Banking is a cyclical industry, and anyone who has invested through multiple economic downturns is likely well aware of that. The cyclicality is exacerbated by banks' need to use immense leverage to earn profits. Because banks lend out 90% of the cash received from depositors, their businesses are highly vulnerable to market cycles. Banking practices both drive and can be affected by boom-and-bust cycles, and not all bank stocks pay dividends in both good times and bad.

But dividend investors shouldn't disregard the banking industry completely. Well-run banks can and do deliver strong and reliable dividend income.

Best bank stocks for dividends

Here are five top dividend-paying bank stocks to add to your watch list.

| Bank Name | Dividend Yield |

|---|---|

| American Express (NYSE:AXP) | 1.5% |

| Bank of America (NYSE:BAC) | 3.2% |

| Bank of N.T. Butterfield & Son (NYSE:NTB) | 6.8% |

| JPMorgan Chase (NYSE:JPM) | 3.1% |

| Goldman Sachs (NYSE:GS) | 3.1% |

1. American Express

American Express probably doesn't come to mind for many investors as being a bank, or its stock as being a great dividend stock. The company is much better known as a provider of credit and debit cards. But while competitors Visa (V -0.48%) and Mastercard (MA -1.19%) operate open payment networks by partnering with banks to issue payment cards and lend money, the American Express payment network is closed, meaning it is both a payment network operator and a lender. The U.S. Federal Reserve Board considers it a bank holding company.

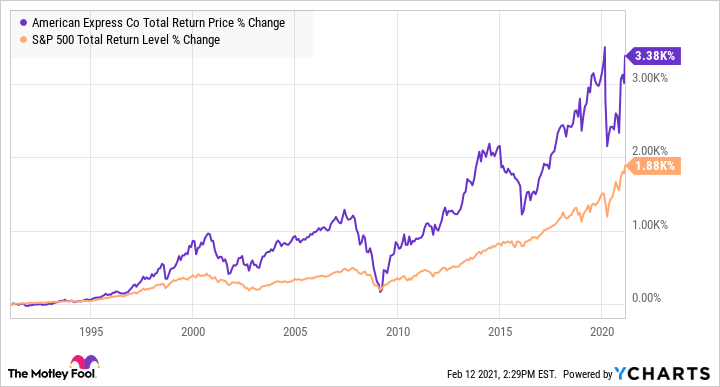

American Express makes this list of best dividend-paying bank stocks because it has a long track record of delivering robust returns, in part because its dividend is both generous and reliable. The returns delivered by American Express over the past three decades have dwarfed those of the broader market, as the chart below demonstrates:

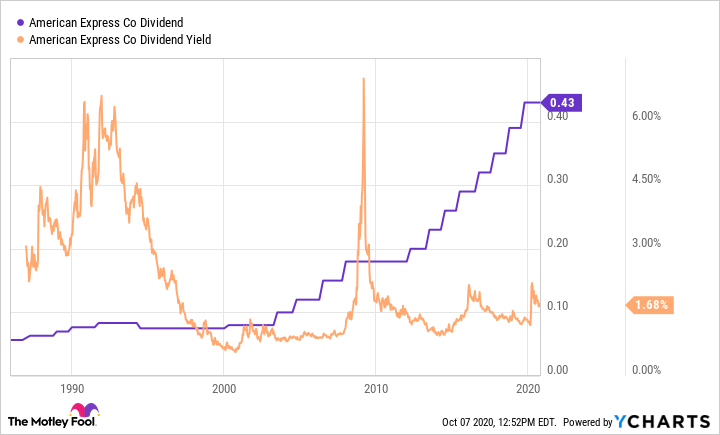

Perhaps surprisingly, American Express' dividend yield (equal to the dividend paid divided by the stock price) during much of its history has been less than 2%. But the consistent and massive rise in the value of its stock has meant that the absolute value of its dividend has steadily increased and likely will continue to increase in the years ahead.

The chart below displays the historical performance of the American Express dividend, both in absolute value and as a percent of the stock price:

The future looks bright for American Express. The growth of the global middle class, along with the worldwide transition away from cash to digital payments, creates favorable conditions for American Express to continue to thrive. The company is likely to keep outperforming the market and rewarding investors with attractive dividends.

2. Bank of America

A decade ago, Bank of America was one of the most hated banks in the U.S. During and in the years following the 2008 global financial crisis, few companies were as closely associated with questionable lending practices, predatory lending, and outright deception as the megabank and its subsidiaries. But fast-forward to today, and after paying tens of billions of dollars in fines and legal settlements, Bank of America under CEO Brian Moynihan (who took the helm in 2010) has transformed into one of the best big banks.

Before Moynihan's ascension to chief executive, Bank of America had become bloated and disorganized after multiple high-profile acquisitions (that were also the source of many of the company's legal and regulatory problems). But the company has since immensely improved its lending standards and customer service, becoming a leader in digital banking. Its online banking platform is now rated one of the best.

Bank of America has increased its dividend payment consistently over the past decade, and its recent dividend yield of 3.2% exceeds the average dividend yield of S&P 500 stocks. Bank of America is both fully focused on helping to create the future of banking. It also has a strong balance sheet and ready access to low-cost capital. It should be considered favorably by any dividend-focused investor.

3. Bank of N.T. Butterfield & Son

While Bank of America is a household name, many investors may not have heard of Butterfield before. Instead of catering to Main Street, Butterfield is an offshore bank that serves high-wealth individuals. It has physical locations in Bermuda, the Cayman Islands, and the Channel Islands. The Butterfield brand is one of the oldest in offshore banking, with a history that goes back more than a century. It only became a public company in 2016.

Dividend investors should know two important things about Butterfield. First, serving high-wealth individuals and those with international banking needs is a typically profitable business. The international elite are growing in number, and Butterfield is well positioned to provide high-end banking services and privacy that align with its clients' expectations for an offshore bank.

Second, while Butterfield is not collecting much interest income in the current economic climate, it is maintaining its profitability by collecting an increasing amount of fee income from customers. Butterfield's business model is likely to continue turning a profit regardless of the movements of interest rates.

Using recent stock prices, Butterfield's dividend yield is 6.8%, the highest on this list. While Butterfield's dividend is generally reliable, the company's payout ratio (equal to the dividend paid as a percentage of profits) remains less than 50%, which is healthy if slightly low for dividend-focused investors. Payout ratio included, investing in Butterfield is still a great way both to gain concentrated exposure to offshore banking and collect dividends from a high-yield stock.

4. JPMorgan Chase

Like Bank of America, JPMorgan Chase is another of the "Big Four" U.S. megabanks. Ranking as the nation's largest bank by asset value, the financial institution has delivered strong returns to investors since emerging from the 2008 financial crisis. And despite the COVID-19 pandemic and recent bank crisis severely affecting the performances of bank stocks, JPMorgan Chase's stock has still outperformed the S&P 500 over the past decade.

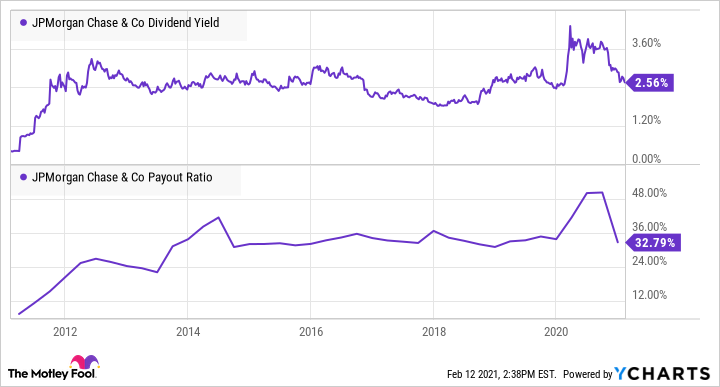

Since the end of the 2008 financial crisis, JPMorgan Chase has increased its dividend 17-fold, which has played a significant role in the outperformance charted above. Management and the company's board of directors have been increasingly prioritizing the return of profits to investors for many years.

As of early April 2023, JPMorgan's per-share dividend equaled 3.1% of its stock price, and its total dividend amounted to substantially less than one-third of its profits. While the 3.1% dividend yield is relatively high for the company based on its historical performance, the payout ratio remains very low. The dividend strategy is intentional, and CEO Jamie Dimon has described the company's dividend as "completely sustainable." As depicted by the chart below, JPMorgan Chase's dividend yield and payout ratio have each grown over time:

Investing in JPMorgan stock carries some risk, of course. A protracted economic downturn could hurt the bank's profitability, and regulators could force it and its big-bank peers to hold more capital in reserve -- which might compel the company to reduce its dividend. But, with an immensely strong balance sheet and low-cost access to a large amount of capital, any short-term challenges that may arise are not likely to have significant lasting effects. At every point in the cyclical banking cycle, JPMorgan Chase stock is likely to remain attractive to dividend investors.

5. Goldman Sachs

Goldman Sachs has historically not been the highest-paying bank stock, or even close to it, but the investment banking giant has emphasized dividend increases in recent years, and it now pays on par with other large U.S. banks.

Goldman has some traditional banking operations that produce interest income -- it is the bank behind the Apple (AAPL -0.57%) credit card, for example. However, Goldman generates most of its revenue from investment banking and trading (fee-based) revenue. And one interesting thing to keep in mind is that these services can do well even in tough environments. Investment banking advisory services that include mergers & acquisitions deals and equity underwriting tend to perform well in strong economies. On the other hand, trading revenue tends to spike in volatile and uncertain times, setting Goldman up to be highly profitable no matter what.

Dividend stocks are long-term investments

While the banking industry can be highly cyclical, the top banks are generally resilient and almost always reward patient investors. Dividend-paying companies -- even those operating in cyclical industries -- are positioned to produce enormous long-term gains for their investors. Even considering the risks, you can likely boost your portfolio's overall returns by including some of these top dividend-paying bank stocks in your dividend stocks portfolio.

Related Investing Topics

Frequently asked questions

What is a good dividend yield for a bank?

There's no cutoff between a "good" and "bad" dividend yield. But ideally, a bank will pay a dividend yield that is higher than the S&P 500 average, which is sustainable and has a solid track record of growth over time.

Are bank shares a good long-term investment?

To be sure, banks have had their share of turbulent times, and it's very important to choose high-quality banks and make sure they're part of a diverse portfolio. Having said that, some of the bank stocks on this list have solid track records of outperforming the market over long periods.

Is Bank of America a good dividend stock?

Bank of America pays an above-average dividend yield that is well covered by its net income. However, there's a lot that makes a stock a "good" dividend stock, and even more to consider when deciding if it's a good dividend stock for you.