Investing doesn't have to be complicated. One of the simplest ways to get started building wealth is by buying index funds.

But investors shouldn't just blindly throw their money into the first index fund they come across. It's important to understand what you're investing in, how to analyze an index fund, and make the best decision about where to put your savings.

How do index funds work?

Index funds are a special type of mutual fund. A mutual fund is a financial vehicle that pools money from investors and invests it in securities such as stocks or bonds. The person in charge of making the buy-and-sell decisions for a mutual fund is called a fund manager.

An index fund aims to track the returns of a designated stock market index. A market index is a hypothetical portfolio of securities that represents a segment of the market.

For example, the S&P 500 represents 500 of the largest U.S. companies. The Dow Jones Industrial Average is a collection of 30 highly influential U.S. companies. Others represent certain stock market sectors. There are thousands of indexes, some with just a handful of companies and some with thousands.

What happens when you invest in an index fund?

When you buy an index mutual fund, your money is pooled with other investors. The fund manager takes that money and allocates it in the stocks, bonds, or other financial instruments that make up the index it tracks. A manager may or may not invest in every component of an index but merely aims to get an appropriate sample of every piece in order to effectively track the index performance over time.

There are also index ETFs. ETFs are exchange-traded funds, and you buy and sell them like a stock. When you buy an ETF, you aren't sending your money to a mutual fund company to invest. Instead, you're buying the fund directly from an investor who's selling their shares. There are mechanics to create new shares if demand outstrips supply. The end result is very similar to investing in an index mutual fund.

Benefits of index fund investing

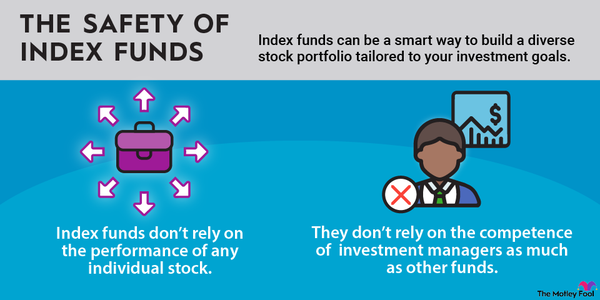

Index funds have several benefits over individual stock or bond investments and actively managed mutual funds.

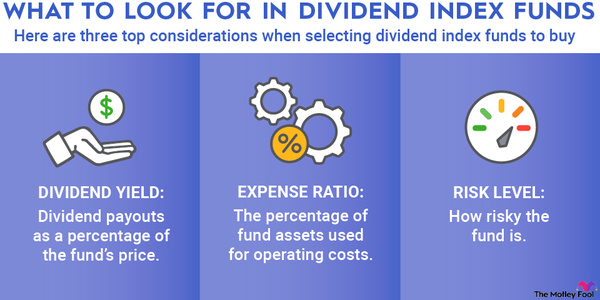

- The fees associated with index funds are far lower than actively managed funds. A high expense ratio can drastically eat into your investment returns over time, and that's one reason why most actively managed funds underperform over time when factoring in their fees.

- When you buy an index fund, you're effectively buying a small piece of a lot of securities. That provides instant diversification so you're not as susceptible to violent swings in a single company's stock price.

- Index funds are very tax-efficient. Most indexes have very low turnover ratios compared to actively managed funds. In other words, fund managers aren't buying and selling securities and incurring capital gains all the time. The holdings will only change when the index changes, which is relatively infrequently. And fund managers can often manage to offset capital gains or keep them to a minimum for most index funds, thereby reducing the tax burden for investors.

This is a fictional index fund created as an example.

Index funds are less expensive

Since actively managed mutual funds require more research from the fund manager, they charge more for the service. That charge comes in the form of an expense ratio. That's the percentage of assets under management the mutual fund company keeps, which is taken straight out of its investors' accounts.

Index funds, by comparison, have very low expense ratios, with some as low as 0%. Broad market index funds, such as those tracking the S&P 500, typically have expense ratios of around 0.05%. So for every $100,000 you have invested, the fund company will take out $50 per year to pay the fund manager and cover its expenses. A typical actively managed fund might have an expense ratio of around 1%.

Analyzing index funds

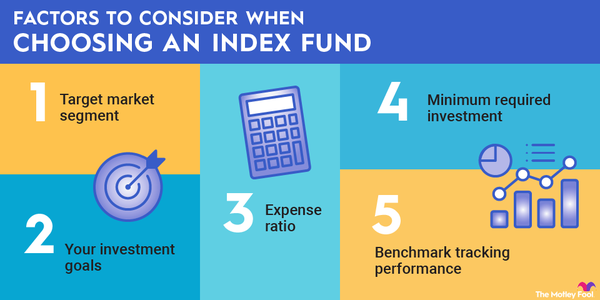

There are a few factors to consider when analyzing index funds and making a decision about which mutual fund company to invest with.

First of all, you'll want to find an appropriate index you want your fund to track. If you're looking to invest in the general U.S. stock market, an index fund tracking the S&P 500, the Wilshire 5000, or some other total market index is appropriate. If you want added exposure to small companies, you'll want a fund that tracks the Russell 2000 or the S&P 600. There are indexes for just about any segment of the market, so consider your investment objectives and what segments you want exposure to.

Once you've settled on an index you want to track, you can gather information on all the index funds tracking that index. There may only be one option, or there may be a dozen.

The biggest factors to consider and compare are the expense ratio and tracking error.

Expense ratios will vary from provider to provider, and you may notice differences in expense ratios between the mutual fund version and ETF version of the same index fund.

But don't just pick the index fund with the lowest expense ratio. You'll also want to check the tracking error for the fund. The tracking error will tell you how closely the fund matches the returns of the benchmark index. Finding a fund that's better at minimizing tracking error could be worth paying a slightly higher expense ratio. A wide tracking error could indicate challenges in efficiently managing the fund's holdings.

Once you've decided on the best low-cost index fund to buy, it's as simple as sending money to your broker or the mutual fund company and clicking that buy button.

What an index fund manager does

Since an index fund aims to track a market index, the fund manager's job is to update the fund's holdings whenever the index changes. The company in charge of the S&P 500 updates the index once every quarter, and the fund manager will follow those updates. The fund manager is also responsible for allocating inflows and outflows of money from investors.

This job is significantly less research-intensive than managing an actively managed mutual fund. Actively managed funds aim to outperform their benchmark market index. In order to do so, the mutual funds holdings are necessarily different from the index.