Cryptocurrencies have quickly become a hot investment that is gaining mainstream adoption. Markets for digital currencies such as Bitcoin (BTC -4.32%) were virtually unheard of in 2012, but it has since grown into a massive industry.

The cryptocurrency sector reached a peak market value of $3 trillion in fall 2021. The sudden surge in value and rapid evolution created immense wealth for early crypto investors. As a result, there is huge interest in finding and investing in the next cryptocurrency unicorn.

With more than 20,000 different cryptocurrencies on the market -- and the world having been pushed further into the digital realm by the COVID-19 pandemic -- investing in technologies linking the digital blockchain space with society could be even more lucrative than guessing which token will become the next Bitcoin or Ethereum (ETH -4.2%). And there is no shortage of innovative companies trying to bridge the gap between the two.

Digital currency companies hold major potential

The original idea behind blockchain technology -- a digital ledger that automatically tracks transactions between parties and confirms ownership of a crypto asset -- was to create a borderless, peer-to-peer electronic cash payment system that's efficient and secure.

Investors can certainly purchase cryptos themselves, perhaps by buying small amounts of several different cryptocurrencies. But a better way to gain exposure to the sector is to invest in bigger and more established companies that benefit from the increased popularity of blockchain and crypto assets. The revenue that crypto service providers are deriving from blockchain tech has explosively grown over the past few years.

Companies that adopt blockchain technology, especially in finance, may gain a considerable edge over traditional competitors in processing payments. And brokers offering digital assets may attract more customers than exchanges offering traditional assets such as stocks and bonds.

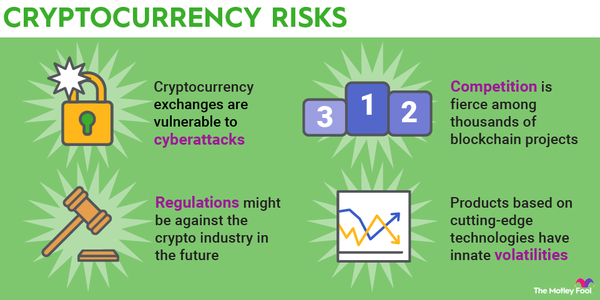

However, the sector is subject to sharp market swings. Its peak value of $3 trillion slipped to less than $1 trillion in June 2022 as rising inflation drove many investors away from high-risk investments. This was not the crypto market's first gigantic plunge, and it probably won't be the last. Every investment is subject to risks, and you should only invest money you don't need in the short term. That guidance is even more important in the highly volatile crypto sector.

In keeping with that guidance, here are some of the best cryptocurrency stocks to consider:

1. Coinbase Global

Coinbase Global (COIN -9.09%), a top cryptocurrency trading exchange, made its initial public offering (IPO) in April 2021. The company is a popular platform for purchasing major cryptocurrencies such as Bitcoin, Ethereum, and Cardano (ADA -2.76%), allowing users to trade more than 250 altcoins.

The Coinbase platform’s success has been contingent on the increase in crypto prices, which in turn has led to millions of new users creating accounts. Coinbase earns a small transaction fee whenever someone buys or sells a cryptocurrency. But the company aspires to be more than just a place to trade. It also sponsors a debit card that allows consumers to spend from the balance in their digital wallet, and it’s launched a cloud platform for companies using and storing digital currencies.

Coinbase offers two game-changing innovations. The first is bringing the practice of asset loans -- which were previously only available to affluent investors -- to the masses. Users can pledge their Bitcoin or other cryptocurrencies as collateral and receive a low-interest loan to cover expenses. Using crypto as collateral means investors don’t have to sell their assets when emergencies arise, allowing their principal to continue compounding while they deal with matters at hand.

The second innovation is the rising adoption of Coinbase’s blockchain analytics by governments and financial institutions. Because most blockchains operate on a public ledger, the company can harness and monitor the data for illicit transactions and wallet addresses.

Suppose hackers managed to break through an individual's computer and demand ransom in the form of Bitcoin to unlock the machine. In that case, Coinbase could then match the hacker's wallet address with millions of know-your-customer (KYC) data points stored on its platform. This could help law enforcement track down the flow of funds and apprehend the cybercriminals -- building greater trust in the crypto space.

[Cryptocurrency] is a new asset class, but like real estate, there's only so much Earth. So it's defined, and therefore this moving price of the commodity is just how much, within this finite class of a commodity, this new asset class, how much people value it or want it.David Gardner, co-founder, The Motley Fool

2. Block and PayPal Holdings

At the heart of every digital payment protocol is the absence of central intermediaries (and therefore, lower costs for businesses and consumers). So Block (SQ -4.53%) (formerly Square) and PayPal (PYPL -1.67%) saw a meaningful business opportunity in enabling users to purchase and hold cryptocurrencies within a digital wallet.

In late 2017, Block’s Cash App consumer-facing application began allowing Bitcoin trading. In 2020 and 2021, Bitcoin was a huge revenue generator for Block, although the trading feature did little to help the company’s bottom line.

However, the company is helping to foster the use of Bitcoin among its business users (through the Block ecosystem), and it could become a top platform for crypto transactions between companies and their customers. This is especially promising for disrupting traditional international transactions in which banks often charge hefty foreign exchange fees. Cash App added support for the Bitcoin Lightning network in April 2022, allowing customers to transfer Bitcoin much faster and without transaction fees. CEO Jack Dorsey said the feature will “increase the usability of Bitcoin all toward an open global monetary transmission network the world can trust.”

PayPal’s Venmo digital wallet and peer-to-peer payments app, which unlocked crypto trading in early 2021, offer a similar mix of simple banking features and mass-market crypto-trading tools. At the launch, Venmo supported the trading of Bitcoin, Bitcoin Cash (BCH -13.36%), Ethereum, and Litecoin (LTC -3.29%). With the most users of any peer-to-peer money movement app, Venmo could become a leading cryptocurrency platform with its new feature. It serves as a solid access point for investors who wish to buy major cryptocurrencies and then use them to purchase altcoins or access decentralized finance (DeFi) applications.

3. Canaan and Hut 8 Mining

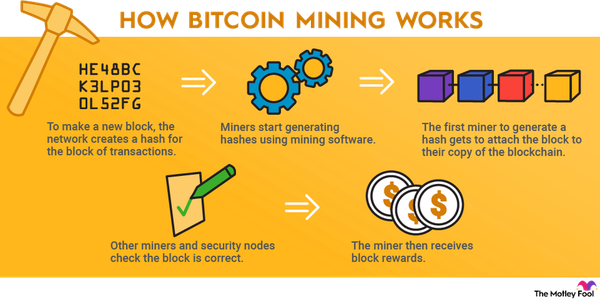

Bitcoin mining has changed dramatically over the past few years. These days, companies such as Canaan (CAN -5.83%) design high-powered, application-specific integrated circuit (ASIC) machines specifically for the purpose of brute-force guessing the network's correct hash (passcode). Canaan's next-generation Avalon ASICs can make tens of trillions of guesses every second for the right hash to validate blocks on the Bitcoin network, which is millions of times more powerful than AMD (AMD -1.81%) and Nvidia's (NVDA -2.48%) latest graphics processing units (GPUs) for this hyper-specific purpose. Sales have been skyrocketing due to the device's affordability and relatively low energy consumption, meaning greater profits for miners.

One of the most popular Bitcoin mining stocks is Hut 8 Mining (NASDAQ:HUT). The company, based in Canada, commands a sizable minority stake on the overall Bitcoin network, and it generates very strong cash flows compared to revenue. Instead of selling the Bitcoin it mines on the market, Hut 8 Mining maximizes returns for shareholders by lending them out and farming yields, leading to compounded returns. Furthermore, investors can be assured that environmental concerns regarding the practice won't hold the company back. Hut 8 Mining uses a mix of wind, solar, and natural gas sources for its electricity, with decade-long leases.

4. Nvidia and AMD

Chipmakers Nvidia and AMD don’t deal with cryptocurrencies directly, but the two semiconductor companies are the leading designers of graphics processing units (GPUs). Best known for powering high-end video game graphics, GPUs now enable computing-intensive applications such as data centers, artificial intelligence, and the creation of crypto assets.

Cryptography and blockchain creation require immense computational power, and GPUs are well-suited for the job. Back in 2018, booming cryptocurrency prices were a driving force for Nvidia and AMD stock price increases as digital currency miners (people using their computers to create new units of digital assets) scrambled to purchase GPUs for the task. GPUs remain a fundamental piece of hardware for creating and managing crypto assets. Nvidia even launched a new lineup of chips specifically for crypto mining in early 2021.

Both Nvidia and AMD look to further cement their positions as leaders in chip technology through acquisitions. Nvidia recently tried to purchase ARM Holdings, which licenses chip architecture design for data centers and smartphones, and AMD wanted to acquire field-programmable chip leader Xilinx. Nvidia had to give up on its ARM deal, but AMD completed its Xilinx buyout in February 2022. With or without the acquisitions, Nvidia and AMD are poised to continue taking market share of the semiconductor industry and are leading the way in developing more emerging technologies such as blockchain ledgers.

5. Meta Platforms and Shopify

Facebook parent Meta Platforms (META -2.28%) attempted to develop a new cryptocurrency called Diem (formerly Libra). Diem was envisioned as a global financial payment and infrastructure platform accessible to everyone, including almost one-third of the global population without bank accounts.

The project had some setbacks, including losing Visa (V -1.7%), Mastercard (MA -1.2%), and PayPal from its consortium of high-profile members. Government regulators expressed skepticism about Diem since cryptocurrency is still largely unregulated, and Meta eventually sold its control of Diem for $200 million. Nevertheless, work on the project is continuing under the new ownership, and Meta is reportedly considering different options for entering the cryptocurrency market. The company certainly wants to control part of the blockchain infrastructure behind its ambitious Metaverse vision.

E-commerce infrastructure and software provider Shopify (SHOP -2.04%) allows merchants using its platform to accept cryptocurrencies as payment. It recently deepened its capability by integrating with cryptocurrency payments processor CoinPayments. In the spring of 2020, Meta’s Facebook Shops was announced as a new offering for small business e-commerce, with Shopify as a third-party software provider powering the new online stores. Together, Meta and Shopify are primed to benefit if the adoption of digital assets continues among small businesses and entrepreneurs.

6. Robinhood Markets

Robinhood Markets (HOOD -4.34%) is a popular discount brokerage app that allows users to buy stocks, options, rare metals, and now, cryptocurrencies. Investors can buy and sell more than a dozen cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin (DOGE -4.84%), commission-free on the platform 24/7. The company already holds billions of dollars in crypto assets under custody, with crypto trading revenue now comprising a significant portion of overall sales.

Robinhood can combine its commission-free model with scaling the number of cryptocurrencies on the platform, gaining a massive competitive advantage over both traditional and decentralized exchanges. The company also could offer the same crypto analytics services as Coinbase to further promote trust in the sector and boost its adoption.

7. CME Group

CME Group (CME -1.56%) operates the world’s largest financial derivatives exchange allowing investors to trade futures, which bet on the future price of an asset, and options, which grant investors the option to sell or buy an asset in the future at a predetermined price. CME Group's exchange trades a diverse assortment of assets, including agricultural and mining products, energy, stocks, and currencies. It’s the latter that makes CME Group a crypto stock.

At the end of 2017, CME established the first market for Bitcoin futures. At the start of 2020, the company created a market for options on Bitcoin futures. As of March 2022, Ether (units of the crypto platform Ethereum) also had futures available on the exchange. Both Ether and Bitcoin futures were joined by micro futures this year, based on smaller slices of the underlying cryptocurrencies.

Establishing a full-featured exchange for derivatives of the best-known cryptocurrencies has given Bitcoin and Ethereum some extra legitimacy and provided a way for digital currency owners (both individuals and a growing list of businesses that accept cryptocurrencies as payment) to mitigate risk from changes in cryptocurrency prices. Cryptocurrency derivatives are still a small market for CME Group, but adding more exchanges for crypto assets in the future is possible -- and even likely.

Related crypto topics

The beauty of crypto stocks

The best part about cryptocurrency stocks is that most of them are not pure plays on the industry, giving investors the reward of ample diversification. Cryptocurrencies are quite volatile and can cause wild swings in the revenue and earnings of companies with sector exposure.

The crypto realm is rapidly gaining mainstream adoption. In August 2021, United Wholesale Mortgage (UWMC -3.34%), the second-largest mortgage lender in the U.S., announced it would accept Bitcoin to settle mortgage payments from its customers. Expect further momentum in crypto stocks as more companies join in the blockchain revolution.

At the same time, you need to keep an eye on the evolving regulatory framework while the crypto market adapts to the ever-changing global economy. The stocks mentioned above are smart investments in digital currencies, and most of them come with the benefit of also running significant business operations outside the crypto sector. As such, many investors find that they make more sense than buying the cryptocurrencies themselves, at least until regulators and governments around the world have nailed down their long-term approach to digital assets.