With the stock market sharply declining throughout 2022, continued sluggishness into 2023, and the roller-coaster ride showing no signs of stopping, it's natural for investors to feel a sense of anxiety over the market and their portfolio.

However, in turbulent times it's important to take a step back, take a deep breath, and keep things in perspective. In this article, we'll discuss some of the ways to keep a cool head during uncertain times and even how to use corrections and market crashes to your financial benefit, both from a long- and a short-term perspective.

To be perfectly clear, this is intended to help address your financial anxiety as a stock market investor but is not meant to be mental health advice.

Tips on how to handle stock market anxiety

Tips on how to handle stock market anxiety

While there's no perfect way to deal with stock market anxiety, here are some of the best tips that can help reduce your general stress level and keep your eye on your long-term investment objectives.

1. Turn off the noise

When I wake up in the morning and turn on the financial news and see a screen full of red quotes and panicky commentators, I say to myself, "Today is a good day to do nothing." I don't check my brokerage account balance, and I don't buy or sell anything until things have calmed down.

The reason? Aside from the mental health benefits of not watching your portfolio decline minute by minute, paying too much attention during volatile times often causes investors to make irrational, knee-jerk decisions. It's common knowledge that the goal of investing is to buy low and sell high, but human nature makes us want to "sell before things get any worse," which is the exact opposite.

2. Check your conviction

If you're invested solely in index funds, you can skip this section. But if you invest in individual stocks, one exercise I like to do when the stock market is giving me anxiety (and it happens to all of us) is to go through my portfolio and look at how the underlying businesses are doing. If a company is increasing earnings and revenue at the same pace it has been for the past several years, and my general investment thesis remains intact, I don't care nearly as much that the stock price is down.

If you're invested in great businesses, you can rest soundly. The stock market is going to do its thing -- all of the most successful stocks in the market have drawn down by 50% or more at one point or another. But great businesses can deliver excellent returns over the long run despite the volatility.

3. Zoom out

One of the smartest things you can do when you're feeling anxious as a stock market investor is to remind yourself that you're a long-term investor. And the best way to do that is to visually remind yourself that, over the long term, stock investors make money.

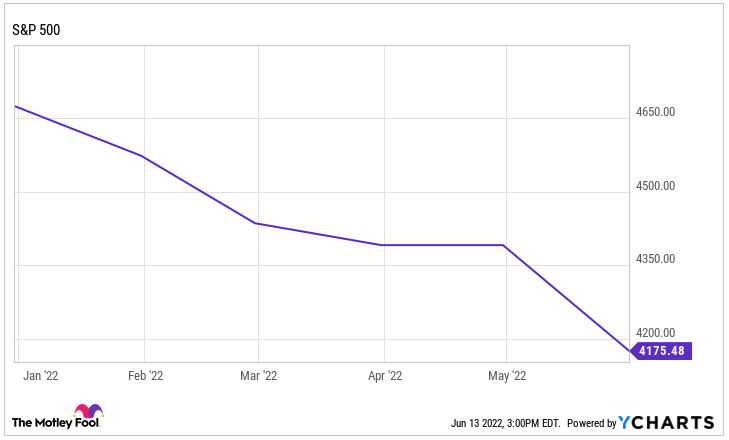

Consider this six-month chart of the S&P 500 through June 13, 2022. It looks terrifying:

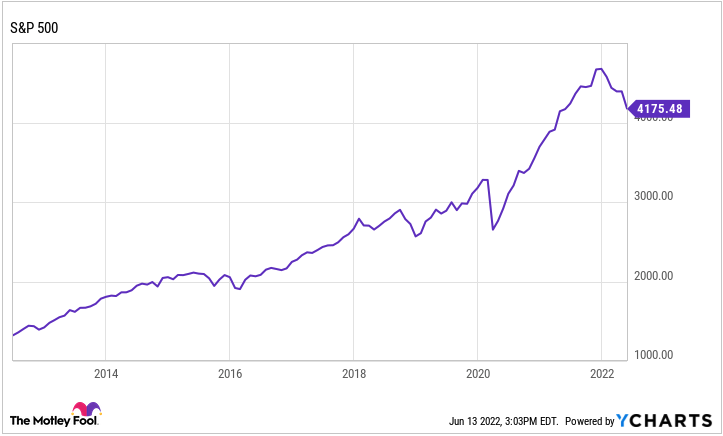

On the other hand, this 10-year chart looks far more encouraging:

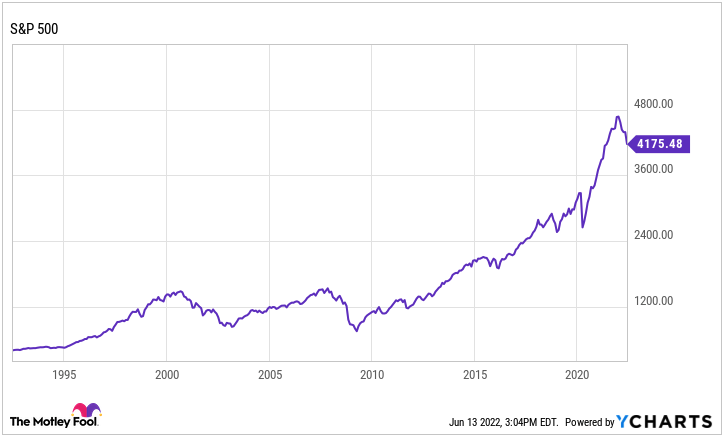

And, in this 30-year chart, the 2022 market decline is barely visible:

Strategies to take advantage of turbulent times

Strategies to take advantage of turbulent times

As long-term investors, it can be helpful to find the silver linings in tough situations. And, believe it or not, there are a few ways you may be able to use stock market declines to your advantage.

Tax-loss harvesting

Tax-loss harvesting is a tax strategy that refers to selling losing investments to reduce your tax liability.

Here's how it works: If you sell an investment at a loss, you can use those losses to offset any capital gains you have during the same tax year. In other words, if you sold a stock in January 2022 for a $5,000 profit and sold another in May 2022 at a $3,000 loss, the IRS would only consider $2,000 of taxable gains.

Even if you don't have any capital gains to report on your tax return, the IRS allows you to use up to $3,000 of capital losses to offset your other taxable income. And, if you have more than $3,000 in losses, you can carry over the excess to next year.

It's important to mention that it's not a good idea to sell investments only to get a tax benefit. But if you're on the fence about selling an investment that didn't quite work out and you see better ways to deploy that capital, a market decline can be a smart time to harvest some of your losses and move on.

Look for bargains

There's an old saying in real estate investing: "You make your money when you buy, not when you sell." The idea is that the price you pay for an investment is more important to your long-term returns than the price you'll eventually sell at. The same idea applies to stock market investing. After all, asset prices are generally going to go up over time, and there's no telling what a stock's price will be in 15, 20, or 30 years when you need the money. But you can certainly take advantage of bargains today.

Obviously, nobody likes watching the value of their portfolio declining. But one of the biggest mindset milestones in my investing career was when I learned to think of stock market crashes and bear markets as buying opportunities. Think of it this way -- if you were shopping at your favorite store and everything was suddenly marked down by 50% for a limited time, how would you react? As Warren Buffett has said, "When it rains gold, put out the bucket, not the thimble."

An important caveat is your own risk tolerance and overall mental well-being. We're absolutely not saying that you should be cramming as much money into your brokerage account as possible, even if you won't be able to sleep at night for a while. If it makes you feel comfortable to have a certain amount of cash in reserve or to simply let your cash reserves build up during tough times, by all means do it. But the point is that market corrections and crashes have historically been smart places for long-term investors to add shares of excellent businesses to their portfolios.