Apple (AAPL -0.57%) is one of the largest companies in the world. It has come a long way from humble beginnings. College dropouts Steve Jobs and Steve Wozniak founded the company in 1976 with a vision of shrinking the size of computers so everyone could have them in their homes and businesses.

Investments and products

Apple's investments, products, and VR launch

Today, many of us hold an Apple-branded computer product in the palm of our hand. The company has developed many widely successful products, like the iPhone, iPad, and Mac.

Apple continues to invest heavily in product innovation to upgrade its offerings and stay ahead of the competition. In 2024, it plans to launch a new virtual reality (VR) headset, the Apple Vision Pro. The new product could help drive more growth for the consumer technology product giant.

In addition to technology products, Apple has a growing services business (e.g., iCloud, AppleTV+, and Apple Music). The company's streaming platforms, cloud solutions, and other services generate recurring revenue, helping offset some of the variability of product sales.

The company's service offerings are growing faster than product revenue. And they deliver higher-margin revenue for Apple, making them an important profit growth driver for the company.

Cloud Computing

The Apple ecosystem of products and services has created unparalleled customer loyalty. Apple fans often purchase the latest version of its iPhone as soon as it's available. They stay subscribed to its growing number of services, helping steadily increase revenue, earnings, and cash flow. The growth should enable Apple stock to continue its upward climb.

Here's a step-by-step guide on buying shares of Apple and some factors to consider before investing in the technology stock.

How to buy

How to buy Apple stock

You can buy shares of Apple in any brokerage account. If you still need to open one, these are some of the best-rated brokers and trading platforms. If you haven't placed a trade before, here's our guide to six steps for buying stocks.

Here's an example of how to buy Apple stock using the five-star-rated platform Fidelity, which makes it easy to buy stocks. Its website offers a video tutorial and a step-by-step guide. Here's a screenshot of how to place a stock trade with Fidelity:

On this page, you would fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares

- The ticker symbol (AAPL for Apple)

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately for the market price at that moment.

Market Order

Once you complete the order page, click the "Place Order" button at the bottom and become an Apple shareholder.

Should I invest?

Should I invest in Apple?

Before investing in Apple, you need to determine whether the company's stock is a good one to buy. Here are some reasons why you might want to consider buying Apple stock:

- You love Apple's products and want to invest in the company that makes them.

- You believe Apple's shares can continue to outperform the S&P 500.

- You understand how Apple makes money.

- You think Apple can continue developing innovative products that increase its revenue, income, and free cash flow at healthy rates.

- You believe Apple can continue growing its higher-margin services offerings at a strong pace.

- You want to invest in a financially strong company.

- You want to earn some dividend income and believe Apple can continue growing its payout.

- You think Apple does a great job allocating its copious cash flows to increase shareholder value, including its preference for share repurchases.

- You believe Apple's strategic investments in digital content, payment processing, cloud services, and advertising will accelerate growth.

- You have faith that CEO Tim Cook can continue growing shareholder value.

- You understand the risks of investing in Apple stock, including that it could lose value.

- You think the upcoming 2024 release of Apple's new Apple Vision Pro will be a catalyst to drive the company's profits and stock price higher.

On the other hand, here are some factors to think about that might lead you to decide against buying Apple stock:

- You're not a fan of Apple's products.

- You're not sure Apple can outperform the market.

- You think Apple's days of product innovation are in the rearview mirror.

- You need a higher dividend yield than Apple currently offers.

- You are a younger investor and want to invest in a company earlier in its growth cycle than Apple.

- You're worried about the economy and think a recession could affect demand for Apple products.

- You're concerned that a competitor could start eating into Apple's dominant share of the smartphone market.

- You don't think Apple's upcoming VR headset will move the needle for the company's earnings or stock price.

Profitability

Is Apple profitable?

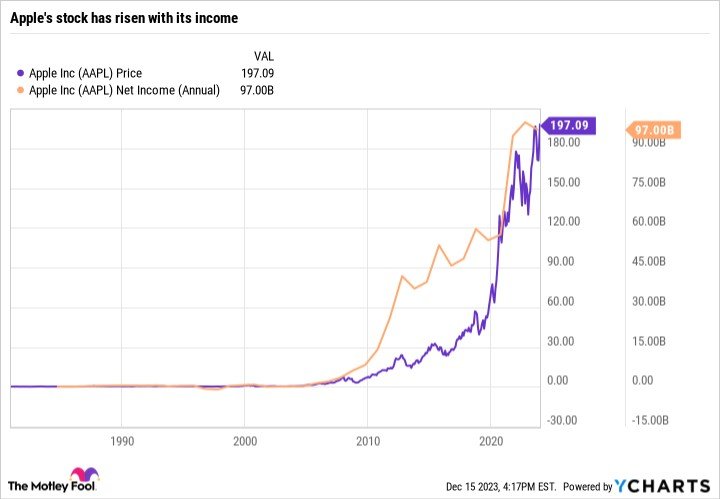

Income growth helps fuel stock price appreciation over the longer term. It's an ideal area for beginning investors to focus on before buying shares of any company.

Apple is an extremely profitable company. It recorded $89.5 billion in revenue and $22.9 billion in net income in the fourth quarter of its 2023 fiscal year. While revenue dipped by 1%, earnings per share grew by more than 10%. The company posted record iPhone revenue for the fourth quarter, while services revenue reached an all-time high. Apple's steadily rising profits have helped drive its stock price skyward over the years:

Apple generates most of its revenue from selling products (78% in fiscal 2023). However, services are an important profit-growth driver.

Services revenue is growing faster than product revenue (9.1% versus a 5.7% decline in fiscal 2023) and has a higher gross margin (70% versus 37%). It's growing into a meaningful profit contributor. Services supplied 36% of Apple's gross profit in fiscal 2023 on only 22% of its revenue.

Apple's income should continue to rise. The technology giant is investing heavily in developing innovative products (like the Apple Vision Pro) that its fans must have as soon as they become available. It also continues expanding its service offerings, providing the company with more recurring revenue.

Apple does an excellent job of converting revenue into cash flow. The technology titan generated $110.5 billion in cash from operating activities in fiscal 2023, giving it the funds to invest in growing its business and to return cash to shareholders through dividends and share repurchases -- all while maintaining one of the strongest financial profiles in the world.

Dividends

Does Apple pay a dividend?

Apple has paid a dividend on its stock since reinstating the payout in 2012. The company started paying dividends in 1987 but suspended the payout in 1995. Since reinstating the shareholder payout a decade ago, Apple has increased its dividend every year. Apple paid $15 billion in dividends in fiscal 2023.

In addition to paying dividends, Apple repurchases a significant amount of its stock each year. Apple spent $77.6 billion on share repurchases in fiscal 2023. The repurchases reduced its outstanding shares by 3.1%.

Exchange-Traded Fund (ETF)

ETF options

ETFs with exposure to Apple

Instead of actively buying Apple shares directly, you can passively invest in the technology company through a fund holding its shares.

As of late 2023, Apple was the biggest company in the world by market capitalization, at more than $3 trillion. Because of its huge market cap, it's a very widely held stock.

Apple is in several stock market indexes, including the Dow Jones Industrial Average and S&P 500 Index. As a result, index funds and exchange-traded funds (ETFs) that benchmark their returns against those indexes hold Apple stock.

According to ETF.com, 448 ETFs held 1.3 billion shares of Apple as of late 2023. The ETFs with the most shares were:

| Exchange-Traded Fund | Assets Under Management | Apple Shares Held | Fund Weighting | Position Ranking in ETF |

|---|---|---|---|---|

| SPDR S&P 500 ETF Trust (NYSEMKT:SPY) | $444.3 billion | 167.1 million | 7.4% | Largest |

| iShares Core S&P 500 (NYSEMKT:IVV) | $394.8 billion | 145.9 million | 7.3% | Largest |

| Invesco QQQ Trust (NYSEMKT:QQQ) | $226.6 billion | 126.2 million | 11.1% | Largest |

| Vanguard S&P 500 ETF (NYSEMKT:VOO) | $361.2 billion | 132.0 million | 7.1% | Second-largest |

| Vanguard Total Stock Market ETF (NYSEMKT:VTI) | $338.5 billion | 108.0 million | 6.2% | Largest |

Given its gargantuan size, even the world's largest ETFs have a meaningful portfolio weighting to Apple stock. Of the top five ETFs by assets under management, the Invesco QQQ Trust has the highest portfolio weighting to Apple, at 11.1%, making the fund a potentially attractive way to gain passive exposure to Apple stock.

Another relatively large ETF with an even higher portfolio weighting to Apple stock is the Technology Select Sector SPDR Fund (XLK -1.14%), at 23% of the fund's holdings, giving investors even greater exposure to Apple stock.

Stock splits

Will Apple stock split?

As of late 2023, Apple had yet to announce an upcoming stock split. Here's a snapshot of Apple's stock split history:

| Date | Type of Stock Split |

|---|---|

| August 2020 | 4-for-1 |

| June 2014 | 7-for 1 |

| February 2005 | 2-for-1 |

| June 2000 | 2-for-1 |

| June 1987 | 2-for-1 |

Apple's stock price was around $500 per share right before its last stock split. As of late 2023, shares were around $200 each. The price point suggests Apple stock could have much higher to rise before the company considers another stock split.

Related investing topics

The bottom line on investing in Apple stock

Apple is the world's largest company by market cap. It makes some of the most ubiquitous products on the planet. Despite its massive size and already significant installed base, the company continues to increase its revenue and earnings at a healthy pace. Consumers routinely upgrade their Apple products and subscribe to more of the company's services.

The company should continue growing shareholder value in the future, making Apple a potentially attractive stock to own over the long term.

FAQs

FAQs on investing in Apple stock

How to invest in Apple for beginners?

It's easy for beginners to invest in Apple. The first step is to open and fund a brokerage account. Once you've done that, open your broker's order page and fill it out, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares

- The ticker symbol (AAPL for Apple)

- Whether you want to place a limit order or a market order, The Motley Fool recommends using a market order since it guarantees you buy shares immediately for the going market price.

Once you've filled out the order page, submit your trade to become an Apple shareholder.

Is it worth it to invest in Apple?

It can be very worthwhile to invest in Apple. Over the last decade, Apple shares have gained almost 900% (more than 25% annualized). That has significantly outperformed the S&P 500's 165% gain (10.2% annualized). Although that past success is no guarantee of future performance, Apple continues to grow its profitability, putting it in a solid position to continue delivering outsized returns for its investors.

How much is it to buy a share of Apple?

It cost less than $200 to buy a share of Apple in late 2023. You can buy shares with even less money if your broker allows trading of fractional shares. Some trading platforms allow you to invest as little as $1 into buying shares of companies like Apple.

Can I buy stock directly from Apple?

No, you can't buy stock directly from Apple. However, anyone can buy shares of Apple in their brokerage account. It trades publicly on the Nasdaq Stock Exchange under the stock ticker AAPL.