There are right and wrong reasons to sell a stock. While it's generally a bad idea to sell a stock simply because its price increased or decreased, other situations perfectly justify placing one or more sell orders.

Let's delve into several good reasons for selling a stock, when to sell stock for a profit or loss, and which circumstances do not justify selling a stock.

Reasons to sell a stock

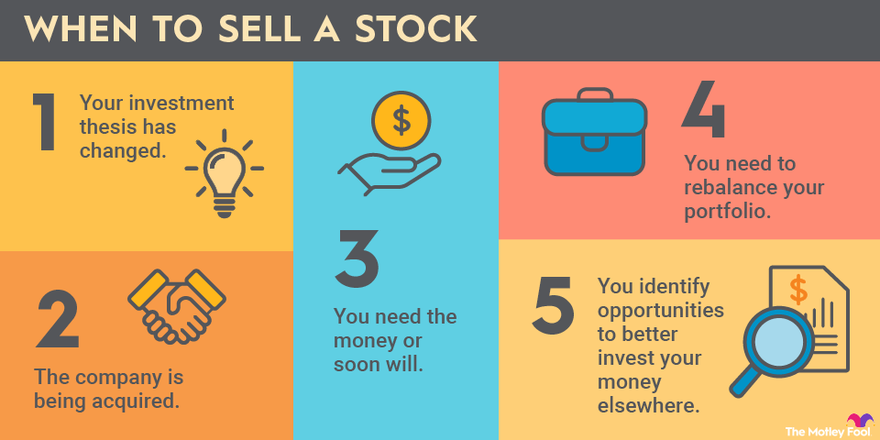

Here's a rundown of five scenarios that can justify selling a stock:

1. Your investment thesis has changed.

The reasons why you bought a stock may no longer apply. Examine why you bought a stock in the first place and ask yourself if those reasons are still valid. You should have a reason -- or an investment thesis -- for each of your stock investments other than just wanting to make money.

If something fundamental about the company or its stock changes, that can be a good reason to sell. For example:

- The company's market share is falling, perhaps because a competitor is offering a superior product for a lower price.

- Sales growth has noticeably slowed.

- The company's management has changed, and the new managers are making reckless decisions such as assuming too much debt.

Of course, this list isn't exhaustive. If something substantially changes that contradicts your investment thesis, that's one of the best reasons to sell.

2. The company is being acquired.

Another potentially good reason to sell is if a company announces it has agreed to be acquired. After an acquisition is announced, the stock price of the company being acquired typically rises to a level close to the agreed-upon purchase price. Since further upside potential can be quite limited, it may be wise to lock in your gains shortly after the acquisition announcement.

Specifically, the way the company is being acquired affects whether selling your stock is the right decision. A company can be acquired in cash, stock, or a combination of the two:

- For all-cash acquisitions, the stock price typically quickly gravitates toward the acquisition price. But if the deal is not completed, then the company's share price could come crashing back down. It's rarely worth holding on to your shares long after the announcement of an all-cash acquisition.

- For stock or cash-and-stock deals, your decision to hold or sell should be based on whether you have any desire to be a shareholder in the acquiring company. For example, Slack Technologies (NYSE:WORK) agreed to be acquired by Salesforce (CRM -0.18%) in a cash-and-stock deal. Slack shareholders who don't want to become Salesforce investors would be well advised to cash out.

3. You need the money or soon will.

It's generally a best practice not to invest in the stock market with any money you expect to need within the next few years. But if you need the money, that's certainly a valid reason to sell.

Perhaps you want to purchase a house and sell some stock to cover the down payment. Or you may have children who plan to attend college in a few years, and you want to convert your stock holdings into more secure investments such as certificates of deposit (CDs).

4. You need to rebalance your portfolio.

Your investment portfolio can become unbalanced in one or more ways. That is why periodically rebalancing your portfolio -- which may involve selling some stock -- is necessary for most investors. These are two of the most common circumstances preceding a stock sale:

- Owning a high-performing stock: If you own shares that have significantly increased in price, your position in the company may represent a large portion of the value of your portfolio. While this is a good problem to have, you may not be comfortable with having so much of your money invested in a single company and choose to sell part of your stock.

- Seeking to reduce your stock exposure: As you get closer to retirement, it's smart to gradually reduce your portfolio's stock holdings in favor of safer investments such as bonds. One popular rule of thumb is to subtract your age from 110 to determine the percentage of your portfolio that should be invested in stocks. If your portfolio seems too stock-heavy, then selling some stock to reallocate your resources can be a good decision.

5. You identify opportunities to better invest your money elsewhere.

In a perfect world, you'd always have spare cash to invest for every time you identify an attractive investment opportunity. Since that's probably not the case, you may decide to sell stock to invest the cash differently.

Let's say you notice an incredible buying opportunity for one of your favorite stocks and decide you want 10% of your portfolio to be allocated to this investment. If you don't happen to have 10% of your portfolio sitting in cash, you may decide to sell some shares of another stock or exchange-traded fund (ETF) you own to free up some capital. There's likely nothing wrong with the other stock or ETF, but recognizing an excellent long-term opportunity elsewhere can be a valid reason to sell.

When to sell stocks for profit

Any of the above are good reasons to sell a stock for a profit. Having earned a profit from an investment can further justify selling the stock to pay for a major purchase, your living expenses in retirement, or as part of your portfolio allocation strategy.

But don't sell a stock for profit just because the price increased. Doing that would be falling into the trap of believing that it's a good idea to "take some money off the table" if a stock gains value.

When to sell stocks at a loss

Similarly, it's usually a bad idea to sell a stock only because its price decreased. At the same time, though, sometimes you just have to cut your losses on a stock position. It's important to not let a drop in a stock's price prevent you from selling.

As legendary investor Warren Buffett says, "The most important thing to do if you find yourself in a hole is to stop digging." If your original reason for buying a stock no longer applies, or if you were just plain wrong about the company, then selling at a loss rather than continuing to hold may be your best option.

When not to sell a stock

It's important to clearly know when not to sell a stock. Here's a list of some of the situations in which it's inadvisable to sell your shares:

- Don't sell a stock just because its price increased. Winning stocks increase in price for a reason, and they also tend to keep winning.

- Don't sell a stock just because its price decreased. Every investor wants to buy low and sell high. Selling a stock just because its price fell is literally doing the exact opposite.

- Don't sell stock just to save money on taxes. While a tax strategy known as tax loss harvesting can reduce your taxable capital gains by incurring losses on unprofitable stock positions, it's nonetheless a bad idea to sell stocks just to lower your taxes. Tax loss harvesting can be a smart tax-saving strategy, but only if you are choosing to sell a losing stock for other valid reasons.

Related investing topics

The Motley Fool sells stock regularly, too

While The Motley Fool always approaches investing with a long-term perspective, that doesn't mean we only suggest stocks to buy. We regularly give "sell" recommendations to our members and often for one of the reasons described above. There can be several valid reasons to sell a stock, and many long-term-focused investors frequently have reasons to offload parts of their holdings.