Bitcoin (BTC 0.29%) has been one of the most exciting investments of the 2000s. One Bitcoin was worthless when it launched in 2009, but each coin is worth the equivalent of tens of thousands of dollars today.

The blockchain technology that underpins the original digital currency has spawned thousands of altcoins and decentralized finance applications along the way, with the most successful being Ethereum (ETH -1.16%). The price of Bitcoin has rallied as U.S. Securities and Exchange Commission (SEC) approval neared for new funds based on Bitcoin's spot price. It's no wonder so many investors have wanted a part of the action.

But investing in Bitcoin isn't always that simple. That's where a new Bitcoin ETF (exchange-traded fund) might come into play. Here's what you need to know.

Investing in Bitcoin and other cryptocurrencies requires some extra work over and above what's involved in investing in stocks, bonds, and the like. Many traditional brokerage firms don't support cryptocurrency trading, so an account may need to be opened with a crypto trading exchange. Additionally, there's the matter of storing crypto, which requires the use of a crypto wallet.

A workaround for these issues is buying a Bitcoin ETF or fund that trades on a stock exchange so your investment in Bitcoin can be held in the same account as your other stocks, bonds, and traditional investment securities.

What are Bitcoin ETFs?

What are Bitcoin ETFs?

Bitcoin ETFs are funds that trade on a stock exchange that attempt to track the performance of Bitcoin. When you buy an ETF, you aren't buying the underlying investment directly. Rather, you're buying shares of a fund that either invests in or attempts to mimic the performance of a particular security or index -- Bitcoin, in this case.

Until 2024, there were no ETFs that were able to directly own Bitcoin. That's because trading in cryptocurrency and other digital currencies was still unregulated by the SEC. However, a number of new ETF and investment firms finally had their applications approved by the SEC to launch ETFs that directly purchase Bitcoin (including Cathie Wood's Ark Invest).

Bitcoin vs. Bitcoin ETFs

Bitcoin vs. Bitcoin ETFs

Why buy a Bitcoin ETF instead of Bitcoin directly? After all, even the best fund isn't going to perfectly track the crypto's price since there are fees built into ETFs to pay for management.

Besides avoiding the added complexity of opening an account with a crypto exchange and safely storing Bitcoin, one big reason to opt for an ETF is that it's easier to get Bitcoin investment exposure in an individual retirement account (IRA). At this point, only a few specialty investment companies support crypto trading within an IRA account. But if you want to keep Bitcoin with the rest of your investments, buying a fund or ETF might be your ticket.

List of 5 Bitcoin ETFs

5 Bitcoin ETFs and funds for 2024

Before new SEC approvals in January 2024, Bitcoin funds were only generally available using futures contracts in their portfolios. A new batch of Bitcoin ETFs can now directly purchase Bitcoin and hold it in custody (or outsource the holding of the Bitcoin to a third party). Here are five options to consider:

| ETF Name | Assets | Description |

|---|---|---|

| iShares Bitcoin Trust (NASDAQ:IBIT) | $2.2 billion | From investment giant BlackRock, this is the first of the new Bitcoin ETFs to reach $2 billion in assets. |

| Grayscale Bitcoin Trust ETF (NYSEMKT:GBTC) | $21.4 billion | As of this writing, this is the largest ETF tracking Bitcoin's performance. |

| Fidelity Wise Origin Bitcoin Fund (NYSEMKT:FBTC) | $1.34 billion | Another new ETF launch from one of the world's largest investment managers. |

| ARK 21Shares Bitcoin ETF (NYSEMKT:ARKB) | $637 million | Ark Invest, Cathie Wood's investment firm, making its foray into Bitcoin with an ETF sponsored by crypto company 21Shares. |

|

Invesco Galaxy Bitcoin ETF (NYSEMKT:BTCO) |

$295 million | Top fund manager Invesco's new Bitcoin ETF. |

1. iShares Bitcoin Trust

The iShares family of ETFs, from investment management titan BlackRock (BLK 1.35%), is among the first of the new Bitcoin spot price ETFs approved by the SEC. It is also quickly emerging as one of the largest Bitcoin funds, scooping up more than $2 billion in investor assets under management in a mere couple of weeks.

While iShares takes care of the management of the passive investment vehicle, Coinbase's (COIN 7.04%) Custody service actually holds the Bitcoin that makes up the ETF's portfolio of assets. In fact, Coinbase Custody is scooping up a large share of Bitcoin from the new batch of SEC-approved ETFs.

iShares is a well-established ETF provider with decades of experience. The iShares Bitcoin Trust is also an affordable option. It is waiving half its 0.25% management fee (or $2.50 in annual fees for every $1,000 invested) to just 0.12% unless the fund reaches $5 billion in assets under management before the first 12 months from inception. For reference, the inception date was Jan. 5, 2024.

2. Grayscale Bitcoin Trust ETF

Grayscale's Bitcoin fund was originally created in 2013. Before 2024, the Grayscale Bitcoin Trust wasn't an ETF but an investment trust with units trading over the counter (traded via broker-dealer networks instead of a centralized exchange). Grayscale had its application approved by the SEC and converted the Bitcoin trust to an ETF in early January 2024. It now offers investors more direct exposure to Bitcoin.

The Grayscale Bitcoin Trust ETF charges a hefty 1.5% annual fee ($15 for every $1,000 invested each year) compared to its newer ETF peers, although the fee was reduced from 2% in January 2024. Owing to the higher fee, the fund had extensive outflows of investor funds when the new ETFs were approved and began trading.

Nevertheless, this is currently the largest fund tied to Bitcoin's fate, and the company has extensive knowledge about the crypto. If you want a product that seeks to follow Bitcoin's price changes without buying Bitcoin, the Grayscale Bitcoin Trust might be a good place to start your search.

3. Fidelity Wise Origin Bitcoin Fund

Fidelity is another global investment giant and one of the first to dabble in the nascent cryptocurrency industry. It launched a cryptocurrency exchange in 2023, so an ETF on the top cryptocurrency, Bitcoin, is a natural fit.

Fidelity's Bitcoin fund also started trading in January 2024, so it has a short history. It has an annual expense ratio of just 0.25%, although there is no fee waiver. But given Fidelity's long tenure in the investment world, the ETF is worth considering.

4. ARK 21Shares Bitcoin ETF

It comes as no surprise that Cathie Wood's Ark Invest would also launch a new Bitcoin ETF. Wood and company are known for investing in disruptive new technology, and blockchain and Bitcoin are no exception. As the name implies, the ARK 21Shares Bitcoin ETF is sponsored by cryptocurrency investment outfit 21Shares.

ARK 21Shares Bitcoin ETF has one of the lowest expense ratios at 0.21% per year and is waiving its fee until July 2024 or until fund assets reach $1 billion. Given its hot start in collecting investor assets (more than $600 million at the end of January 2024), the fee waiver may not last much longer.

5. Invesco Galaxy Bitcoin ETF

Rounding out the list is another giant investment fund manager, Invesco (IVZ 1.37%). Its Galaxy Bitcoin ETF was also recently approved by the SEC. The fund is in partnership with crypto company Galaxy Asset Management, a division of Galaxy Digital Holdings (BRPHF 2.12%).

Invesco's Bitcoin is being held in custody directly (vs. a third party like Coinbase). The ETF is also waiving its 0.39% annual fee for the first six months (until July 2024) up to $5 billion in assets. The managers have the ability to extend the waiver longer if they decide to do so (to obtain more investor funds).

Related investing topics

Choose the right Bitcoin investment product carefully

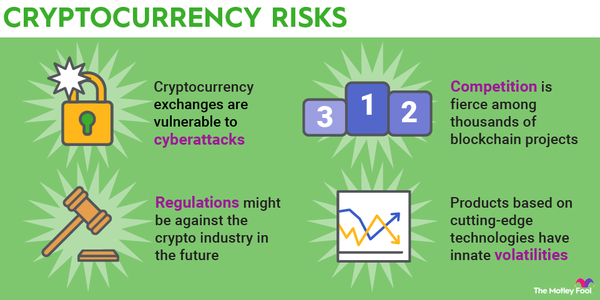

Bitcoin ETFs and funds aren't a perfect replacement for direct investment if you want exposure to the largest digital currency. However, there are benefits to selecting an ETF since it can be a workaround for getting Bitcoin's performance inside your IRA. Just remember to take a measured approach, given the inherent volatility in crypto prices.

FAQ

FAQ about Bitcoin ETFs

Which ETF is best for Bitcoin?

The best Bitcoin ETF to choose will depend on various factors, like the annual fee, the reputation of the investment manager and its custodian (who holds the actual Bitcoin in the fund portfolio), and the fund's total investor assets under management. Since new Bitcoin spot price ETFs are new as of January 2024, these criteria are subject to frequent change in the first year.

Does a Bitcoin ETF exist?

Yes, there are now many Bitcoin ETFs that actually invest in Bitcoin itself, based on the top cryptocurrency's actual daily price movements. Most of the top investment management firms have launched new Bitcoin ETFs.

What is the new ETF for Bitcoin?

Some of the new ETFs for Bitcoin include iShares Bitcoin Trust ETF, Fidelity Wise Origin Bitcoin Fund, ARK 21Shares Bitcoin ETF, and Invesco Galaxy Bitcoin ETF.

What does the approval of Spot Bitcoin Exchange mean?

On Jan. 10, 2024, the U.S. Securities and Exchange Commission (SEC) approved applications for Bitcoin exchange-traded products. This means a new batch of ETFs that, directly or through a third-party custodian, can hold the cryptocurrency Bitcoin directly in their portfolio, giving investors an easier way to gain cryptocurrency exposure in their investment accounts.