The automotive industry is huge and very visible. Almost everyone knows automotive brands, and most people have an opinion about the best new cars and trucks on the market.

Because of that visibility, automotive stocks have gotten lots of interest from investors for decades. We’ll look more closely at automotive stocks and the best ways to invest in them.

The auto industry is rapidly changing in the current economic climate, especially with the rise of electric cars. Find the latest information in the newsfeed at the end of this article.

Top car stocks of 2024

Top car stocks of 2024

Some of the best-known automotive stocks are:

| Automotive company | About |

|---|---|

| Ford Motor Company (NYSE:F) | Investors know this automaker as a longtime market leader in pickup trucks and commercial vehicles, with operations all over the world. Ford is now investing in electric and automated vehicles to help it maintain that lead. Ford’s F-Series pickups are the best-selling vehicles in the U.S. and an important profit driver for Ford. |

| Ferrari NV (NYSE:RACE) | This small Italian automaker is known for its expensive sports cars and years of racing success. Ferrari’s strong brand and its long waiting list give it great pricing power and luxury-level profit margins. |

| Tesla (NASDAQ:TSLA) | The pioneering maker of “premium electric vehicles” has grown to be the world’s largest automaker by market cap, with strong U.S. sales and a growing international presence. Investors clearly expect great things from CEO Elon Musk and his team. |

| Stellantis (NYSE:STLA) | Formed in 2021 by the merger of Fiat Chrysler and Peugeot, this automaker houses brands including Jeep, Ram, Dodge, Opel, Vauxhall, and Peugeot. It also owns the Fiat, Alfa Romeo, and Maserati brands, and it has strong operations in Europe and South America, as well as the U.S. |

| Volkswagen (OTC:VWAGY) | Volkswagen is one of the best-selling automakers outside the U.S. Its portfolio of brands includes VW, Skoda, and SEAT, plus the Audi, Lamborghini, Porsche, and Bentley luxury brands. |

| Toyota (NYSE:TM) | Established in 1937, the Japanese automotive giant's portfolio of brands includes Toyota, Lexus, Daihatsu, and Hino. The power of its brand and its global footprint make Toyota the largest car brand in the world in terms of sales. |

| General Motors (NYSE:GM) | Owner of the GMC, Buick, Chevrolet, and Cadillac brands, GM is the largest car company in the US in terms of sales. |

The auto industry

The auto industry

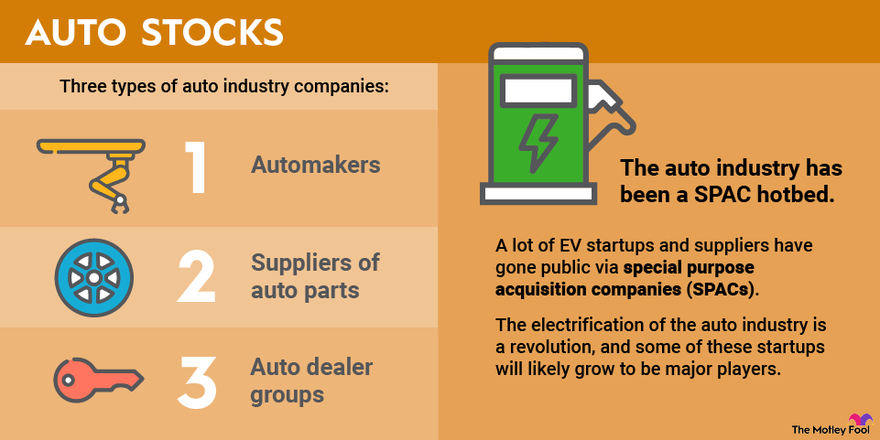

You’ll find the following types of stocks within the automotive industry group:

- Automakers, which manufacture cars, trucks, and sport utility vehicles, including electric vehicles (EVs)

- Suppliers of auto parts, from seats and spark plugs to complex electronic systems, tires, and batteries for electric cars

- Auto dealer groups

- Auto parts retailers

Evaluating an automotive stock

How do you evaluate an automotive stock?

Automotive stocks are part of the consumer durables sector. This sector includes companies that make products intended to last for more than a few years, such as washing machines, dishwashers, furniture -- and cars and trucks.

Before investing in automotive stocks, it’s important to understand how economic cycles affect automotive companies and how these companies work to maximize profits and stay competitive during good and bad economic times.

The auto sales cycle

Understanding the auto sales cycle

Automakers and their suppliers are cyclical stocks, meaning their profits rise and fall with consumer confidence. It’s easy to see why. When businesses and consumers are worried about the economy, they postpone buying new vehicles.

Auto sales’ cyclicality matters to investors because:

- Automakers have high fixed costs that include factories, tooling, logistics networks, and labor contracts. These bills have to be paid no matter how many cars get sold.

- Automakers and suppliers also need to invest in product development to make sure they have a steady stream of competitive new products.

- High costs and steady spending mean that profit margins in the automotive industry tend to be low, even during good economic times.

- When sales slump, as in a recession, automotive companies’ profits fall sharply -- putting future product spending and future competitiveness at risk.

One way to avoid the cyclicality of the sector is to buy stocks exposed to the replacement market, such as auto parts retailers or auto parts manufacturers that sell primarily to the replacement market.

Cash reserves

Cash reserves

Most automotive companies sharply cut future product spending during the 2008-09 recession. The few that didn’t, like Ford and Hyundai, had fresh products in their showrooms when the recovery began and were able to gain market share.

That was an important lesson for the industry. Now most global automakers tend to keep substantial cash reserves so they can keep investing to develop new products through recessions.

One interesting development during the COVID-19-induced recession was that many automakers decided to forego investment in traditional internal-combustion engines in favor of EVs.

Many automotive companies also pay dividends to their shareholders. Some automakers plan to use their cash reserves to continue to pay dividends during a recession. During the COVID-19 pandemic, both Ford and General Motors (GM 4.37%) suspended their dividends to conserve cash. Analysts expect both to resume dividends in the future.

Understanding financial statements

How do you understand car companies’ financial statements?

For the most part, automotive companies’ financial statements aren’t too hard to decipher. Here are three things to know:

- Auto investors tend to look at operating income, or EBIT (earnings before interest and taxes), as well as operating or EBIT margins (calculated by dividing profits by total revenue) and cash flow, to track an automotive company’s financial performance. These include the direct costs of manufacturing and shipping vehicles, as well as research and development expenses (which can be very high in the automotive industry), while excluding interest costs and taxes less directly related to the company’s ongoing performance.

- Automakers will often provide adjusted figures that exclude the impact of one-time charges and gains such as write-offs and tax windfalls, which are useful for understanding the underlying performance of the business. (Note that one-time charges and gains can be important, too.)

- Many automakers have subsidiaries that are finance companies, providing loans and leases to customers and dealers. They can make automotive financial statements confusing for investors. To help, most automakers provide debt and cash flow figures specific to their core automaking businesses, often called “automotive” or “industrial” numbers. You can use those to understand a car company’s debt and for comparisons between automakers.

Competition in the car industry

Competition in the car industry

Generally speaking, the automaker with the newest products will get the highest prices and the biggest profits. Automakers must constantly invest to be sure they have a steady flow of new products in the pipeline.

Virtually all automakers and many parts suppliers are also making big investments in future technologies such as EVs, extra safety features, and autonomous driving systems. Most experts believe those technologies will be necessary for automakers if they are to stay competitive in the not-too-distant future.

Electric vehicles

Electric vehicles

Some exciting opportunities in the next few years will involve manufacturers of electric and hybrid electric vehicles. These are new and different, and most analysts expect them to largely displace internal-combustion vehicles over time.

EV companies might see high growth, which is also exciting for investors. But it’s important to remember that the processes involved in developing and manufacturing EVs aren’t all that different from those used by makers of traditional internal-combustion vehicles. That means EV manufacturers face high costs just like traditional automakers.

It’s also important to remember that all the major traditional automakers are introducing electric vehicles of their own, and the competition in this segment of the market will eventually become fierce.

COVID-19 and the car industry

COVID-19 and the car industry

Car companies were hit hard by the coronavirus pandemic in the first half of 2020. Most car factories around the world were shut down for several weeks, and many dealers ran short of popular models. By the end of June 2020, most factories had reopened with new rules and equipment to protect workers from the virus, but 2020 sales remained sluggish for most traditional automakers.

A rebound has been slow to emerge because automakers have been dealing with supply chain problems and a shortage of silicon chips. The supply chain is crucial for the automotive industry since it tends to run tight inventories using “just-in-time” production techniques.

Supply chain problems lasted through most of 2021, not least due to a lack of auto semiconductors, and production was continually pared back through the year. The problems continued through 2022, only for the industry to be hit with slowing demand coming from a rising rate environment. Light vehicle production is improving in 2023, but not at quite the rate that industry commentators expected going into the year.

Another way that automakers changed their behavior during the pandemic investing more in electric vehicle development than in the development of traditional internal combustion engine vehicles.

A SPAC hotbed

The auto industry has been a SPAC hotbed

There are more public automotive companies now than a few years ago because EV start-ups and suppliers have gone public via special purpose acquisition companies (SPACs). These tend to be younger companies that are years away from profitability, but many have captured the eye of investors, and some trade at a premium compared to traditional automakers.

The electrification of the auto industry is a revolution, and some of these start-ups will likely grow to be major players. But given the number of companies out there and the success incumbents such as Volkswagen and GM have had building out their EV credentials, investors should be cautious when considering these SPACs.

Are automotive stocks for you?

Are automotive stocks for you?

Automotive stocks can be important contributors to your investment portfolio. And because they rise and fall with consumer confidence, they can be useful indicators that economic trouble -- or a recovery -- may be on the way.

In addition, buying into an automotive maker means taking a positive view on the company's long-term hybrid and electric vehicle strategy.

Automotive stock FAQ

Automotive Stock FAQ

What is the best automotive stock to buy?

Investors are willing to pay a premium for car companies with powerful electric vehicle brands, such as Tesla, and are discounting traditional internal combustion engine manufacturers. While the car industry is low growth in terms of unit sales, the winning stocks will ultimately be those that are relevant to the transition to hybrid and electric vehicles.

Which is the fastest-growing auto stock in the world?

Workhorse Group, a manufacturer of commercial zero-emission vehicles, is the fastest-growing auto company in 2023, with analysts expecting sales to increase by about 1,200% for the full year.

What car companies are on the stock market?

Giants like Toyota, General Motors, Ford, and Stellantis own multiple brands. Other well-known brands with U.S. listings include Tesla, Honda, Li Auto, Rivian, Vinfast, Nio, Lucid, and XPeng. Lesser-known car companies such as NWTN, Fisker, and Polestar are also listed on the U.S. market.

What car companies are on the S&P 500?

Tesla, Ford, and General Motors are all members of the S&P 500 index.