Most stock market participants invest using buy-and-hold strategies, aiming to identify strong companies with bright, long-term futures.

But Wall Street uses numerous, more creative strategies to speculate on stock movements. Even as a buy-and-hold investor, there will be times when the prices of stocks you own are influenced by what other investors are doing rather than by the company's underlying business fundamentals. One such phenomena, the "short squeeze," has the potential to make a stock's price rocket much higher overnight.

A short squeeze happens when many investors short a stock (bet against it) but the stock's price shoots up instead.

Let's say an investor believes that shares of NoGood Co. are overvalued at their current share price of $100, then that investor can borrow someone else's shares of NoGood and immediately sell them to another buyer -- again, for $100. Of course, you can't simply sell what you don't own with no consequences -- at some point, those borrowed shares have to be returned. When that day comes, the investor needs to buy shares in the market to be able to return them to the lender. If the investor is correct and the share price has indeed declined, let's say to $70, then the investor will make $30 in profit. They sold borrowed shares for $100, repurchased them for $70, returned the shares, and pocketed the difference.

If the shares of NoGood instead increase in price, then the short seller is at risk of losing a very large amount of money on the trade. (Unlike price declines, which are capped when the share price reaches $0, price hikes are theoretically limitless.) If a stock's price rises quickly, then short sellers sometimes scramble to close out their positions as rapidly as possible. A high volume of investors who are shorting a stock and racing to exit their positions at the same time creates a short squeeze. The sudden surge in demand to buy shares of a stock can send the stock's price even higher.

If, for example, NoGood Co. reported better-than-expected earnings and its stock price jumped to $120, then panicked short-sellers might rush to close out their positions before the share price kept climbing. This sudden high demand could cause the stock's price to rise even more sharply to $130 or $140 per share. The dramatic jump in price "squeezes" those who shorted the stock.

One of the biggest short squeezes of all time: Volkswagen

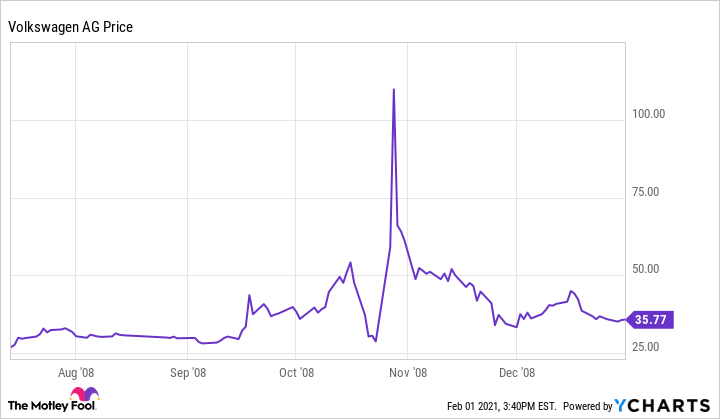

One of the most notable short squeezes in recent history centers on the stock of European automaker Volkswagen (VWAGY 0.2%). In 2008, Volkswagen saw its stock price jump by more than 300% in a matter of days, briefly making the company seemingly worth more than $400 billion -- above the valuation of any other public company at the time.

In Volkswagen's case, a number of factors contributed to the squeeze. Holding company Porsche SE owned a big chunk of the shares, and the German government also owned a large stake, meaning that relatively few shares were actually traded in the public market. There was ample speculation that Porsche would buy the rest of Volkswagen.

In October 2008, amid the broader financial crisis that caused most every stock to trade down, Volkswagen's stock continued to trade higher. Those who didn't think a deal with Porsche would happen, or were buying Volkswagen stock to hedge another investment, shorted the automaker's stock, assuming that its price would fall eventually.

But Porsche surprised the market by putting out a statement: It had been building its stake in Volkswagen via options, meaning that only about 6% of Volkswagen's shares remained in the open market. That's a danger sign for short sellers who need shares to be available to exit their positions. The Porsche statement caused short sellers to rush for the exits, creating a massive spike in demand for the relatively few Volkswagen shares still available. With extremely high demand and little supply, the stock's price soared.

How to find the next short squeeze

The kindling needed to start a short squeeze is a stock for which many investors hold short positions.

Most online brokerages and stock data websites provide information indicating, for each publicly traded company, the number of shares sold short and the total number of shares outstanding. To find the percentage of shares being shorted, divide the number of shares sold short by the total number of shares outstanding and then multiply by 100. Although company size and the number of shares available can be relevant factors, companies with more than 25% to 30% of their shares sold short could be prime candidates for a short squeeze. But the numbers can be deceiving since there are technical reasons that can enable a single share to be shorted more than once. This distortion can lead to a stock's shorting percentage being inflated.

A few words of caution: Generally speaking, heavily shorted stocks are heavily shorted for a reason. Likely valid reasons are what caused a large number of investors to bet on a stock's price going down. Be cautious about establishing any position in a heavily shorted stock. At the very least, study up on the company and evaluate the reasons some are choosing to bet against it.

Also, looking at the Volkswagen chart above, notice the price went down nearly as fast as it went up. By the end of 2008, the stock's price was basically back to where it started before the squeeze.

Even in a best-case scenario, a short squeeze is a quick occurrence -- not a long-term strategy. Buying into a company in the hope of lassoing a rocketing price is speculative at best. Not all stocks with high short interest get squeezed.

A short squeeze may seem exciting, but the more reliable way to get rich is to identify and buy strong companies and hold them for as long as possible.

Related investing topics

Expert Q&A

The Motley Fool had a chance to connect with an expert on shorting: Sofia Johan, an associate professor in the finance department of FAU's College of Business.

The Motley Fool: As we saw with GameStop in January 2021, when forces align, a stock's price can rocket higher, causing a "short squeeze." That said, do you anticipate any trends in the future as more of these phenomena are fueled by the internet and social media?

Johan: I expect that there will be greater oversight on naked shorts. This is especially relevant as many retail investors do not fully understand the trading process. In a typical short sale, a seller will either directly or go through an intermediary to borrow the shares to deliver to the buyer. When prices go down (hopefully) the seller will buy shares at a lower price to deliver to lender or to close out. The short squeeze resulting from prices going up is one issue, but there also are other risks, such as difficulty in borrowing the shares. Some intermediaries have access to client accounts, such as Mutual Funds, or other Institutions that tend to keep their stock holdings stable. But as demand to borrow increases, then the lending cost may increase, or some intermediaries get preferential treatment. This potentially increases levels of naked shorts, where the seller does not intend to deliver the shares.