chamath Palihapitiya's investment approach

Palihapitiya has a sharp investment focus on technology innovators. He prefers early-stage companies that deploy tech to tackle social issues ranging from climate change to improved healthcare.

In the pandemic era, Palihapitiya earned the nickname "SPAC King" for his use of special purpose acquisition companies to bring private entities public. SPACs are public companies that raise money from investors and use the funds to acquire private companies. For the acquisition target, the process is essentially an initial public offering (IPO) with less regulatory scrutiny.

Palihapitiya's first SPAC, created in 2017, took Virgin Galactic Holdings (SPCE -5.56%) public in 2019. Over the next three years, Palihapitiya would launch nine more SPACs -- all the while promoting SPACs as a path to wealth for smaller investors. His cheerleading supported fundraising efforts and exploded his Twitter following, which now stands at 1.6 million.

Unfortunately for Palihapitiya, the heyday for SPACs appears to have come and gone. High interest rates and a tough market have dampened investor interest in speculative assets.

By the end of 2021, the SPAC model was also receiving negative attention from lawmakers. One criticism is that SPAC sponsors like Palihapitiya collect free shares as their fee, giving them an unfair advantage over retail investors. Many of those retail investors saw huge losses in these positions during the tech sell-off that began in 2021. Palihapitiya admitted to profitably reducing his stake in several of his sponsored companies before they crashed.

Today, Palihapitiya has moved on from the SPAC model. He announced in 2022 that he was closing some of his SPACs that hadn't identified acquisition targets yet. Social Capital is now a holding company that buys equity in emerging and transformative technologies.

Chamath Palihapitiya's investments

Chamath Palihapitiya's investments

The table below shows five companies Palihapitiya took public through his SPACs. Prokidney and Akili remain part of the Social Capital portfolio.

| Name | Ticker | Market Cap | Description |

|---|---|---|---|

| Virgin Galactic Holdings | NYSE: SPCE | $1.06 billion | Virgin Galactic develops and operates spaceships for human spaceflight and commercial research. |

| Clover Health Investments | NASDAQ: CLOV | $409 million | Clover Health is a Medicare Advantage insurance provider that uses technology to improve outcomes and lower costs. |

| Opendoor Technologies | NASDAQ: OPEN | $1.75 billion | Opendoor is an online platform for buying and selling homes. |

| Prokidney | NASDAQ: PROK | $690 million | PROK is a biotech company working on a cell therapy platform to treat chronic kidney disease with the patient's own cells. |

| Akili | NASDAQ: AKLI | $91 million |

Akili makes digital therapeutics to treat cognitive conditions, including a doctor-prescribed video game. |

More from Chamath Palihapitiya

More from Chamath Palihapitiya

- Palihapitiya on Twitter

- Palihapitiya's weekly reading list

- Palihapitiya on YouTube

- All-In podcast with Chamath Palihapitiya, Jason Calacanis, David Sacks and David Friedberg

Chamath Palihapitiya, SPAC King

Chamath Palihapitiya, SPAC King

Palihapitiya is a Sri Lankan-born venture capitalist and the founder and CEO of Social Capital. He made his money by investing in early-stage tech stocks. He also became known for facilitating backdoor IPOs by setting up SPACs and merging them with private companies.

Social Capital now runs more like a holding company, investing in select equities with an eye for long-term gains and social transformation.

Chamath Palihapitiya FAQs

Chamath Palihapitiya FAQs

What is Chamath Palihapitiya's net worth?

Chamath Palihapitiya's net worth is approximately $1 billion.

Is Chamath Palihapitiya self-made?

Yes, Palihapitiya is a self-made billionaire. His parents reportedly held low-paying jobs, and he worked in a fast-food restaurant as a teenager to help make ends meet.

After graduating college, Palihapitiya fast-tracked up the corporate ladder at AOL and Facebook while, on the side, making key investments in Playdom and Bumptop to expand his personal balance sheet. By 2011, he was rich enough to start his own venture capital firm.

How much Bitcoin does Chamath Palihapitiya own?

Palihapitiya has said he's invested hundreds of millions in Bitcoin. He was an early investor in the digital currency, owning $5 million worth of Bitcoin in 2013. That year, Bitcoin traded for $13 to $1,200. Today, the price of one Bitcoin is nearly $27,000.