Johnson & Johnson (JNJ 1.49%) is an iconic global healthcare company. It was originally formed in 1866 when three brothers (Robert, Edward, and James Johnson) founded the company to focus on producing bandages and baby products. It has since grown into one of the largest and most well-regarded healthcare companies in the world.

Johnson & Johnson has three main concentrations:

- Consumer Health: The company's consumer health division (Kenvue) includes well-known brands Listerine, Band-Aid, Tylenol, and Zyrtec.

- Pharmaceuticals: Johnson & Johnson develops and manufactures several drugs. Top sellers include Stelara, Remicade, and its COVID-19 vaccine.

- MedTech: The medical technology division develops and markets products for orthopedics, surgery, intervention solutions, and vision.

In 2021, Johnson & Johnson unveiled a plan to spin off its consumer products division to focus on pharmaceuticals and medical technology. The company expects to complete the Kenvue spinoff to shareholders in November 2023.

Here's a step-by-step on how to buy shares of Johnson & Johnson and some factors to consider before investing in the healthcare stock.

How to buy Johnson and Johnson stock

How to buy Johnson & Johnson stock

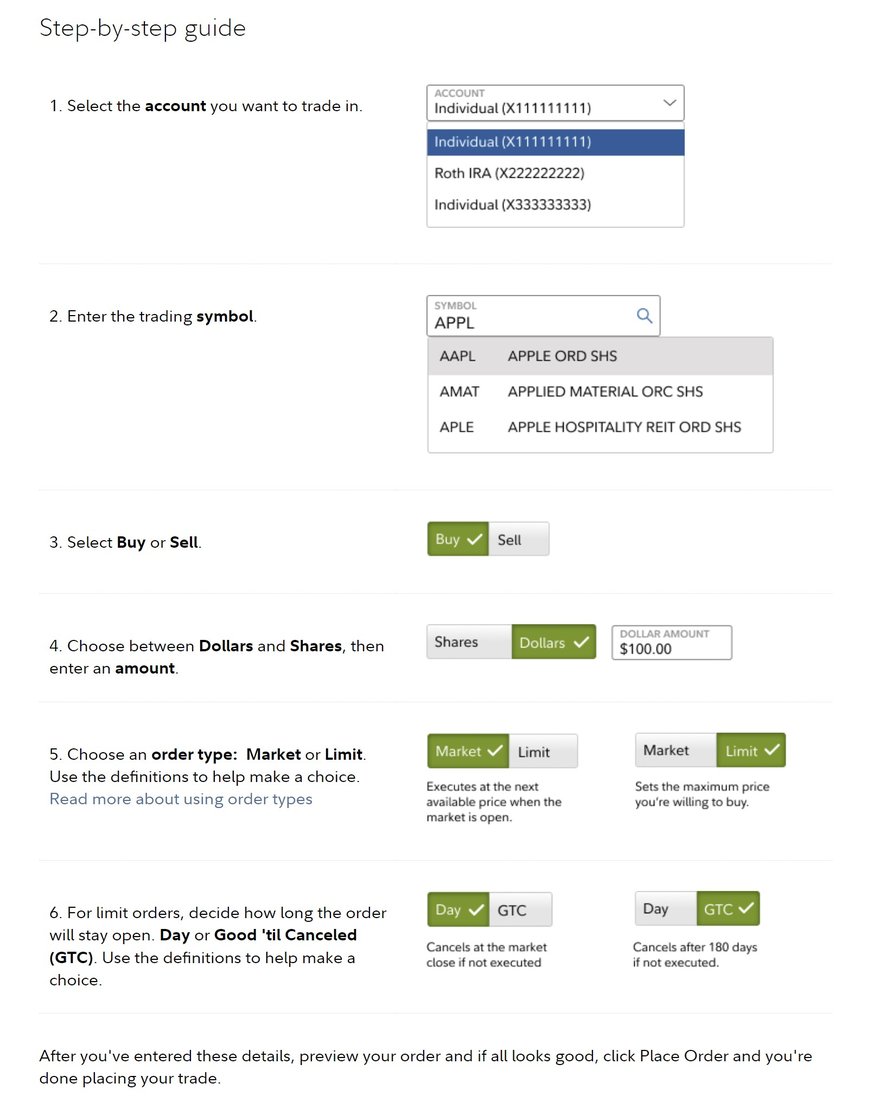

To buy shares of Johnson & Johnson, you must have a brokerage account. If you need to open one, these are some of the best-rated brokers and trading platforms. Here's a step-by-step guide to buying Johnson & Johnson stock using the five-star-rated platform Fidelity.

Fidelity makes it easy to buy stocks. Its website offers a video tutorial and a step-by-step guide. Here's a screenshot of how to place a stock trade with Fidelity: :

On this page, fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The ticker symbol (JNJ for Johnson & Johnson).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Once you complete the order page, click the "Place Order" button at the bottom and become a Johnson & Johnson shareholder.

Should I invest?

Should I invest in Johnson & Johnson?

Before buying shares of Johnson & Johnson, you need to determine whether the company's stock is a good investment. Here are some reasons why you might want to consider buying shares of Johnson & Johnson:

- You believe that Johnson & Johnson will benefit from the continued growth in healthcare spending.

- You understand how Johnson & Johnson makes money.

- You think Johnson & Johnson stock can outperform the S&P 500 over the long term.

- You want to earn dividend income.

- You're retired or retiring soon and want to own shares in a relatively stable company.

- You understand that Johnson & Johnson stock can lose value.

- You think that the company's upcoming spinoff of Kenvue will unlock value for shareholders.

On the other hand, here are some factors to consider that might make you decide not to buy shares.

- You want to avoid investing in a big pharma company.

- You only have a little time to invest and won't be able to follow both Johnson & Johnson and Kenvue.

- You're younger and want to invest in companies earlier in their growth phase than the more than century-old Johnson & Johnson.

- You don't need dividend income.

Profitability

Is Johnson & Johnson profitable?

Profit growth helps power stock price appreciation over the longer term. It's an ideal area for beginning investors to focus on before buying shares of a company.

Johnson & Johnson is a very profitable company. The healthcare giant produced $27 billion of adjusted earnings in 2022, a 3.2% increase from 2021. The company has an excellent long-term record of increasing its revenue, income, and shareholder value.

Revenue

Dividends

Does Johnson & Johnson pay a dividend?

Johnson & Johnson has a distinguished track record of paying dividends. In early 2023, the healthcare giant delivered its 61st consecutive year of increasing its dividend. That puts it in the elite group of Dividend Kings, companies that have increased their dividend payments for 50 or more years. It also makes Johnson & Johnson one of the best healthcare dividend stocks.

ETFs with exposure

ETFs with exposure to Johnson & Johnson

Instead of actively buying shares of Johnson & Johnson directly, you can passively invest in the healthcare company through a fund holding its shares.

Johnson & Johnson is one of the largest traded companies by market capitalization. It's a widely held stock. Johnson & Johnson is in several stock market indexes, including the Dow Jones Industrial Average and S&P 500 Index. As a result, index funds and exchange-traded funds (ETFs) that benchmark their returns against those indexes hold Johnson & Johnson stock.

According to ETF. Com, 330 ETFs held 246.7 million shares of Johnson & Johnson as of mid-2023. The SPDR S&P 500 ETF Trust (NASDAQ:SPY) owned the most shares at 29.2 million. However, Johnson & Johnson only had a 1.2% portfolio weighting in the ETF.

Investors wanting an ETF with greater exposure to Johnson & Johnson could consider the iShares U.S. Pharmaceuticals ETF (IHE -0.13%). Johnson & Johnson had a 22.9% portfolio weighting in the ETF. It's a better option for investors seeking to invest passively in Johnson & Johnson without directly buying shares.

Exchange-Traded Fund (ETF)

Stock splits

Will Johnson & Johnson stock split?

As of early 2023, Johnson & Johnson had not announced an upcoming stock split. However, the company has completed several stock splits over the years. Here's a snapshot of the JNJ stock split history:

| Split date | Stock split |

|---|---|

| June 2001 | 2-for-1 |

| June 1996 | 2-for-1 |

| June 1992 | 2-for-1 |

| May 1989 | 2-for-1 |

| May 1981 | 3-for-1 |

| May 1970 | 3-for-1 |

| June 1967 | 200% Stock Dividend |

| January 1959 | 2 1/2-for-1 |

| March 1951 | 5% Stock Dividend |

| November 1949 | 5% Stock Dividend |

| November 1948 | 5% Stock Dividend |

| May 1947 | 100% stock Dividend |

Although Johnson & Johnson has no upcoming stock split, the company plans to split into two by spinning off its consumer business (Kenvue) in November 2023. When that happens, investors will receive shares of Kenvue in addition to their Johnson & Johnson stock.

Related investing topics

The bottom line on investing in Johnson & Johnson stock

Johnson & Johnson is a global healthcare giant. It should benefit from the continued growth in healthcare spending in the coming years. That could enable the company to continue growing its earnings and dividend. Those two drivers should help it produce attractive total shareholder returns over the long term. It could be a good stock to buy for people seeking steady growth from the healthcare sector.

FAQs

FAQs on investing in Johnson & Johnson stock

Can you buy shares in Johnson & Johnson?

Yes, you can buy shares of Johnson & Johnson with a brokerage account.

Is Johnson & Johnson a good investment?

Johnson & Johnson can be a good investment. During the 10-year period from 2012 to 2022, Johnson & Johnson stock delivered a higher total return than the S&P 500 (12.7% versus 12.5%).

How long has J&J paid a dividend?

As of mid-2023, Johnson & Johnson has paid a growing dividend for 61 consecutive years.

What does a J&J split mean for shareholders?

In 2021, Johnson & Johnson decided to split into two companies. The legacy Johnson & Johnson will focus on pharmaceuticals and medical technology, while a newly formed company named Kenvue (NYSE: KVUE) will concentrate on consumer products.

In early 2023, Johnson & Johnson completed an initial public offering of Kenvue. It plans to spin off the rest of the shares to shareholders later in the year.

The J&J split means existing shareholders will receive shares of Kenvue in addition to their Johnson & Johnson stock.