If you've spent much time researching cryptocurrency investments, you've probably heard of smart contracts, which are contracts that can self-execute. Although the idea was already around well before crypto, blockchain technology has significantly advanced the use of smart contracts.

Several top cryptocurrencies now have blockchains with smart contract functionality, and they're opening up a world of possibilities in finance and other fields. These potential use cases also make cryptocurrencies with smart contracts a popular investment opportunity.

What are smart contracts?

Smart contracts are programs written on the blockchain that self-execute when certain conditions are met. They use code to define and enforce the rules of the contract. Once a smart contract is deployed, it runs autonomously, and there's no need for an intermediary to ensure that the contract is fulfilled.

When a smart contract is created, it exists on a blockchain. The blockchain is a public ledger that records all of a cryptocurrency's transactions. Cryptocurrencies with smart contract capabilities have blockchains that can also store and run smart contracts.

Smart contracts allow cryptocurrencies to offer much more than a role as a digital currency that can transfer funds from point A to point B. Blockchains with smart contracts can build entire systems of decentralized finance (DeFi) that can operate on their own without needing a central governing body.

How do smart contracts work?

Every smart contract can be boiled down to an if-then statement. If one or more conditions are met to fulfill the terms of the contract, then the contract executes.

One of the original and most straightforward examples used to explain smart contracts is a vending machine. If you insert the correct amount of money and make a selection, then the vending machine dispenses the item you chose. The terms of the contract are clear, and the transaction happens on its own.

While a single smart contract is responsible for one action, multiple contracts can be bundled together to handle more advanced tasks. That's how decentralized applications (dApps) work, and they make smart contracts much more useful.

For an example of how a dApp works, we can look at decentralized crypto exchanges. These exchanges let users swap one cryptocurrency for another through various smart contracts.

Here's a quick explanation of the smart contract conditions that can make a swap happen:

Smart contract use cases

There are all kinds of potential uses for smart contracts across a variety of industries, including finance, law, and gaming.

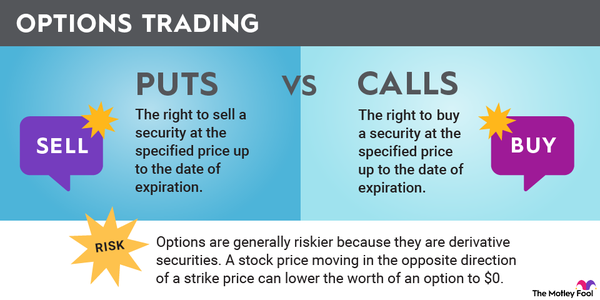

Finance is a natural fit for smart contracts, and, so far, we've seen them used to build complex DeFi systems. These platforms provide similar types of services as financial institutions, but all are decentralized and operate on blockchain technology.

Here are some of the ways smart contracts can provide financial services:

- Users can lend their own cryptocurrency funds into a smart contract with a decentralized exchange to become liquidity providers.

- The decentralized exchange uses those funds to facilitate cryptocurrency trading and lending.

- People can swap cryptocurrencies or put up collateral and receive a loan on the exchange. Smart contracts execute these transactions and collect transaction fees.

- Liquidity providers receive a cut of the transaction fees as a reward for lending their cryptocurrency funds.

Through a series of smart contracts, a decentralized exchange accomplishes this with no central governing body. There are no banks or payment processors involved in the transactions. Users can trade cryptocurrencies and borrow or lend and earn interest, and it all happens without a middleman.

Smart contracts are also well-suited for the legal field. If they're eventually considered legally binding contracts, then smart contracts could cut down on the time and costs involved in executing business deals.

We shouldn't cover use cases for smart contracts without talking about non-fungible tokens (NFTs), which have become wildly popular. An NFT is any type of unique digital asset stored on a blockchain. A smart contract records and stores the unique information of the NFT. Ownership information is also recorded with smart contracts.

Many NFTs are essentially collectibles such as digital art, but that isn't their only purpose. Blockchain games, such as Axie Infinity (AXS -0.14%), have characters that come in the form of NFTs. When players buy a new character, they're buying an NFT with statistics and other information stored on the blockchain in a smart contract.

Benefits of smart contracts

Here are the biggest benefits of smart contracts:

- They're a cost-efficient way to do business. Since smart contracts run on their own and self-execute, they cut down on the need for middlemen. No one needs to confirm if the contract conditions have been met or pay out the contract themselves, which means smart contracts can be used without unnecessary fees.

- They're fast. A smart contract can execute immediately when its conditions are met. The wait time is practically nothing, which is one reason why these contracts work so well for financial services and crypto trading.

- They provide total transparency. Every smart contract has clear terms and conditions that all parties involved can review and agree on. Smart contracts are also irreversible, so once they execute, no one can dispute the results.

- They're trustworthy for everyone involved. Smart contracts eliminate the possibility of bias affecting an agreement. The terms can't be manipulated to favor one side or the other. The only thing that matters is whether the conditions are met.

Considering how smart contracts could improve on the traditional contracts system, they're something to think about when deciding which blockchain stocks and cryptos to buy.

Related Investing Topics

How to write a smart contract

If you have an idea for a smart contract, the first thing to figure out is where you'll write it. There are many cryptocurrency blockchains with smart contract functionality. Since they all have their own platforms and architectures, writing a smart contract is different depending on the blockchain you choose.

These are a few of the major cryptocurrency blockchains for writing smart contracts:

- Ethereum (ETH -0.19%) introduced smart contract capabilities using blockchain technology, which helped make it the second-largest cryptocurrency and the most popular platform for building dApps. Its smart contract platform is called Ethereum Virtual Machine (EVM), and its programming language is called Solidity.

- Cardano (ADA 2.02%) is the first blockchain platform founded on peer-reviewed research. Its smart contract platform is called Plutus, and its programming language is called Haskell. It also has a domain-specific language, Marlowe, for financial contracts.

- Solana (SOL -0.51%) is designed to be the fastest blockchain, and it can reportedly handle 65,000 transactions per second. It uses three programming languages: Rust, C, and C++.

Once you've chosen a blockchain, visit its website and go to the section on building smart contracts. All the biggest blockchains have plenty of educational information and guides among their resources. The best way to learn how to create a smart contract is to review the information provided by a specific blockchain.

Smart contracts are one of the biggest reasons that people are excited about both blockchain technology and investing in cryptocurrency. Even if you're not planning to write your own smart contract, it's worth knowing the basics of how they work and the blockchains with this functionality because they'll play a major role in determining the success of individual cryptocurrencies.