Google has become synonymous with an internet search. When we search for something online, we say we're "Googling it."

As a portal you likely use frequently (you might have even found this article through Google), you may be wondering how to invest in Google stock. Here's a step-by-step guide on investing in Google stock and some factors to consider before investing in the technology stock.

Is Google publicly traded?

Is Google publicly traded?

Google has been a publicly traded company since 2004. However, it no longer trades under that name. As the company grew beyond its namesake search engine, it changed its name. In 2015, Google formed a holding company called Alphabet (GOOG -0.58%)(GOOGL -0.67%).

The new name fits with its evolution into a collection of companies. In addition to Google, brands underneath the Alphabet umbrella include YouTube, Android, Chrome, Fitbit, Nest, Pixel, and many others (including its Bard artificial intelligence chatbot and Waymo autonomous driving unit).

Google Bard

Stock splits

Google stock split history

Google and its parent company, Alphabet, have completed two stock splits in its history. Google implemented a 2-for-1 split in 2004, giving each Class A holder one Class C share. The second split came in 2022 when Alphabet conducted a 20-for-1 split.

Why does Google (Alphabet) have two tickers?

Google's parent company, Alphabet, trades on the Nasdaq Stock Exchange. It has three share classes and two stock tickers:

- Class A shares (GOOGL): The Class A shares carry one vote per share.

- Class B shares (non-traded): Each Class B share has 10 votes. Google's co-founders own these shares, giving them more voting power.

- Class C shares (GOOG): The Class C shares have no voting power.

Given their voting power, Class A shares (GOOGL) tend to trade at a slightly higher price than Class C stock (GOOG). Investors need to determine if having a vote is worth paying the slightly higher cost to invest in the company.

How to buy

How to invest in Google

Although you can't invest directly in Google's search engine, you can invest in its parent company, Alphabet. You can buy shares of Alphabet in any brokerage account. If you still need to open one, these are some of the best-rated brokers and trading platforms. Here's a step-by-step guide to buying Alphabet stock using the five-star-rated platform Fidelity.

Fidelity makes it easy to buy stocks. Its website offers a video tutorial and a step-by-step guide. Here's a screenshot of how to place a stock trade with Fidelity:

On this page, fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The ticker symbol (GOOG or GOOGL for Alphabet).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Market Order

Once you complete the order page, click the "Place Order" button at the bottom and become an Alphabet shareholder.

Alternative ways to invest

Alternative ways to invest in Alphabet stock

Instead of actively buying shares of Alphabet directly, you can passively invest in the technology company through a fund holding its shares.

Alphabet is one of the largest companies by market capitalization and a widely held stock. Alphabet is in several stock market indexes, including the Nasdaq Composite and S&P 500 index. As a result, index funds and exchange-traded funds (ETFs) that benchmark their returns against those indexes hold Alphabet stock.

According to ETF.com, 412 ETFs owned almost 480 million shares of Alphabet as of late 2023. The SPDR S&P 500 ETF Trust (SPY -0.3%) held the most shares at 67.5 million. The fund had a 2% portfolio weighting to the Class A shares and a 1.7% weighting to the Class C shares. That gave it a 3.7% total portfolio weighting to Alphabet, making it the fund's third-largest holding.

Investors seeking greater exposure to Alphabet could consider the Vanguard Communications ETF (VOX -0.8%). The fund had a 12.6% weighting to Alphabet stock, making it a great way to invest passively in the tech titan.

Should I invest?

Should you invest in Google?

Before investing in Google's parent company stock, you need to determine if Alphabet shares are a worthwhile investment. Here are some factors to consider before investing in Alphabet stock:

Profitability

Is Alphabet profitable?

Alphabet is a wildly profitable company. The technology titan produced almost $20 billion of net income in the third quarter of 2023. That was up from almost $14 billion in the year-ago period.

The company took steps to boost its profitability in early 2023 by cutting jobs and other costs, like reducing its office space. These moves started paying off by driving a meaningful increase in its earnings.

Alphabet's revenue

Alphabet generated $76.7 billion of revenue in the third quarter of 2023, up 11% from the prior-year period. Google search remains the company's biggest revenue contributor. The company's search engine generated $44 billion of revenue in the quarter, 57% of Alphabet's total revenue for the period. YouTube ($8 billion) and Google Cloud ($8.4 billion) are two of the tech giant's other big revenue drivers.

Alphabet's valuation

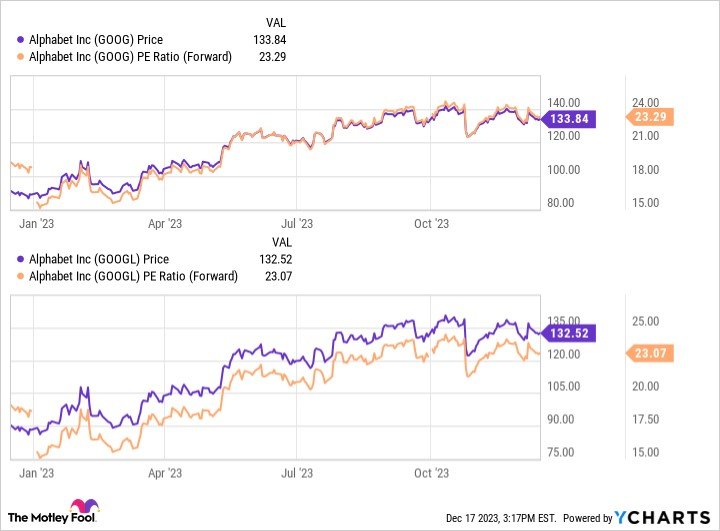

Alphabet's valuation has increased over the past year:

At less than 24 times, the valuation of Google's parent company is about the average of the major stock market indexes. As of late 2023, the S&P 500 traded at more than 21 times its forward price-to-earnings (P/E) ratio, while the Nasdaq Composite traded at 28.5 times its forward P/E ratio.

Related investing topics

Dividends

Does Alphabet pay a dividend?

As of late 2023, Google's parent company, Alphabet, did not pay dividends. Although it's very profitable and generates significant free cash flow, the technology titan uses that money to expand the business and repurchase shares.

The bottom line on investing in Google

Google remains the dominant name in internet search. However, the company has grown beyond search over the years, leading it to change its corporate name to Alphabet. The company is highly profitable. Shares of Google's parent could make a good long-term investment, especially if profits continue rising at a rapid rate.

FAQs

FAQs on investing in Google (Alphabet) stock

Is it a good idea to invest in Google?

It can be a good idea to invest in Google. Over the last decade, the technology giant has delivered a 380% gain (17.5% annualized), easily outperforming the S&P 500's 155% gain (10.1% annualized). While that past performance is no guarantee of future success, Google's parent company is in an excellent position to continue growing shareholder value. It's very profitable and generates lots of cash, which it uses to invest in its continued growth (including making bold bets like Bard and Waymo) and repurchasing shares.

How much would it cost to invest in Google?

It cost about $135 to buy one share of Google's parent Alphabet in late 2023. However, some brokers allow investors to buy fractional shares, so it can cost a lot less to invest in Google (sometimes as low as $1).

What is the ticker for Google?

Google's parent company has two stock tickers: GOOG and GOOGL. The Class A shares (GOOGL) carry one vote per share while the Class C shares (GOOG) have no voting power.

Where can I buy Google stock?

You can buy Google stock in any brokerage account. The company's parent, Alphabet, trades on the Nasdaq exchange under the stock tickers GOOG and GOOGL.