Investing is an exciting endeavor, but it can be daunting too. Investing is a way to earn passive income.

Putting your savings to work so you can earn more money sounds great, but most people don't have a spare $1,000 just lying around. Can you still invest in stocks with a more modest sum?

Good news! You don't need a lot of money to start investing. In fact, you could start investing in the stock market with as little as $1, thanks to zero-fee brokerages and the magic of fractional shares.

Here's what you need to know about how to transform even a small amount of money into the beginnings of an investment empire.

How much?

What is the right amount to invest?

The short answer is, it depends on your personal financial situation and your investment goals.

If you've got a lot of money you don't need sitting in a checking or savings account, you're interested in saving for later in life (like retirement), and have many years until you expect to need the money, your "right amount" is going to be very different from that of someone who's maxed out their credit cards and is hoping to put a down payment on a home.

Here are some general guidelines on how to choose the right initial investment amount:

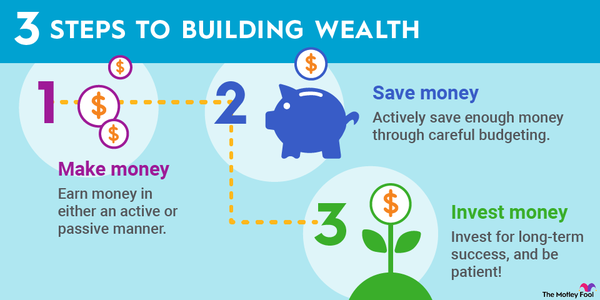

- Pay off debt first: Sure, it may be tempting to start making money right away, but investing is a long-term activity. Your investments will probably start generating money slowly, but after years will earn more, thanks to the magic of compound interest, dividends, and growth. This means that high-interest debt like credit card debt is likely to cost you more money than you make through investing. Pay down any debt (say, with an interest rate of greater than 7% interest rate) before investing your money.

- Make a budget: For example, money you put into a Roth IRA -- which charges big penalties if you withdraw it before age 59 1/2 -- doesn't do you any good if you can't pay rent. To be sure you're able to set aside money for investing, write out a monthly budget that outlines your basic expenses (like rent or your mortgage, utilities, transportation costs, groceries, and any loan payments) and discretionary spending (like eating out, entertainment, and monthly shopping trips that isn't an absolute necessity). That should help you determine what you can afford to put toward investing.

- Don't forget about emergencies: We've all had that unexpected expense -- a car repair, medical emergency, or layoff -- that blows a budget out the window. While putting money into a retirement plan or account can offer tax advantages, it makes those funds much harder to recover in a hurry. Make sure you have the means to pay for an emergency by setting aside money in a savings account. A general rule of thumb is to have about six months of your average spending (which you can calculate from the budget you made above) stashed away in savings for that inevitable rainy day.

- Other savings goals: There are some other items you may need to budget for a set aside in a savings account. It could be a vacation fund, money you're saving for a down payment on a car, a down payment on a home purchase, a home remodel, or something else. Some people like to have a dedicated savings account for these items, separate from their emergency savings account. Either way, make sure you set aside money for these other items, so that your long-term investments don't need to be tapped.

Once you've done those basic calculations and established some financial goals, you should be able to find an amount you can commit to investing every month. Yes, every single month! Saving one lump sum of money and forgetting about it might pay off in the long run, but depositing a little bit more cash every month will help you reach your financial goals far more quickly.

Maybe that amount is $2,000 a month. Maybe it's just $10 a month. The overall amount doesn't matter, as long as it's a sustainable amount you can commit to every single month.

Investing a small amount

How can I invest a small amount?

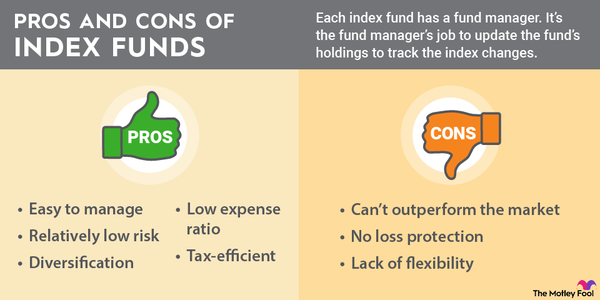

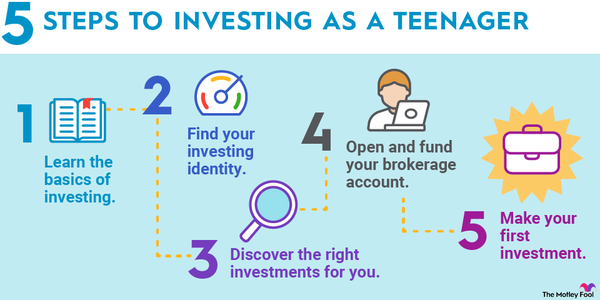

To invest any amount of money in individual stocks, bonds, mutual funds, index funds, or other types of investments, you'll need to open an account with a broker.

Most major financial institutions offer brokerage accounts. If you have an account at a bank, it may offer some perks for investing directly with them. However, you may also want to consider an independent brokerage firm or an online-only or app-based broker.

If you're starting with a small sum, make sure the broker you're considering offers the following:

- No minimum balance fees: Investments can go up, but they can also go down. Even if your initial investment amount is higher than the broker's threshold for a "low balance" fee, if you invest in a stock that drops, you might wind up beneath that threshold down the line.

- No commissions or transaction fees: Ten years ago, it would have been unheard of for a brokerage to offer unlimited commission-free trades. Many, if not most, brokerages have gone fee-free (or very low-fee, like less than $1 per trade) these days. Make sure yours is part of this trend.

- Allows fractional share purchases: Fractional shares are investments of less than one share of stock (like one-half, one-quarter, or less, of a single stock). Some brokers will allow fractional shares only in a special event, like a stock split, or reinvestment of dividends. With single shares of many stocks costing hundreds or thousands of dollars, your options will be severely limited if you can't directly purchase fractional shares. This is especially important if the amount of money you initially plan to invest is less than $1,000, and if your monthly contributions are less than $1,000. Make sure the broker you open an account with allows for fractional share investing. Some of them allow you to purchase stock with as little as $1.

Finding it hard to choose which broker is right for you? Compare top online brokers at The Ascent, a division of The Motley Fool.

Related investing topics

Getting started

Getting started

Once you've chosen a broker, decide what your investing goals are, and have your initial investment amount in hand, you're ready to choose your first investment.