Tesla (TSLA -1.06%) is one of the world's best-known and most popular companies. A big driver of its popularity is the presence of outspoken co-founder and CEO Elon Musk.

The visionary Musk, who also leads SpaceX, The Boring Company, Neuralink, and X (formerly Twitter), created Tesla with one ambitious goal: to accelerate the advent of sustainable transport by bringing compelling mass-market electric cars to market as soon as possible.

Musk has certainly succeeded with that mission. Tesla produced almost 1.4 million electric vehicles (EVs) in 2022, including about 1.3 million Model 3 cars designed for the mass market. It was on track to produce even more cars in 2023, having already produced 1.35 million through the third quarter. In addition to producing EVs, Tesla develops, manufactures, and installs solar energy systems (Solar City), battery storage systems (Powerwall), and EV charging infrastructure (Superchargers). It has also developed other technologies, including autopilot and self-driving features.

The company is as ambitious as ever. Tesla unveiled its Master Plan 3 at its investor day in early 2023. The company aims to help lead the planet to sustainability. A key aspect of that strategy is to ramp up its production to 20 million EVs annually by 2030. The company plans to build more gigafactories to manufacture its EVs, battery storage systems, and other sustainable energy products.

These investments should help drive the company's revenue and profits, giving the stock the power to soar and making Tesla a compelling stock for investors to buy. Here's a step-by-step guide to buying Tesla's stock and some things to consider before you do.

How to buy

How to buy Tesla stock

To buy shares of Tesla, you must have a brokerage account. If you need to open one, here are some of the best-rated brokers and trading platforms. This step-by-step guide will show how to buy Tesla stock using the five-star-rated platform Fidelity.

Fidelity makes it easy to buy stocks. Its website offers a video tutorial and a step-by-step guide. Here's a screenshot showing how to place a stock trade with Fidelity:

On this page, you would fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The ticker symbol (TSLA for Tesla).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order because it guarantees you buy shares immediately at that market price.

Once you complete the order page, click the "Place Order" button at the bottom and become a Tesla shareholder.

Should I invest?

Should I invest in Tesla?

Before buying shares in Tesla, you need to decide whether you should invest in Tesla stock. Here are some reasons to consider investing in Tesla:

- You want to invest in a company driven to accelerate the adoption of sustainable energy.

- You understand the risks of investing in Tesla, including the possibility that shares could lose value.

- You've thoroughly researched Tesla and understand how it makes money.

- You believe Tesla's strategy will increase its revenue and earnings at an above-average rate over the long term.

- You want to invest directly in stocks and have the time to follow the company.

- You don't need to earn dividend income.

- You are confident that Elon Musk can lead Tesla and handle all his other responsibilities.

- You plan to hold shares for the long term and ride out any near-term volatility.

- You think that more auto companies will follow Ford (F -0.41%), GM (GM -0.47%), and Rivian (RIVN 0.34%) in adopting Tesla's supercharging network, making it a growth driver for the company.

Conversely, here are some reasons an investor might choose not to buy shares of Tesla:

- You need the money you plan to invest in Tesla stock to cover emergencies or for a major planned purchase within the next three to five years.

- You're concerned about the company's valuation.

- You're worried about the economy, your job, health issues within your family, or other pressing matters.

- You have yet to research Tesla and need to know what it does and how it makes money.

- You don't have the time to invest directly in stocks and follow Tesla.

- You're near retirement and need dividend income.

- You're concerned about the risk that shares could lose value.

- Elon Musk's values don't align with yours.

- You're worried that Musk's focus on his other business pursuits, like X, could take away his focus on creating value for Tesla shareholders.

- You don't think other automakers' growing adoption of Tesla's supercharger network will be a profit driver.

Profitability

Is Tesla profitable?

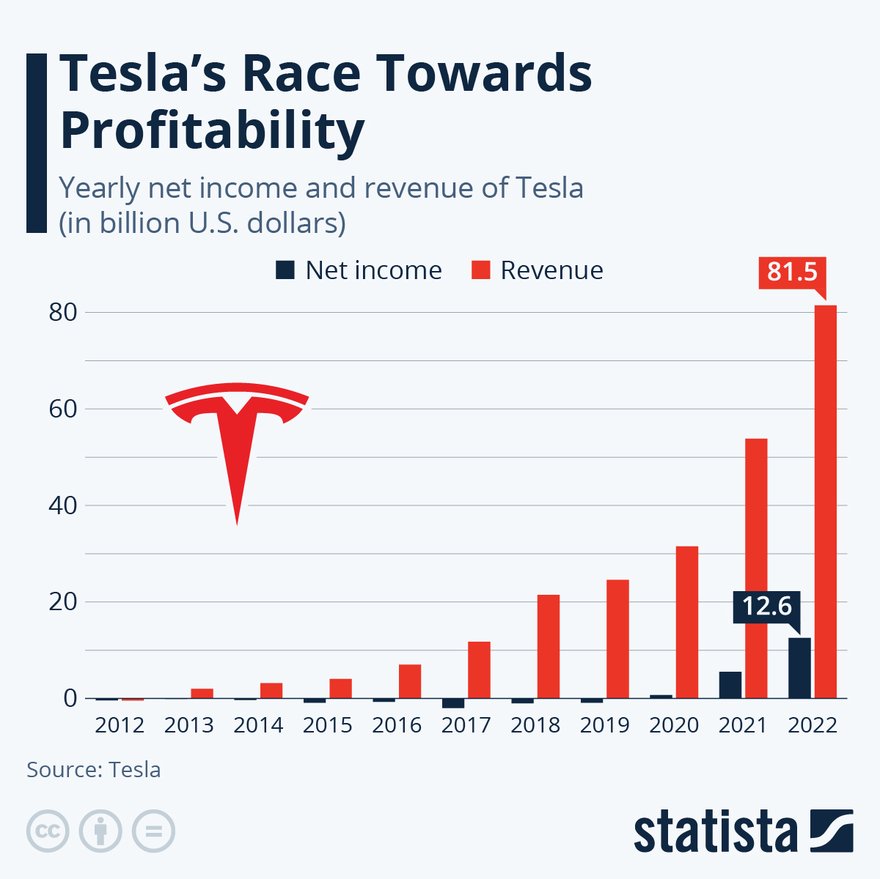

Earnings growth is one of the key drivers of a company's stock price over the long term. After years of posting losses, Tesla finally turned the corner on profitability in 2020.

The company's profits have surged over the last two years. They more than doubled in 2022, reaching a record $12.6 billion.

The company's profit did reverse throughout 2023. Its third-quarter earnings were down 44% to almost $1.9 billion, driven lower by falling profit margins and rising operational expenses.

However, the company is in a strong position to continue growing its earnings. It's investing heavily to build out production capacity, which should increase its scale while reducing production costs.

Tesla is also free-cash-flow positive. The company produced $2.3 billion in free cash flow through the first nine months of 2023, which helped grow its cash and investments balance to $26 billion against only about $4.4 billion of debt and finance leases. This put Tesla in a strong financial position.

Tesla's rapidly rising profits should help power its stock over the long term. If the company can continue growing earnings faster than average, the share price should gain value in the coming years. However, shares could crash in value if Tesla hits an earnings growth speed bump.

Dividends

Does Tesla pay a dividend?

As of late 2023, Tesla didn't make dividend payments to its shareholders. The company retains 100% of its earnings and cash flow to reinvest in growing the business and its cash balance.

Tesla is investing heavily to build additional gigafactories and expand its production capacity. In 2023, it unveiled an additional $3.6 billion investment to continue the expansion of Gigafactory Nevada. The company also plans to invest more than $5 billion in building a new gigafactory in Mexico.

Given the company's continued heavy investments in expansion, it likely won't start paying dividends anytime soon. It's not an ideal stock for those who need to earn passive income for retirement.

ETF options

ETFs with exposure to Tesla

Instead of actively buying shares directly, you can passively invest in Tesla by investing in a fund holding its stock. Tesla is one of the largest publicly traded companies by market capitalization and is a widely held stock.

Tesla is in several stock market indexes, including the S&P 500 index and the Nasdaq Composite index. As a result, index funds and exchange-traded funds (ETFs) that benchmark their returns against those indexes hold Tesla stock.

According to ETF.com, 345 ETFs held a reported 229 million shares of Tesla as of late 2023. The five biggest ETFs holding Tesla shares are:

| Exchanged-Traded Fund | Assets Under Management | Tesla Shares Held | Fund Weighting | Position Ranking in ETF |

|---|---|---|---|---|

| Invesco QQQ Trust (NYSEMKT:QQQ) | $220.7 billion | 25.8 million | 2.9% | Ninth-largest |

| SPDR S&P 500 ETF Trust (NYSEMKT:SPY) | $444.9 billion | 31.9 million | 1.7% | Ninth-largest |

| iShares Core S&P 500 (NYSEMKT:IVV) | $388.4 billion | 27.3 million | 1.7% | Ninth-largest |

| Vanguard S&P 500 ETF (NYSEMKT:VOO) | $359.3 billion | 24.8 million | 1.6% | Ninth-largest |

| Vanguard Total Stock Market ETF (NYSEMKT:VTI) | $334.8 billion | 19.6 million | 1.3% | Ninth-largest |

While the SPDR S&P 500 ETF holds the most shares, almost 32 million, it has a relatively low weighting compared to smaller ETFs. Among the most notable funds with more meaningful weighting to Tesla stock are the Consumer Discretionary Select Sector SPDR Fund (XLY -0.48%) and Cathie Wood's ARK Autonomous Technology & Robotics ETF (ARKQ -1.16%).

The Consumer Discretionary Select SPDR ETF, which had $19.2 billion of assets under management in late 2023, had a 17.3% weighting to Tesla (its third-largest holding). Meanwhile, the ARK Autonomous Technology & Robotics ETF had $1 billion in assets under management and a 12.4% weighting to Tesla (its top holding). Given their higher weightings, the ETFs are potential options for investors who want higher exposure to Tesla stock without directly owning shares.

Exchange-Traded Fund (ETF)

Stock splits

Will Tesla stock split?

As of late 2023, Tesla did not have an upcoming stock split. However, the company has completed two stock splits in its history as a public company:

| Type of Stock Split | Date | Pre-Split Price |

|---|---|---|

| 5-for-1 | August 2020 | Around $2,200 per share |

| 3-for-1 | August 2022 | Around $900 per share |

Each time the company split its stock, the share price decreased to a more accessible level for individual investors. The most recent split reduced the share price to about $300.

As of late 2023, Tesla stock was below that post-split level at roughly $250 per share. It seems unlikely that Tesla will split its stock anytime soon. Given the historical trend, Tesla will likely wait until shares are closer to $1,000 before announcing another split.

Related investing topics

The bottom line on investing in Tesla stock

Tesla is one of the most innovative companies in the world. It has a charismatic and controversial leader driving the company toward an ambitious mission. If he's successful, Tesla's stock price could ride higher, enriching its shareholders in the process.

Many people want to invest in Tesla stock. It's easy to buy shares. However, before you do, make sure you want to. It might not be for everyone.

FAQs

FAQs on Tesla

Does Tesla use AI?

Tesla is among the growing number of companies using artificial intelligence (AI). The company uses AI to improve its autonomous driving capabilities, among other things. The company noted in the third quarter of 2023 that it had "more than doubled the size of our AI training compute to accommodate for our growing dataset as well as our Optimus robot project. Our humanoid robot is currently being trained for simple tasks through AI rather than hard-coded software, and its hardware is being further upgraded."

Can anyone invest in Tesla stock?

Anyone with a brokerage account can invest in Tesla stock. The company trades on the Nasdaq exchange under the stock ticker TSLA.

Who is the CEO of Tesla?

Elon Musk has served as the CEO of Tesla since October 2008.

When was Tesla founded?

Tesla started up on July 1, 2003, in San Carlos, California.