Investing in the stock market is a risky game in the short run but an unusually dependable game in the long run. Because nobody can accurately predict the market's next move, we're often scared to see aggressive selling -- and to see all of our numbers in the red.

Here, we'll walk through what's actually happening when the market crashes and offer some practical advice on how best to navigate choppy waters.

What happens when the stock market crashes?

When we see market values rapidly decrease, we're seeing the very basics of supply and demand in real time. In short, stock prices go down when there are more sellers than buyers for a particular security. When the stock market goes down as a whole, we can say that this is happening across a wide range of companies.

Stock market values can decline for any number of reasons, not least of which is a combination of fear and uncertainty about the market's short-term future. During the past two years, we've seen COVID 19 pandemic-related uncertainty shake markets in the short term, but we've also seen some incredible price growth when we look at the two-year pandemic period as a whole.

Stocks can trade lower in the short run due to changes in expectations about the future. For example, if the Federal Reserve Board indicates it might raise interest rates more than expected, the stock market likely will react negatively. The threat of tighter money policy can spook markets, which ultimately leads to selling. Frantic selling can lead to a related effect: more selling.

What happens to your money?

Account values throughout the investing universe were, on average, inflated at the end of 2021. Share values were around all-time highs for a number of months, which made investors feel richer than ever.

Then January 2022 hit. The S&P 500, presumably shaken over concerns that the Fed would increase interest rates faster than expected, fell more than 10% from its all-time high of around 4,800. Although the index ended the month down only 5.3%, fear ran rampant. With the S&P falling quickly, many investors felt as though large portions of their accounts had evaporated. To some extent, that's exactly what happened.

Let's go over what happens when you buy shares of the total stock market through a fund such as Vanguard's Total Stock Market Index Fund (NASDAQMUTFUND:VTSA.X).

Let's say you purchased 100 shares of the fund when it was trading at $100 per share, spending a total of $10,000. Then imagine that the total market fell by 20%. The value of a share you owned would drop to $80, and your total investment would plummet to $8,000.

When the market goes down, the total value of your investment decreases. In other words, the market value of your investment has changed, but you still own the same 100 shares as you did previously.

Recall that investing in the stock market is a risky endeavor, and market values can change from moment to moment. However, there is strong evidence that short-term fluctuations are best ignored, and a focus on the long term is the smart approach.

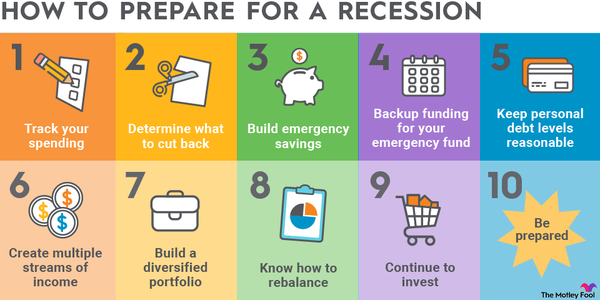

How to prepare for a stock market crash

The best thing to do to prepare for a stock market downturn depends on a variety of factors -- primarily, your time horizon and risk appetite. Identifying your specific goals will help you decide what to do if stocks should go south.

If you're a long-term investor, and you don't need your invested money for more than, say, 10 years, your best bet is to do nothing at all. The probability of losing money with a 10-year passive index investment is near zero, and that probability decreases as your investment time horizon increases. In other words, short-term stock market movements mean next to nothing when viewed in the context of a long-term investment.

If you're close to retirement, however, you may want to employ a different strategy. If you're heavily invested in stocks and retire as the market crashes, you might need to sell stocks at a loss to cover living expenses. This is clearly not ideal. Unless you're extremely wealthy, you might be putting your portfolio in peril by having taken too much risk.

The way to prepare is simple: As you near retirement, consider building up your cash reserves and "de-risking" your asset allocation. Put another way, you should think about converting some of your stock investments to bonds or to even more stable assets such as money market funds or high-yield savings accounts. Although cash and bonds aren't ways to necessarily maximize your portfolio returns, they represent important insurance policies if the market takes a dive just as you retire.

Choosing the right stocks

Choosing the perfect stocks for your portfolio is a very difficult venture, if not impossible. Beating the market with stock picking, day trading, or both is a dicey proposition, to say the least. As a result, diversified stock market index funds that cover a wide population of stocks and seek to mimic the market's overall return are likely to yield acceptable results over the long run.

Historically, a long-term focus and a "stay-the-course" attitude in the short run have led to investing success. Trading on emotion or today's news is a good way to damage your portfolio over time, especially if you have another 20 or 30 years to invest. So, if you don't need the money in the immediate future, it's best to let your investments go along for the ride -- even during a crash.

By placing your chips on the market as a whole, you'll be giving yourself the best chance to build wealth, and you'll also be in a position to recover from market crashes sooner when they inevitably occur.

Related Investing Topics

Market crashes are normal

While no two market declines are exactly the same, drops in stock prices are quite common and expected. Throughout history, we've seen the market move in cycles. At certain points, stocks overheat and selling corrects stretched valuations. Eventually, stocks become oversold, and buying surfaces again.

Managing your emotions during market crashes is imperative. If you're someone who will be tempted to trade if bad news arises, turn off the television or change the channel. Try not to check your portfolio. Sticking to your long-term strategy is a tried-and-true way to get the most from your investments -- even if it means enduring some stomach-churning drops.