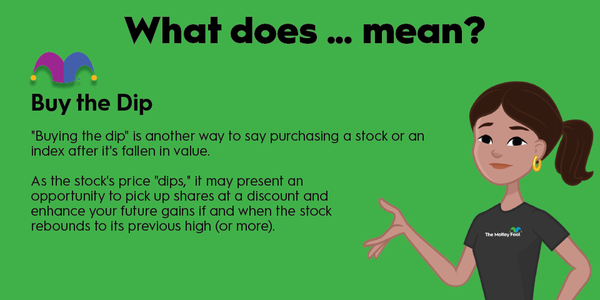

It's generally understood that stocks can produce better returns than many other types of securities. But anyone who has ever looked at a stock chart knows that stock prices often don't increase smoothly. A buy-and-hold strategy ignores the short-term peaks and valleys and makes the most of the long-term potential of stock investing.

A buy-and-hold strategy entails buying stocks or other securities and not selling them for long periods of time, sometimes decades. Buying and simply holding investments stands in contrast to active investing, where investors try to time the market by selling shares when stock prices are high and buying shares when stock prices are low.

How does the buy-and-hold strategy work?

How does the buy-and-hold strategy work?

The buy-and-hold strategy is simple to execute. All you have to do is buy a financial security and not sell it.

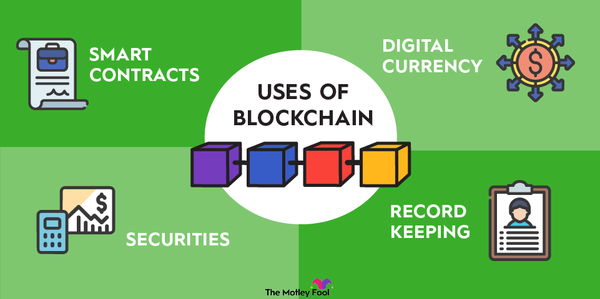

Financial Securities

Buy-and-hold investors prioritize owning shares of companies with strong business fundamentals. They're more concerned with how a company is performing than with short-term changes in the company's stock price. As long as the company's business continues to perform well, buy-and-hold investors are happy to continue owning the company's stock.

That's not to say stock price is not important to buy-and-hold investors. A stock must be able to generate enough value for the price paid.

Some buy-and-hold investors prefer to own value stocks, which trade below the prices that their business fundamentals suggest they're worth. Other buy-and-hold investors focus on growth stocks, the shares of companies that are increasing their revenues and profits by pursuing attractive business opportunities.

Buy-and-hold investors typically make stock purchase decisions based on long-term investment theses about the companies of interest. As long as an investment thesis remains intact, the buy-and-hold investor continues to own the company's shares.

Example of buy-and-hold investing

Example of buy-and-hold investing

One of the biggest proponents of buy-and-hold investing is Warren Buffett. In his 1988 letter to shareholders of his asset management firm and holding company Berkshire Hathaway (BRK.A 0.64%) (BRK.B 0.54%), he famously wrote, "Our favorite holding period is forever."

In fact, the full excerpt from the letter reads, "When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever." That's a clearer picture of what a buy-and-hold investor aims to achieve -- to own outstanding companies.

Buffett acquired a significant stake in Coca-Cola (KO 0.68%) for Berkshire Hathaway in the same year he penned that famous line. Buffett's asset management business bought about 14 million shares for just under $600 million and added to the position in 1989.

Asset Management

Coca-Cola has also split its stock four times since Berkshire established its initial position. The company currently owns 400 million shares worth around $24 billion. Berkshire's cost basis for those shares is just $1.3 billion.

From the start of 1988 to the end of 2021, the price of Coca-Cola shares grew 25-fold, and the company reliably pays an appealing and growing dividend. (By comparison, the S&P 500 (SNPINDEX:^GSPC) index increased about 19-fold in the same period.)

But Coca-Cola shares didn't outperform the market throughout that entire 34-year period. For example, from the start of 1998 to the end of 2006, the price of Coca-Cola shares declined almost 28%, while the S&P 500 increased by more than 46%. Over the last half of the 2010s, from 2016 through 2020, Coca-Cola shares increased in value by just 28%, while the S&P 500 index gained 84%.

Buffett has held his shares of Coca-Cola the whole time and maintains his conviction that the beverage giant will continue to produce solid returns over the long term.

Pros and cons of buying and holding stocks

Pros and cons of buying and holding stocks

The positive aspects of buy-and-hold investing include:

- Simplicity: Buy-and-hold investors don't need to constantly monitor their investments every hour of every trading day to make buy and sell decisions. Once a security is in your portfolio, you usually only have to pay attention to key news and documents, such as quarterly earnings reports.

- Minimal risk of investor error: Since buy-and-hold investing is so simple -- buy shares, then don't sell -- there's very little risk that the strategy will fail due to a tactical error on your part. While active investors attempt to time stock purchases and sales with the market's peaks and valleys, buy-and-hold investors don't make nearly as many decisions.

- Tax efficiency: Not selling stocks prevents you from owing capital gains taxes on stock sales. When they do sell stock, buy-and-hold investors can do so in ways that minimize their tax liabilities. Unlike active investors, buy-and-hold investors are generally not in a hurry to exit their positions.

However, there are some disadvantages to buy-and-hold investing:

- Higher likelihood of poor risk management: Some buy-and-hold investors neglect to implement simple risk management strategies such as rebalancing their portfolios to keep their assets appropriately allocated. Investors who completely ignore price when making buy or sell decisions are susceptible to the risk of buying high and selling low. Some buy-and-hold investors are overly willing to accept risk as an unavoidable part of investing.

- No way to profit from market volatility: Some of the best times to buy more shares occur when the stock market is experiencing volatility. A sharp dip in a stock's price could be a great buying opportunity for investors. But if you're already fully invested with a buy-and-hold strategy, you don't have much capital to spend when short-term buying opportunities present themselves.

Related investing topics

Become a buy-and-hold investor

Become a buy-and-hold investor

Buy-and-hold investing is one of the best ways to increase wealth over the long term. Basing your investment choices on business fundamentals, a well-thought-out investment thesis, and the company management's ability to execute is the foundation of a good investment portfolio.

It's impossible to know what the stock market will do tomorrow, next week, or next year. But if you buy shares of a strong company that executes well, you'll very likely see good returns if you hold your shares through the market's ups and downs.