It's essential for investors to have a diversified portfolio, which is a balanced collection of stocks and other investments across non-related industries. That's because those assets work together to reduce an investor's risk of permanent loss and their portfolio's overall volatility. The trade-off of diversification is an associated reduction in a portfolio's return potential.

However, it's possible to have too much diversification. Over-diversification occurs when each incremental investment added to a portfolio lowers the expected return to a greater degree than the associated reduction in the risk profile. In a sense, an investor can hold so many investments that instead of diversifying their portfolio, they've engaged in a bit of "di-worsification" where their portfolio is worse off because there's no added benefit to the incremental investments owned above a certain level.

How much diversification is too much?

There's no absolute cutoff point that distinguishes an adequately diversified portfolio from an over-diversified one. As a general rule of thumb, most investors would peg a sufficiently diversified portfolio as one that holds 20 to 30 investments across various stock market sectors. However, others favor keeping a larger number of stocks, especially if they're riskier growth stocks. For example, some take a basket approach of investing in similar companies in an industry to make sure they don't end up being correct on the thesis that the sector will rebound or grow at an above-average rate but choose the wrong stock that underperforms its competitors.

Instead of being an absolute number, over-diversification is more a function of spreading a portfolio too thin by investing in lower-conviction ideas for the sake of diversification. For example, not all investors need to own oil stocks or tobacco stocks to have a diversified portfolio, especially if doing so would conflict with their values. Similarly, owning more than 100 stocks can make it difficult for an investor to keep up with their portfolio, which could cause them to hold on to losing stocks for too long.

What are the risks of over-diversification?

The biggest risk of over-diversification is that it reduces a portfolio's returns without meaningfully reducing its risk. Each new investment added to a portfolio lowers its overall risk profile. Simultaneously, these incremental additions also reduce the portfolio's expected return.

However, at some point, an investor will reach the number of investments where the benefit of risk reduction from each new addition is smaller than the decrease in expected gains. Thus, there's no incremental benefit to adding that investment. It would be better to sell a lower-conviction idea and replace it with this new one than add it to the portfolio since there's no incremental benefit.

The other danger of over-diversification is that it takes an investor's focus away from their highest-conviction ideas. They'll need to divert some of their time to stay up to date on all their holdings. That could cause them to focus too much on losing investments and not enough on the winners. It would be better to cultivate the winning ideas and add capital to those investments while weeding out bad ones that don't add an incremental benefit.

How do I avoid over-diversification?

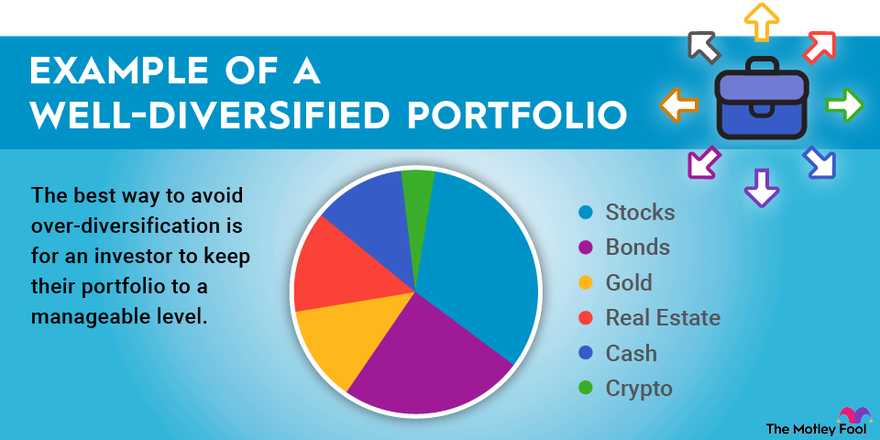

The best way to avoid over-diversification is for an investor to keep their portfolio to a manageable level. For some investors, that means only holding their 10 highest-conviction investments, so long as they're in various industries. For others, avoiding over-diversification means trimming investments in certain sectors (e.g., volatile materials producers, cyclical or industrial stocks, or hard-to-understand sectors such as biotechnology stocks) that they own simply for the sake of diversification.

Over-diversification can also mean owning shares in overlapping mutual funds or exchange-traded funds (ETFs). For example, an investor who owns an S&P 500 index fund -- which holds 500 of the largest U.S. companies -- and an ETF of technology stock focused on the NASDAQ Composite Index has over-diversified their portfolio. That's because the S&P 500 already has considerable exposure to information technology at nearly 28% of its total, including its five largest stock holdings. The best way for an investor to avoid over-diversifying with funds is to understand what they hold and sell a fund with similar holdings.

Related investing topics

Too much diversification can make a portfolio worse

Diversification is essential because it reduces a portfolio's risk profile. However, since it also reduces its return potential, investors eventually reach the point where an incremental investment reduces the return potential more than the offsetting reduction in the risk profile. Because of that, investors should avoid over-diversifying their portfolio since it waters down their returns too much.