Disney (DIS -0.22%) is an iconic brand. The company got its start in 1923 by brothers Walt and Roy Disney after a distributor contracted the duo to produce the "Alice Comedies." Originally the Disney Brothers Cartoon Studio, they soon renamed their company Walt Disney Studio.

Over the past century, Disney has grown into a world-class media and entertainment company, boasting an unparalleled portfolio of iconic brands and franchises. The company has two operating segments:

- Disney media and entertainment distribution: This segment features the company's TV channels, direct-to-consumer businesses (e.g., Disney+, Hulu, and ESPN+), and content sales and licensing.

- Disney parks, experiences, and products: This segment includes the company's global portfolio of parks and experiences, as well as its consumer products.

Disney has invested heavily in recent years to build a leading streaming service in Disney+. It has spent huge amounts on content to increase its subscriber base in hopes of reaching long-term profitability. The company believes the investment will start paying dividends in the coming years.

The profit growth potential of Disney+ could produce big gains for Disney shareholders in the coming years. This upside potential makes Disney a compelling stock for investors to consider.

Here's a step-by-step guide on how to buy Disney stock and some things to consider before purchasing shares.

How to buy

How to buy Disney stock

To buy shares of Disney, you must have a brokerage account. If you still need to open one, here are some of the best-rated brokers and trading platforms. Here's a step-by-step guide to buying Disney stock using the five-star-rated platform Fidelity.

Fidelity makes it easy to buy stocks. Its website offers a video tutorial and a step-by-step guide. Here's a screenshot of how to place a stock trade with Fidelity:

On this page, fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The ticker symbol (DIS for Disney).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Once you complete the order page, click the "Place Order" button at the bottom and become a Disney shareholder.

Should I invest?

Should I invest in Disney?

Before purchasing shares of Disney, you need to determine if you want to invest directly in the company. Here are some reasons why someone would consider buying shares of Disney:

- You want to invest in the company behind your favorite brands, characters, or experiences.

- You want your kids or grandkids to start investing and think Disney is a company they'd enjoy following.

- You believe Disney's investment in streaming will pay off.

- You think the company's cost-cutting strategy will improve profitability and boost the stock price.

- You think Disney could unlock shareholder value by selling some of its legacy media businesses.

- You want to earn some dividend income.

- You have confidence that CEO Bob Iger can get Disney back on track.

- You understand the risks of owning Disney stock, including the possibility that shares could lose value.

- You've thoroughly researched Disney and understand how to make money investing in the stock.

- Adding Disney would help diversify your portfolio.

- You plan to be a long-term investor and hold your shares through any volatility.

On the other hand, there are some negatives that you'll also want to consider while weighing whether to buy shares, including:

- You need the money you plan to use to buy Disney shares to cover an emergency or a major planned purchase over the next three to five years.

- You're seeking stocks with a higher dividend yield than Disney currently offers.

- Disney's values don't align with yours.

- You don't have time to research Disney stock to understand how it makes money and its risks.

- You think some of Disney's legacy issues, including problems at ESPN, will continue to weigh on its stock.

- You're not sure Disney can turn around its feature film business after a string of recent box office flops.

- You're worried about a potential recession and the impact it could have on Disney's consumer-facing business.

- You don't want to follow Disney's business.

There are many positive reasons to buy shares of Disney. The company's investments in streaming and its cost-cutting initiatives could drive profits higher in the future, which could help propel the share price.

However, each investor needs to determine if Disney is the right fit for their portfolio based on their personal situation and preferences.

Profitability

Is Disney profitable?

Earnings growth drives stock price appreciation over the longer term. That makes it a good area for beginning investors to focus on before buying shares.

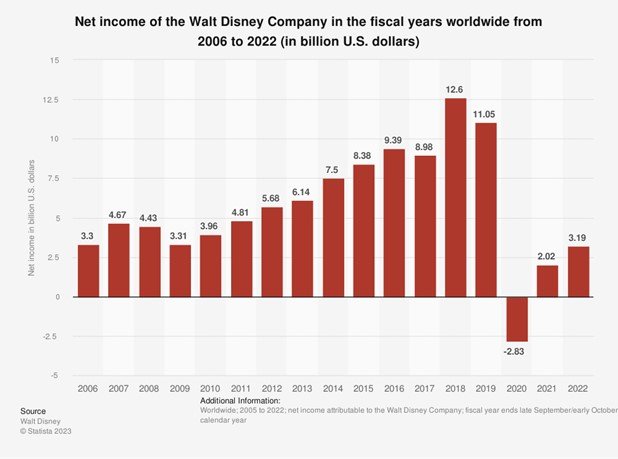

Disney is a profitable company. In its 2023 fiscal year, the company generated almost $2.4 billion of net income from continuing operations -- down 25% from the company's total in its 2022 fiscal year.

Disney's profitability remains well below its pre-pandemic peak:

Although some lingering effects from the pandemic have weighed on Disney's earnings, that's not the only issue. The company has also invested heavily in its streaming service, Disney+, to expand its content and subscriber base. The company hopes to achieve profitability from Disney+ by the end of its 2024 fiscal year.

Disney also launched a restructuring effort in early 2023 to slash as much as $7.5 billion in annual costs, including $3 billion from content. The move should help bolster the company's profitability, which has weighed on the stock price in recent years:

If the company's streaming investments and cost-saving initiatives work, Disney's profits should improve. That could get the company back on the path toward increasing shareholder value. However, if the company fails to improve profits, shares could continue to falter.

Dividends

Does Disney pay a dividend?

After a nearly three-year hiatus, Disney reinstated a dividend in late 2023. The company had decided to forgo making dividend payments in 2020 due to the pandemic's impact on its operations. The decision allowed Disney to retain additional cash to sustain its operations and invest in growth, including its streaming platform. Before the suspension, Disney had a history of paying a steadily rising dividend.

The company declared a semiannual dividend payment of $0.30 per share in November 2023. While that was less than the $0.88 per share bi-annual rate the company paid before the pandemic, it was a good start. Disney could increase its dividend in the coming years as its streaming investments start paying off.

ETF Options

ETFs with exposure to Disney

Instead of actively buying shares directly, you also can passively invest in Disney stock with a fund that holds its shares.

Disney is among the larger publicly traded companies by market capitalization. It's a widely held stock. Disney is included in several stock market indexes, including the Dow Jones Industrial Average and S&P 500 index. As a result, index funds and exchange-traded funds (ETFs) that benchmark their returns against those indexes hold Disney stock.

According to ETF Database, 334 ETFs held shares of Disney in late 2023. The five ETFs with the highest weighting to Disney stock were:

| Exchange-traded Fund | Fund Weighting | ETF Expense Ratio | ETF Category |

|---|---|---|---|

| Invesco S&P 500 Equal Weight Communications Services ETF (NYSEMKT:RSPC) | 5.21% | 0.40% | Communications stocks |

| Communications Services Select Sector SPDR Fund (NYSEMKT:XLC) | 5.14% | 0.10% | Communications stocks |

| ALPS Global Travel Beneficiaries ETF (NYSEMKT:JRNY) | 5.05% | 0.65% | Consumer Discretionary Stocks |

| iShares Global Comm Services ETF | 4.88% | 0.42% | Communications stocks |

| AdvisorShares Gerber Kawasaki ETF | 4.85% | 0.75% | All stocks |

Those five ETFs all have relatively similar weightings to Disney stock. That makes them all decent options to gain some exposure to the entertainment giant. However, given its low ETF expense ratio, the Communications Services Select Sector SPDR Fund stands out as the best option for those seeking a low-cost way to invest in Disney and other companies in the communications sector.

Exchange-Traded Fund (ETF)

Stock splits

Will Disney stock split?

As of mid-2023, Disney hadn't announced an upcoming stock split. However, the company has implemented seven stock splits throughout its history:

| Payable Date | Amount | Closing, Pre-Split Price |

|---|---|---|

| July 1998 | 3-for-1 | $111 |

| May 1992 | 4-for-1 | $153 |

| March 1986 | 4-for-1 | $143 |

| June 1973 | 2-for-1 | $215 |

| March 1971 | 2-for-1 | $178 |

| November 1967 | 2-for-1 | $105 |

| August 1956 | 2-for-1 | N/A |

All of Disney's stock splits have occurred when shares topped $100. Due to the impact of the pandemic and its investments in streaming, Disney's stock was below the triple-digit mark in late 2023. It seems unlikely that Disney will split its stock again soon.

The bottom line on investing in Disney stock

Disney is a brand that's beloved by many. The company's rich storytelling, likable characters, and enjoyable experiences have passed the test of time. Meanwhile, the company's investments in streaming could mean its best days still lie ahead. Disney stock could turn out to be a rewarding long-term investment.

Disney could be a great stock to buy and is easy enough to purchase at most brokerages. However, you still need to determine whether you want to own Disney since it might not be the best fit for everyone.

FAQs on Disney Stock

What's the highest Disney stock has been?

Disney stock hit an all-time high of $201.91 per share on March 8, 2021.

Did Disney stock split?

Disney has split its stock seven times throughout its history. The last Disney stock split was a 3-for-1 split in July 1998.