It costs money to make money. Every successful business keeps its costs below revenue to generate profits. One way to measure a company's profitability is to calculate its gross margin, which is the percentage of revenue it retains after subtracting the costs directly related to the sale of goods or services.

We'll take a closer look at this profitability measure by exploring:

- What is gross margin?

- How to calculate gross margin.

- Gross margin vs. gross profit: What is the difference?

- How to use gross margin to evaluate a company.

- What are the limitations to gross margin?

What is gross margin?

Gross margin -- also called gross profit margin or gross margin ratio -- is a company's sales minus its cost of goods sold (COGS), expressed as a percentage of sales. Put another way, gross margin is the percentage of a company's revenue that it keeps after subtracting direct expenses such as labor and materials. The higher the gross margin, the more revenue a company has to cover other obligations -- like taxes, interest on debt, and other expenses -- and generate profit.

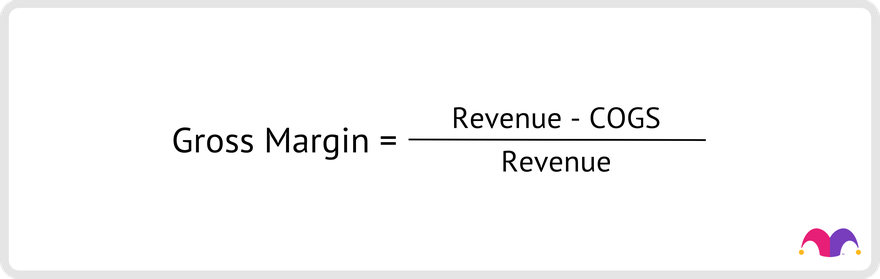

How to calculate gross margin

The computation for gross margin is a two-step process. First, you need to determine a company's gross profit, which is a straightforward calculation:

Gross profit = Revenue-COGS

You can find the revenue and COGS numbers in a company's financial statements.

You can then use the gross profit number to determine gross margin:

As an example of how to calculate gross margin, consider a company that during the most recent quarter generated $150 million in sales and had direct selling costs of $100 million. The company's gross profit would equal $150 million minus $100 million, or $50 million, during this period.

We can use the gross profit of $50 million to determine the company's gross margin. Simply divide the $50 million gross profit into the sales of $150 million and then multiply that amount by 100. The gross margin for this example company is 33.3%.

Gross margin vs. gross profit: What is the difference?

There can be some confusion between gross margin and gross profit. Gross profit is a measure of absolute value, while gross margin is a ratio. Gross profit is simply the difference between a company's sales and its direct selling costs, and a company's gross margin is its gross profit expressed as a percentage of sales. Gross margin puts gross profit into context by taking the company's sales volume into account.

How to use gross margin to evaluate a company

Margins are metrics that assess a company's efficiency in converting sales to profits. Different types of margins, including operating margin and net profit margin, focus on separate stages and aspects of the business. Gross margin gives insight into a company's ability to efficiently control its production costs, which should help the company to produce higher profits farther down the income statement.

Calculating gross margin is useful for comparison purposes. Determining a company's gross margins for multiple reporting periods provides insight into whether the company's operations are becoming more or less efficient. Determining the gross margins of multiple companies within the same industry is another type of comparison, and it can help you to understand which market participants have the most efficient operations.

What are the limitations to gross margin?

While calculating gross margin can be helpful for evaluating a company's reporting periods or similar companies, the metric has more limited value when comparing companies in different industries. Capital-intensive industries, like manufacturing and mining, often have high costs of goods sold, which translates to relatively low gross margins. Others, like the tech industry, that have minimal costs of goods typically produce high gross margins.

Related investing topics

Gross margin is a strong indicator of profitability

Determining gross margin is an easy and straightforward way to understand the core elements of a business. It's also a great way to get started when assessing any income statement. Gross margin is something that all investors should consider when evaluating a company before buying any stock.