Some of the biggest companies in the world are oil and gas producers, including ExxonMobil (XOM -0.09%) and Royal Dutch Shell (SHEL -0.15%). But just because you've heard of a stock or a company doesn't necessarily mean it's a good investment.

The oil and gas industry has experienced significant market volatility over the past several years, leaving energy investors wondering whether oil companies -- even top oil companies -- are smart investments right now. Let's dig in to better understand whether oil and gas stocks are good long-term investments that deserve a place in your portfolio.

Is it safe to invest in oil and gas?

Is it safe to invest in oil and gas?

Fossil fuels such as oil and natural gas remain in high demand in part because they're usually cheaper than other heating and transportation fuels. They also have a massive infrastructure advantage over emerging clean fuel sources such as renewable energy.

However, oil stock investments are riskier than other stock market sectors because the industry has several additional risk factors, including:

- Cyclicality: The oil and gas sector tends to include cyclical businesses, meaning that investors are likely to experience booms and busts.

- Volatility: Oil and gas companies face other factors beyond their control. The prices of oil and gas are a major factor in the valuations of oil and gas stocks. When prices are low, the market tends to punish these stocks. When Saudi Arabia and Russia began an oil price war in March 2020 that caused global oil prices to plummet, stock prices in the oil and gas sector also collapsed. Conversely, when oil prices rose after Russia invaded Ukraine in February 2022, energy stocks also soared.

- Uncertainty: Oil and gas exploration is unpredictable. A company buys the rights to an exploration block and conducts tests to determine the presence of oil or gas deposits. If they're found, the company drills test wells to determine the quality of the deposits and then drills production wells and connects the associated infrastructure, all before earning any money. The inherent uncertainty of exploration can result in large losses from investments that don't pan out.

- Environmental issues: Fossil fuels emit greenhouse gases during their production, transportation, and combustion, which contribute to climate change. As a result, governments are increasingly pressuring companies to decarbonize their operations, and demand for oil and gas will likely wane in the coming decades.

- Safety concerns: Oil and gas are both flammable and toxic, and the pipelines transporting them stretch for hundreds or thousands of miles. Meanwhile, the machinery that extracts oil and gas is heavy and complex. Combine these factors, and a misstep can have tragic consequences. For example, BP's (BP -1.17%) Deepwater Horizon oil spill in the Gulf of Mexico in 2010 caused catastrophic damage, which it's still paying for to this day.

Add it all up, and oil and gas is one of the riskiest sectors for investors. However, some oil and gas companies are safer than others.

Which oil and gas stocks are the safest?

Which oil and gas stocks are the safest?

As with many other industries, the larger companies tend to be less risky. The so-called "oil supermajors" -- ExxonMobil, Royal Dutch Shell, BP, Chevron (CVX 0.75%), and TotalEnergies (TTE -1.28%) -- each with global operations and annual revenues of more than $100 billion -- aren't going bankrupt anytime soon. Neither are the large exploration and production (E&P) companies such as ConocoPhillips (COP -0.41%), big pipeline companies such as Kinder Morgan (KMI 2.53%), top refiners such as Phillips 66 (PSX -2.51%), or major oilfield services companies, including Schlumberger (SLB 0.26%).

Market capitalization and strong balance sheets matter in this sector because price declines can drive smaller oil and gas companies out of business. After the price of crude oil crashed in 2014, many offshore rig operators went bankrupt because of low demand for their services. In early 2020, as demand for fuel sharply declined due to the COVID-19 pandemic, several smaller E&P companies filed for bankruptcy, including Whiting Petroleum (NYSE:WLL) and Chesapeake Energy (CHK 0.2%).

Large oil and gas companies tend to be better positioned, at least when it comes to not going out of business. But just because a company is still operating doesn't mean that its stock will perform well in the future.

Benefits of investing in oil and gas

Benefits of investing in oil and gas

Oil and gas stocks can produce significant capital gains from share price appreciation and attractive dividend income during periods of high oil and gas prices. As crude oil prices rise, oil companies tend to generate gushers of cash, giving them more money to drill additional wells to increase their oil and gas production, repay debt, repurchase stock, and pay dividends, all of which can create value for shareholders. Of note, dividend payments in the sector tend to be higher than average because of the amount of cash that oil companies can generate during good times. That often makes the sector attractive to investors seeking high dividend yields.

Because of the industry's upside potential during periods of economic growth, oil and gas stocks can be smart investments if timed right. While The Motley Fool does not advocate for attempting to time the market, oil and gas investments made just as the economy transitions from a recession to an expansion can turn out to be wise moves.

Is crude oil a good investment?

Is crude oil a good investment?

Well-timed oil and gas stock investments can turn out well -- although that's risky and almost impossible to do -- but crude oil is often a poor investment. Investors don't have an easy way to invest directly in crude oil. Most exchange-traded funds (ETFs) focused on crude oil only track the price of a barrel of oil using oil futures contracts. The ETFs must routinely purchase new contracts as the existing ones near expiration. Transaction fees, along with the ETF's expense ratio, eat into returns.

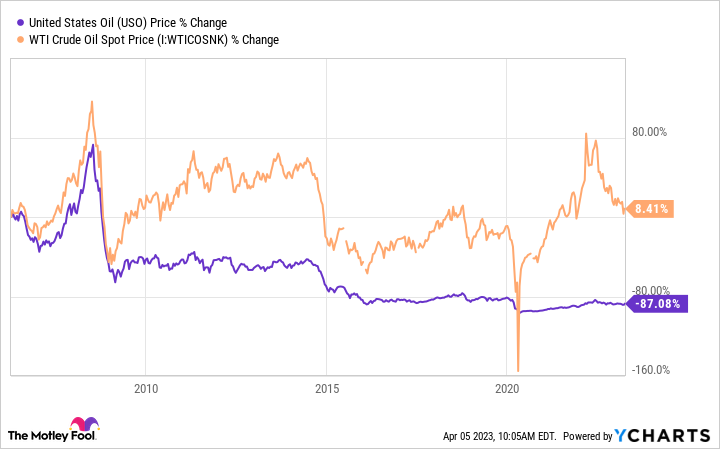

The chart below demonstrates the massive underperformance of the leading crude oil ETF, the United States Oil Fund (USO -0.17%), compared to the benchmark West Texas Intermediate (WTI) crude oil price:

Given that investors don't have a better option, the ETF's significant underperformance relative to the price of crude oil suggests that crude oil isn't a smart investment.

Related investing topics

Investing in oil and gas in 2024

Investing in oil and gas in 2024

Timing plays a crucial role in oil and gas investments. That's evident from the industry's performance in 2021. Crude oil prices were red-hot during the first half of the year as the WTI price rallied more than 50% from January through June. That helped fuel an equally impressive rebound in oil stocks, many of which also rallied more than 50% in the first half of 2021. The main factor driving the rebound was the reopening of the global economy as the COVID-19 pandemic waned, prompting more demand for oil.

Through the end of the first quarter and into the second quarter of 2022, energy prices raced higher in response to the Russian invasion of Ukraine. President Biden has taken actions to curb the spike in oil and gas prices, such as tapping into the Strategic Petroleum Reserve.

For a variety of reasons, energy prices have steadily declined through the second half of 2022 and into 2023, further illustrating the volatile nature of the commodity's pricing. With so much ambiguity surrounding the energy markets, it seems that investing in the industry isn't the smartest choice at the moment.