The stock market was "volatile" in the early days of the COVID-19 pandemic. It was "volatile" again, to a lesser degree, ahead of the 2020 U.S. presidential election. Maybe you've heard about the stock market's "fear gauge" being elevated at various times -- but what does that actually mean?

Here's what investors need to know about stock market volatility.

What is stock market volatility?

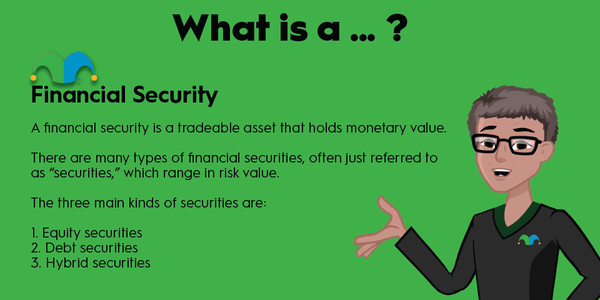

Stock market volatility is a measure of how much the stock market's overall value fluctuates up and down. Beyond the market as a whole, individual stocks can be considered volatile as well. More specifically, you can calculate volatility by looking at how much an asset's price varies from its average price. Standard deviation is the statistical measure commonly used to represent volatility.

Stock market volatility can pick up when external events create uncertainty. For example, while the major stock indexes typically don't move by more than 1% in a single day, those indices routinely rose and fell by more than 5% each day during the beginning of the COVID-19 pandemic. No one knew what was going to happen, and that uncertainty led to frantic buying and selling.

Some stocks are more volatile than others. Shares of a blue-chip company may not make very big price swings, while shares of a high-flying tech stock may do so often. That blue-chip stock is considered to have low volatility, while the tech stock has high volatility. Medium volatility is somewhere in between. An individual stock can also become more volatile around key events like quarterly earnings reports.

Volatility is often associated with fear, which tends to rise during bear markets, stock market crashes, and other big downward moves. However, volatility doesn't measure direction. It's simply a measure of how big the price swings are. You can think of volatility as a measure of short-term uncertainty.

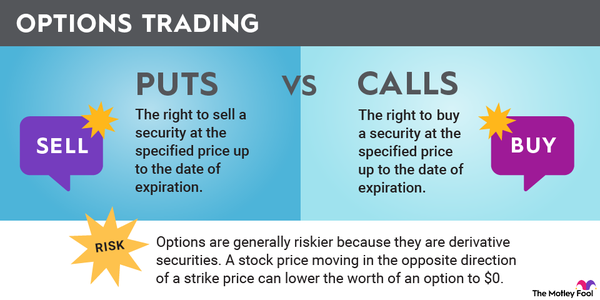

Historical volatility is a measure of how volatile an asset was in the past, while implied volatility is a metric that represents how volatile investors expect an asset to be in the future. Implied volatility can be calculated from the prices of put and call options.

Measuring stock market volatility

For individual stocks, volatility is often encapsulated in a metric called beta. Beta measures a stock's historical volatility relative to the S&P 500 index.

A beta of more than one indicates that a stock has historically moved more than the S&P 500. For example, a stock with a beta of 1.2 could be expected to rise by 1.2% on average if the S&P rises by 1%. On the other hand, a beta of less than one implies a stock that is less reactive to overall market moves. And, finally, a negative beta (which is quite rare) tells investors that a stock tends to move in the opposite direction from the S&P 500.

For the entire stock market, the Chicago Board Options Exchange (CBOE) Volatility Index, known as the VIX, is a measure of the expected volatility over the next 30 days. The number itself isn't terribly important, and the actual calculation of the VIX is quite complex. However, it's important for investors to know that the VIX is often referred to as the market's "fear gauge." If the VIX rises significantly, investors could be worried about massive stock price movements in the days and weeks ahead.

CBOE Volatility Index (VIX)

Why is volatility important?

By understanding how volatility works, you can put yourself in a better position to understand the current stock market conditions as a whole, analyze the risk involved with any particular security, and construct a stock portfolio that is a great fit for your growth objectives and risk tolerance.

It's important to note, though, that volatility and risk are not the same thing. For stock traders who look to buy low and sell high every trading day, volatility and risk are deeply intertwined. Volatility also matters for those who may need to sell their stocks soon, such as those close to retirement. But for long-term investors who tend to hold stocks for many years, the day-to-day movements of those stocks hardly matters at all. Volatility is just noise when you allow your investments to compound long into the future.

Long-term investing still involves risks, but those risks are related to being wrong about a company's growth prospects or paying too high a price for that growth -- not volatility. Still, stock market volatility is an important concept with which all investors should be familiar.

Exclusive Market Volatility Q&A with Outside Experts

Dr. Suchismita Mishra

The Motley Fool: Should stock market volatility impact an investor's overall investing strategy?

Dr. Mishra: Answer to this question will depend on holding period or investment horizon of the investor and the composition of the portfolio he/she is holding.

If majority of the portfolio is held in equity or stocks and the investor is not patient enough to buy and hold then volatility will have an impact on the strategy.

For example: for someone who is young and has long work life in front of them can afford to have a buy and hold strategy depending on their risk appetite. Volatility can be beneficial to buy stocks at the dip (down market) and hold to gain in the long run. In this case someone can capitalize on volatility.

But for someone who are in the middle of their work life or nearing retirement, holding needs to be rebalanced to have more fixed income (bonds or bond funds for example) which are safer asset classes as in this case investor is heading toward the need of more stable cashflow post retirement.

Above all, volatility will impact investing strategy as in general rational investors don't like too much swing (ups and downs) in their investment returns. But extent of this impact will depend on the investment horizon, composition of the current portfolio and investor's risk tolerance.

Typically, volatility will have more impact on investment strategy in a bearish market as investors see their returns plummeting which adds to their stress during a downturn.

The Motley Fool: What micro and macro-economic factors influence volatility the most?

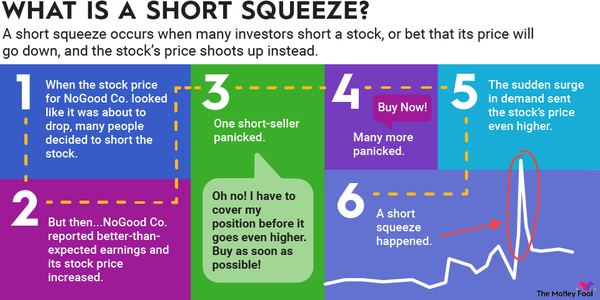

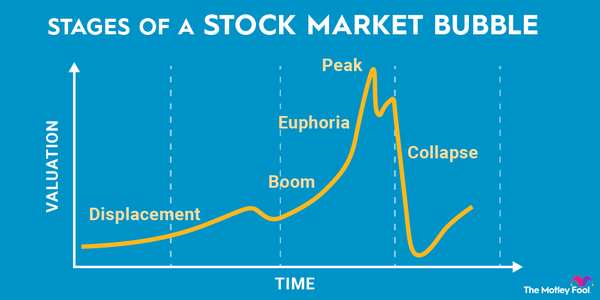

Dr. Mishra: Macro factors such as shocks (example COVID, Delta Variant currently, policy uncertainty) which create unpredictability or uncertainty in the entire economy as they lead to increased probability of recession, unemployment. There are also structural changes such as commission free trading, increased retail participation in the market via social media etc. which create temporary spikes in stock market volatility for example: Game Stop phenomenon.

Micro factors are firms and sectors vary in their response to the shocks for example, hospitality industry had to endure a bigger blow in the COVID crisis whereas banking and finance sector had bigger blow during 2008-11 financial crisis. So the cross sectional differences in the response to the shock are the micro factors which creates varying level of volatility across businesses and sectors.

The Motley Fool: Over the long term, what asset classes have the most or least volatility?

Dr. Mishra: Gold, Treasury bonds, Bond funds in general are least volatile. Currently digital currencies are one of the riskiest asset classes.

The Motley Fool: What is your best advice for investors who experience extreme market volatility near their retirement age?

Dr. Mishra: Best is to move funds to fixed income sector such as bonds or bond funds and diversify within these asset classes to reduce risk for example hold a mix government bonds and corporate bonds, domestic and foreign bonds etc. Less holding in equity(stocks) is recommended and even within the equity holdings more emphasis on value stocks rather than growth stocks.

Dr. Ahmad Namini

The Motley Fool: Should stock market volatility impact an investor's overall investing strategy?

Dr. Namini: Market volatility is an inevitable part of the investment management process. If market volatility did not exist, no financial instrument would ever rise or fall. Thus, if one invested 1000 dollars, after a period of time, one would still have only 1000 dollars. Thus, market volatility affords the investor the ability of make or lose money. This fundamental law of investment dictates that market volatility is necessary for portfolio growth with the caveat that volatility can also result in negative returns, i.e. losses.

An investor should definitely take market volatility into account. With volatility, individual stock prices will go up and down. An investor could "time" the market, i.e. buy the stock when the price is low and sell when the price high. For most investors, timing the market is difficult to achieve on a consistent basis.

Also, market volatility implies that stocks return trends are cyclical in nature. Thus, stocks that go up will go down and everything that will go down will go up. The issue is then transferred to that of what level the ups and downs occur. If the ups are higher than the downs, then in the long term, the stock price is increasing. Obviously, the opposite is true, in that if the ups are lower than downs, in the long run, the stock price is decreasing.

Some financial instruments are fundamentally tied to volatility, such as stock options. The more volatile the stock, the more the option is valued, since the owner of the option has the option and not the obligation to purchase stocks at a given price. Options are not for the casual investor since options have leverage which will amplify positive and negative returns.

The Motley Fool: What micro and macro-economic factors influence volatility the most?

Dr. Namini: Market volatility is the manifestation of the market's level of uncertainty or better known as risk. If the economy makes investors' expectation of economic performance ambiguous, the market will exhibit volatility. The uncertainty comes from interest rates (the cost of borrowing money to invest within a company), economic performance (some sectors expect growth while others expect decline), and probably most important, political and societal events (perceived disruption of normal conditions). During last year, the Presidential election, race protests, and pandemic resulted in the market exhibiting historically a high level of volatility.

The Motley Fool: Over the long term, what asset classes have the most or least volatility?

Dr. Namini: Over the long term, bank deposits are the least volatility. A steady unphased increase of value is expected. However, rates of return are so low under current interest rate levels and the expectation of rising inflation makes bank deposits as an undesirable investment asset class.

Next in line are corporate stocks and bonds, which are always desirable but with the caveat that some corporations do better than others. Blue-chip corporations historically perform well and yield a positive return, while small-cap, more growth-oriented corporations might have large returns with periods of high volatility.

Finally, penny stocks and cryptocurrencies have proven to be highly volatile with huge swings in prices. High growth is possible but hard to predict for an individual stock or token. Investors must have the internal fortitude and long-term conviction to hold these assets during periods of high volatility.

The Motley Fool: What is your best advice for investors who experience extreme market volatility near their retirement age?

Dr. Namini: In the end, extreme volatility should be based on one's own risk preference as well as their life environment. Young investors who are generations from retirement can afford to be less risk averse in their retirement planning, while investors nearing retirement should be more risk averse and start to plan for concrete, more certain monthly cashflows. Market volatility is undesirable for investors nearing retirement. Although some elderly investors, no doubt, have benefited from volatility, the vast majority of near retirement age investors are gambling their future in high volatile stocks. Near retirement age, investors should invest in safe, low volatility, historically strong performers. Stock indices are a great bet with diversification balancing individual stock volatility. Also, ETFs provide diversification at the sector level.

Finally, any investor should invest in a level of market volatility that they are comfortable with. Financial advisors should provide options that match expected returns per unit of risk. The markets provide investors with higher\lower returns with increased volatility. Any adopted strategy for high growth through higher volatility should explicitly understand that the highs are wonderful but the lows can ruin one's wealth.

Dr. Preston D. Cherry, PhD, CFP

The Motley Fool: Should stock market volatility impact an investor's overall investing strategy?

Dr. Cherry: Investing strategy aligns with the individual investor's goals, values, and attitudes. Market volatility tends to trigger emotions and behaviors that counter the objectives planned strategy. A portfolio with diversification, liquidity for living needs, and alignment with goals tend to dampen impulse reactions to market volatility.

The Motley Fool: What micro and macro-economic factors influence volatility the most?

Dr. Cherry: At the micro-level, investor sentiment influences volatility examples such as confidence in the economy's overall direction, prices of their daily goods, the outlook of covid and jobs, and dare we say, behavioral and technical sentiment to meme stocks.

At the macro-level monetary policy, headlines such as money supply flows, interest rates, and inflation lead to conversations about decentralized finance, or 'de-fi' and cryptocurrency. Political news-cycle discussions, government covid management, and comprehensive policy also influence volatility because they are unknown, which leads to uncertainty.

The Motley Fool: What is your best advice for investors who experience extreme market volatility near their retirement age?

Dr. Cherry: Market volatility can significantly impact stress, anxiety, perceptions, satisfaction, and overall well-being levels about life and money. During volatile moments is where conversations with a holistic planner coach you through the technical aspects of the micro and macro environment and counsels you through the money psychology of your life cycle moment are valuable.