In the world of investing, the term “whale” is often used in reference to a market participant with enough buying or selling power to cause a temporary increase or decrease in an asset’s price.

This phrase is frequently used in the cryptocurrency industry as well. Since the original cryptocurrency Bitcoin (BTC 1.79%) was launched in 2009, crypto prices have become known for wild swings. The “whale” activity that could manipulate these prices has become a hot topic among investors.

What is a Bitcoin whale?

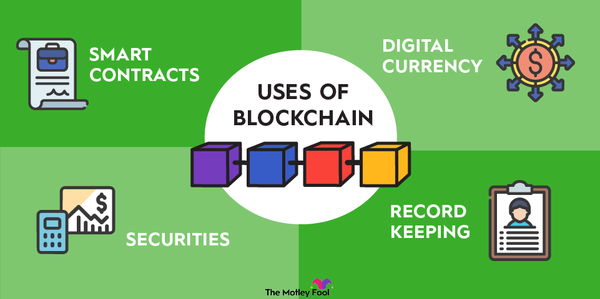

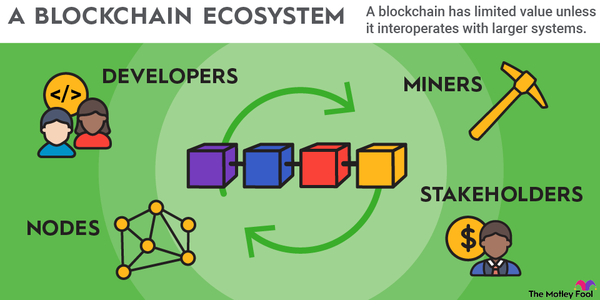

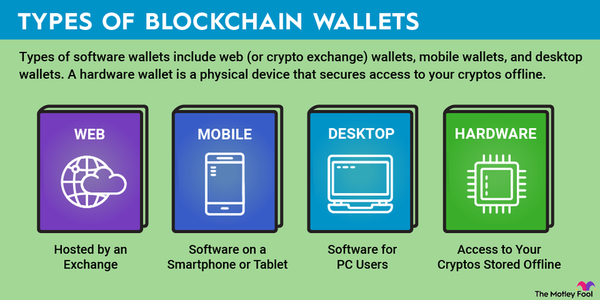

A cryptocurrency whale refers to a single crypto wallet that owns a large concentration of a single cryptocurrency. Because cryptocurrencies such as Bitcoin operate on a publicly distributed ledger, it’s possible to determine which wallets own the most of a given cryptocurrency.

Similarly, a Bitcoin whale is one of these large holders of Bitcoin. As of the end of May 2022, Bitcoin had a market cap of nearly $609 billion. Definitions vary, but a Bitcoin whale is generally referred to as a wallet that owns at least 100 Bitcoins -- or $3.2 million worth of Bitcoin as of this writing.

Bitcoin whale watching

As crypto investing and use has become more common, Bitcoin ownership has become less concentrated. However, studies suggest that a small handful of investors control a large chunk of the total Bitcoin supply. A 2021 study from the National Bureau of Economic Research suggested that one-third of all Bitcoins are owned by just 10,000 investors worldwide.

Given this apparent concentration of ownership, Bitcoin whales are closely watched by crypto traders since Bitcoin whale buying and selling activity can affect prices in the short term.

Cryptos are bought and sold on exchanges and operate on an auction system similar to the stock market. If a Bitcoin wallet is buying large amounts of crypto, the whale’s activity could reduce the supply of Bitcoin being sold on the market, thereby raising prices. Conversely, a whale who is selling could increase supply, which could temporarily lower prices for Bitcoin.

List of top Bitcoin whales

It isn’t possible to know exactly who or what organization owns specific crypto wallets. However, some notable Bitcoin proponents and whales include Bitcoin’s creator Satoshi Nakamoto (a pseudonym that might be an individual or a group of people); software company MicroStrategy (MSTR -2.82%) and CEO Michael Saylor; Coinbase Global (COIN -3.24%) and co-founder and CEO Brian Armstrong; and crypto exchange FTX founder and CEO Sam Bankman-Fried.

Tesla (TSLA -1.92%) CEO Elon Musk has also been known to move Bitcoin prices with his tweets about his interest in the digital asset, although his actual personal investment in Bitcoin is unknown.

Although specific Bitcoin ownership is difficult to track, here are the top five richest crypto wallet holders:

| Bitcoin Wallet Address | Number of Bitcoins Held | Value (as of May 31, 2022) | Percent of Total Bitcoins |

|---|---|---|---|

| 34xp4vRoCGJym3xR7yCVPFHoCNxv4Twseo | 252,597 | $8.08 billion | 1.33% |

| bc1qgdjqv0av3q56jvd82tkdjpy7gdp9ut8tlqmgrpmv24sq90ecnvqqjwvw97 | 168,010 | $5.37 billion | 0.88% |

| 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ | 127,874 | $4.09 billion | 0.67% |

| 3LYJfcfHPXYJreMsASk2jkn69LWEYKzexb | 116,601 | $3.73 billion | 0.61% |

| bc1qazcm763858nkj2dj986etajv6wquslv8uxwczt | 94,643 | $3.03 billion | 0.50% |

Related Fintech Topics

Should you pay attention to Bitcoin whales?

Bitcoin whales can temporarily move the Bitcoin market if they start making big purchases or sales of the crypto. If you are a crypto trader, Bitcoin and crypto whales might be a key way to get hints about short-term price action -- although it’s worth noting that crypto prices are highly volatile, and whale orders are only one metric that affects these swings.

However, if you are a long-term investor in Bitcoin, these short-term moves don’t need to be a constant concern. Over the course of many years, Bitcoin’s value will primarily be affected by the cryptocurrency’s adoption among investors, daily use of the crypto among businesses and individuals, and the development and improvement of the crypto and the blockchain technology itself.