Money for nothing — what could be better? That's the optimistic promise of passive income. Passive income is money you earn with minimal regular effort.

While most passive income sources will require some investment in time or money up front, that hurdle can be worth it. Once you get your passive income stream rolling, you have a source of cash that's not tied to your boss or your timecard. It could even grow into a business that allows you to quit the daily grind and achieve financial independence.

Here's a closer look at 11 smart passive income ideas divided into four categories: easy, most profitable, online, and low-investment ideas for students.

Easy ideas

Easy passive income ideas

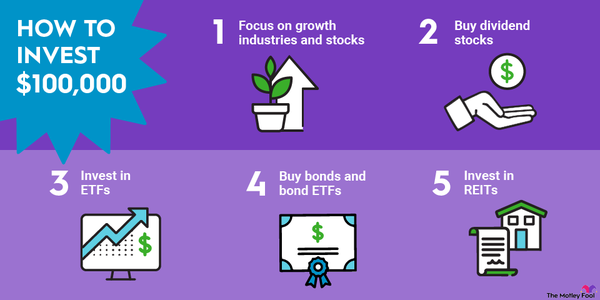

1. Dividend investing

As a dividend investor, you purchase stocks that share earnings with shareholders by way of dividend payments.

Dividend investing is a top passive income idea because it's low effort. You'll do some research up front to pick your stocks and then monitor them over time. That's it — no hustling or sales involved. Your dividends are deposited to your brokerage account automatically.

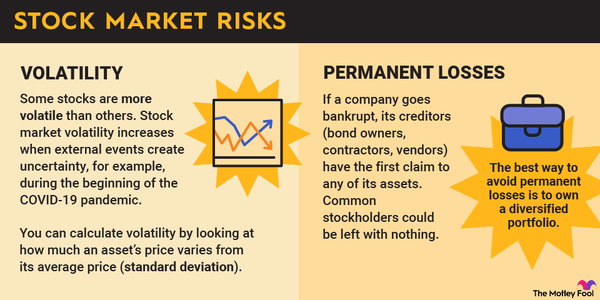

Downsides and risk. Dividend yields for quality stocks are modest, about 2% of the stock price. You can find stocks that pay higher yields, but those usually come with more risk. Also, dividends are not guaranteed. The company can cancel or lower the payment at any time, or the stock price could drop and reduce the value of your investment.

Getting started. Open a brokerage account and start researching how to invest in dividend-paying companies. Learn some metrics, such as the dividend payout ratio, to help you assess the company's ability to keep paying its dividend.

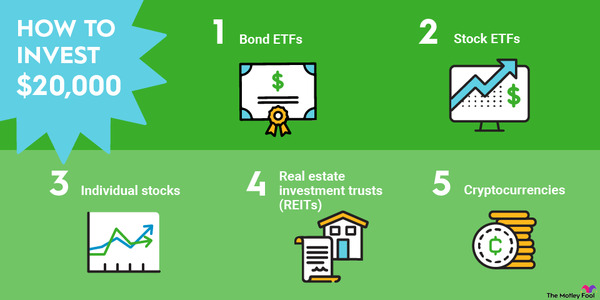

2. REITs

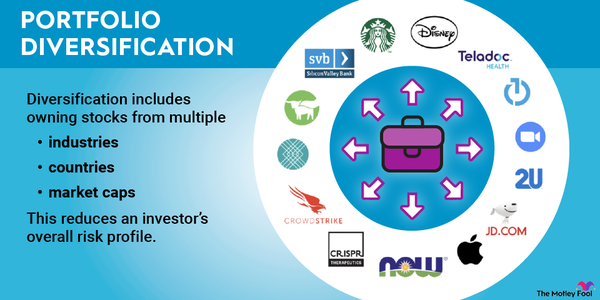

REITs, or real estate investment trusts, are companies that buy and rent commercial properties. Like stocks, many REITs are publicly traded. Also like stocks, REITs don't require much effort besides research and monitoring. And, because the IRS requires REITs to pay out 90% of their taxable income to shareholders, they can yield more than dividend stocks.

Downsides and risk. REIT earnings are taxed as ordinary income, which is higher than the long-term capital gains rates used for most dividend income. Also, REITs fluctuate in value and profitability — meaning you could lose money on your investment.

Getting started. Open a brokerage account and start researching REIT funds. REIT funds invest in a diversified collection of REITs, which is less risky than owning a single REIT.

3. Bond investing

Bonds are loans to corporations or government entities that are sliced up into units and sold to investors. When you invest in a bond, you put up funds and the borrower repays those funds with interest over time.

Downsides and risk. The borrower could go out of business or stop repaying the loan. Market interest rates could rise so that your bond's rate is less than what you could earn elsewhere.

Getting started. The simplest way to get into bond investing is to buy a bond exchange-traded fund (ETF) from your brokerage account. A bond ETF provides exposure to corporate or government bonds of varying maturities, which is safer than funding just one bond or one type of bond.

Most profitable ideas

Most profitable passive income ideas

4. Rental property

Rental property investors buy homes, usually with a loan, and then rent those homes to long-term tenants. The trick is to make sure the rents you collect cover the mortgage payment, property taxes, maintenance costs, and any other expenses — while leaving a nice chunk of profit for you. Ideally, you'll profit on the rents, plus your property should appreciate over time.

Downsides and risk. You can fall behind on the mortgage if your tenants don't pay their rent or the home is vacant. You may incur large maintenance expenses if tenants damage your property.

Getting started. You need good credit and a cash down payment to get started as a property investor. Review housing prices and home rentals near you. Identify investable neighborhoods and start estimating how much capital you'll need.

5. Vacation rentals

Renting your existing home or an investment property to travelers is another passive income option. For properties in popular neighborhoods, vacation rentals command higher nightly rates than residential rentals. They are also a lower commitment. You can customize the property's availability schedule however you want, and most of your visitors will only stay for a few days.

Downsides and risk. If you are renting an unused room in your existing home, the risks are low. Your renters might be loud or messy, or your room may not generate the rents you expected. Renting an investment property is a different story. As with a long-term rental, you risk default if the property doesn't generate enough income to pay the mortgage plus the other expenses.

Getting started. Check your homeowner's insurance to see if you need more coverage for short-term rentals. Review properties like yours on vacation rental marketplaces, including Airbnb, HomeToGo, and FlipKey. Then fix up your place, take some pretty photos, and list it.

Online ideas

Online passive income ideas

6. Affiliate marketing

As an affiliate marketer, you earn commissions for referring people to products and services online. Your referrals are tracked by way of links you publish on your website or social media posts. When someone clicks on your link and buys something, the transaction is credited to you.

Downsides and risk. Affiliate commissions can often be low, usually 1% to 5% of the sale amount. You may not generate enough transactions to produce a solid revenue stream.

Getting started. Most affiliate marketers use a website to promote products, but you could also use Facebook, Twitter, or Pinterest. Make sure you understand the FTC's disclosure requirements for affiliate marketers. Then join affiliate programs for products you'd like to represent and start promoting.

7. Dropshipping

Dropshipping is another way to sell products online and without having a warehouse full of inventory. You'd have an online store, either on your own website or on Amazon. Your product catalog would be items you can purchase from wholesalers. When someone places an order, you collect the funds and then order the item directly from the wholesaler at a lower price. The wholesaler ships the product straight to your customer.

Downsides and risk. As with affiliate marketing, the biggest challenge with dropshipping is generating traffic and sales. A secondary risk is fraudulent transactions. If you fund the purchase with the wholesaler and the customer's payment subsequently fails, you're on the hook.

Getting started. Find wholesalers that dropship products you can promote. Then set up those products in an online store and start driving traffic to it.

8. Membership website

A membership website charges members a monthly fee for access to exclusive content. If you have specialized knowledge, you could build a website to share that knowledge through articles, videos, and other tools. Membership websites also allow members who share an interest in the site's subject matter to connect and interact.

Downsides and risk. You could spend many hours building a website and developing your exclusive content and then have trouble securing new members. If your content isn't better than what's available online for free, your members will cancel their memberships.

Getting started. Join a membership site or two to see how they work. Define how your site will be different and ask friends and family for feedback on your idea. Once you've set your direction, start creating content.

9. Peer-to-peer lending

If you have cash on hand, you can make small loans at high interest rates via peer-to-peer lending platforms such as Prosper, LendingClub, and Funding Circle. These are fixed-rate, fixed-payment loans with no collateral. The platform manages the money transfer and repayments, and you are responsible for choosing borrowers and funding the loans. Prosper reports that its loans average a 5.5% annual return.

Downsides and risk. The risk of default can be high, and you have no collateral to collect if the borrower stops paying. You can mitigate the risk somewhat by diversifying your funds across many small loans.

Getting started. Review how the different platforms work, including minimum loan amounts and tools available to manage your funds. Choose a platform and start making small loans to test the experience. You can invest more as you gain confidence.

Low-investment ideas for students

Low-investment passive income ideas for students

If you are a student, you may not have the budget or the time to set up an online store or buy investment property. What you can do, though, is leverage your online network of friends. Here are two passive income ideas — no cash outlay required — that use your circle of influence to make money.

10. Cashback apps

Cashback apps pay rebates when you shop. To earn, you may need to upload receipts or use the app to pay at the retailer. You won't make big money on your own shopping, but you can generate passive income for referring your friends to the app. GetUpside, for example, pays you a commission every time one of your referrals earns cashback.

Downsides and risk. Most cashback apps have minimum payment thresholds of $5 or $10. If you give up on the app before you reach the threshold, you won't collect your funds.

Getting started. Download apps such as Ibotta, Fetch, and GetUpside and learn how they work. Pick one app to start using regularly and start sharing your referral link with friends.

11. Social media brand ambassador

As a social media brand ambassador, you earn free products and cash payments for promoting brands in your social media posts. You can connect with brands through influencer platforms such as Activate and BrandBacker.

Downsides and risk. To make money as an influencer, you need a strong and engaged follower community. You could lose some of that engagement if your feed becomes too promotional. Avoid any brands that require their influencers to buy products.

Getting started. Join influencer platforms and compare your social metrics to other influencers. Review and apply for brand opportunities that interest you.

Related Investing Topics

Making passive income work for you

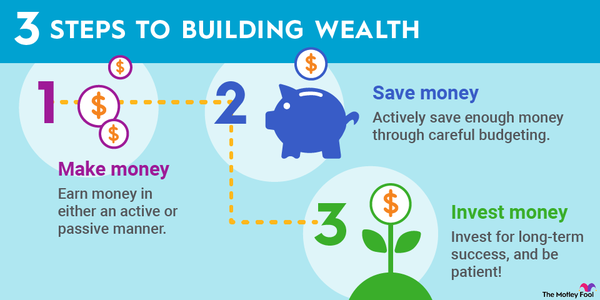

The profit potential of a passive income idea often correlates to the size of the up-front investment in time or money. Dividend stocks, for example, can generate tens of thousands in income over time — but they demand a larger cash outlay to start. On the other hand, cashback apps have lower upside potential but don't require much to get started.

If the strategy you can afford today has less potential than you'd like, you could use one passive income stream to fund another. For example, you could take your cashback app earnings and invest them in dividend stocks. That's a long-term play, but it's also a smart move financially. Down the road, you can look at your portfolio and feel good about how you funded it.