Bancor (BNT -0.85%) was the first decentralized trading protocol. It allows users to trade cryptocurrencies and earn rewards on their holdings without needing to go through a centralized exchange or register for an account.

The protocol's native token is also called Bancor, which you can stake to earn rewards. While decentralized exchanges are everywhere now, Bancor was the first. And that's not the only thing that's special about it. Bancor has some valuable features that its competitors don't.

What makes Bancor unique?

There are two basic types of cryptocurrency exchanges: centralized and decentralized. Centralized exchanges, such as Coinbase Global (COIN 0.22%), are companies that manage an order book and execute trades for their clients. Decentralized exchanges are platforms designed to facilitate peer-to-peer trading.

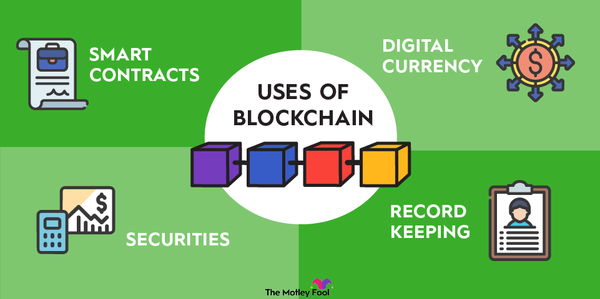

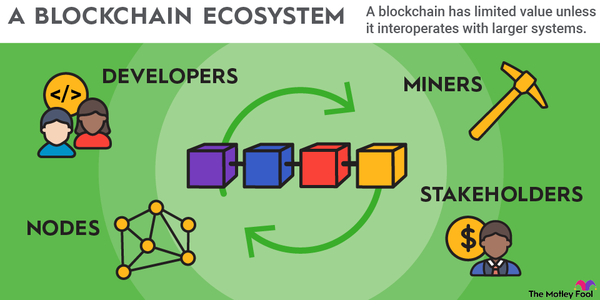

Bancor is a specific type of decentralized exchange called an automated market maker (AMM). An AMM offers cryptocurrency trading that's run entirely by smart contracts, which are programs built into a blockchain.

To fund trades, AMMs have liquidity pools consisting of cryptocurrency deposited by clients. AMMs pay depositors interest on their funds using the trading fees that other users pay.

Bancor was the first AMM, and these types of decentralized finance (DeFi) services have become extremely popular. There are a couple of features only Bancor offers:

- Single-Sided Staking: Most AMMs require depositing equal amounts of two cryptocurrencies to their liquidity pools. For example, a pool with Ethereum (ETH 0.84%) and USD Coin (USDC 0.01%) would require you to deposit an equal amount of ETH and USDC tokens. Bancor offers single-sided staking for all its assets, meaning you can provide just one type of token and earn interest on it.

- Impermanent Loss Protection: Impermanent loss is when tokens you've deposited to a liquidity pool change in price, causing you to lose money. When you deposit to a liquidity pool on Bancor, it matches your deposit using BNT tokens. If impermanent loss occurs when you make a withdrawal, Bancor uses fees to partially or fully compensate you.

Where Bancor came from

Technology entrepreneurs Eyal Hertzog, Guy Benartzi, and Galia Benartzi released a white paper for the Bancor Protocol on May 30, 2017. The team then raised $153 million, a record at the time, in an initial coin offering (ICO) that ended on June 11, 2017.

Bancor launched the next day. Its name came from an idea for a supranational currency called the Bancor, which was proposed at the Bretton Woods Conference in 1944.

How Bancor works

Bancor is made up of liquidity pools, with each pool containing a combination of BNT tokens and one other cryptocurrency. The liquidity pools are how Bancor offers cryptocurrency trading.

Anyone can deposit their cryptocurrency to Bancor and become a liquidity provider. In return, they earn interest based on the amount they deposit. Users can deposit either of the cryptocurrencies in the liquidity pool, but interest rates are much higher for those who deposit BNT.

Users can also trade any of the cryptocurrencies available on Bancor. When a trade occurs, BNT acts as the intermediary token connecting different pools and blockchains. For example, if you want to trade Ethereum for USD Coin, it would go from ETH to BNT to USDC.

There's a small transaction fee on every trade. The transaction fees are used to pay liquidity providers.

Everything on Bancor is managed by smart contracts. These smart contracts fetch prices when people want to trade crypto, execute trades, and control the protocol's liquidity pools.

Connections

Bancor has worked with many companies and DeFi projects over the years. Here are a few of the ones worth knowing about:

- Changelly, a cryptocurrency exchange, was one of the first platforms to offer BNT when it added the token in June 2017.

- Lending protocol Aave (AAVE -0.87%) teamed up with Bancor in 2020 to release a hackathon challenge. It also integrated with Bancor that year and launched a liquidity pool there.

- Kyber Network (KNC 0.09%), a liquidity hub for DeFi platforms, started working with Bancor in 2019. The two created a bridge to integrate Bancor's liquidity pools on to Kyber Network.

- Multiple fiat gateway providers (MoonPay, Banxa, Simplex, Ramp, and Mercuryo) have integrated with Bancor. They allow Bancor users to buy and sell crypto with fiat money.

Can I make passive income with Bancor?

You can make passive income with Bancor, and it's one of the protocol's biggest benefits. When you deposit cryptocurrency to Bancor's liquidity pools, it pays you interest. Your deposit can be BNT tokens or any of the other types of cryptocurrency that Bancor supports.

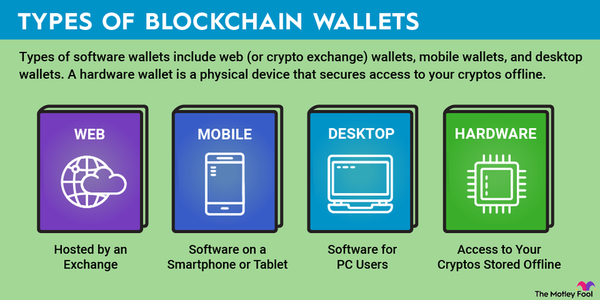

To earn interest on Bancor or use any of its other services, you need a blockchain wallet. Connect your wallet to the Bancor app, and then you can deposit your funds to a liquidity pool.

Unique risks

Among the biggest risks with AMMs are vulnerabilities in their smart contracts. If a smart contract has any issues, it can be exploited by hackers to steal funds from the exchange.

Bancor doesn't have a perfect track record. In July 2018, a wallet it used to upgrade smart contracts was compromised. Criminals used the wallet to steal about $23.5 million in cryptocurrency.

The exchange was able to freeze $10 million in stolen BNT tokens, but the rest of the stolen items were other types of cryptocurrency that it had no control over. Bancor reported that the stolen funds were from a reserve balance and that no customer-owned wallets were compromised.

Another incident occurred in June 2020 when Bancor discovered that it had released a smart contract with a security vulnerability. To prevent users from losing funds, Bancor had to hack itself to migrate at-risk funds to a secure location.

Is Bancor a good investment?

DeFi protocols such as Bancor are popular cryptocurrency investments for multiple reasons. The exchanges themselves make it easy to swap many different types of cryptocurrency, so they provide a valuable service. Simply connect your crypto wallet, and you can start trading.

The tokens for these protocols offer excellent passive income potential. Many of them, BNT tokens included, have high interest rates for liquidity providers. You are getting paid in crypto tokens, though, so the price needs to remain stable or increase to make money from that passive income.

The issue is that Bancor hasn't been nearly as successful as some of its competitors. In April 2022, it had a little more than $930 million in total liquidity. Here's what the biggest AMMs had:

- Uniswap (UNI 1.8%): $7.6 billion

- PancakeSwap (CAKE -4.14%): $5 billion

- SushiSwap (SUSHI 2.6%): $3.2 billion

Being first hasn't helped Bancor in the extremely competitive space of decentralized exchanges. Those three AMMs all launched later and have managed to attract much bigger user bases.

That's not to say that Bancor is a poor investment or protocol. It's one of the more user-friendly platforms, and it consistently makes improvements and adds new features. The way it's trying to protect users from impermanent loss, in particular, is a great innovation in the DeFi space.

Bancor's Version 3 release may give the crypto's ecosystem a boost, and BNT also has more wind in its sails from Binance.US having listed it in April 2022 as a tradable crypto. Based on what Bancor has to offer, it could be undervalued. The best way to evaluate it as an investment is to check it out yourself and compare it to other AMMs such as the three mentioned above.

Related investing topics

How to buy Bancor

You can buy Bancor on many crypto exchanges, including:

Another option is to trade for Bancor on its own protocol. Using the Swap tool, you can trade any supported cryptocurrency for BNT tokens. Keep in mind that you need to connect a crypto wallet to Bancor to do this.

If you decide to invest in Bancor, remember that like other cryptocurrencies, it's volatile and risky. Prices can change quite a bit in short periods of time, so consider it a long-term investment that you'll hold for years, not weeks.