If you want to invest in crypto, but you're overwhelmed by the massive number of options, a cryptocurrency ETF (exchange-traded fund) could be the solution. These ETFs get you exposure to a basket of cryptos and underlying blockchain technology they're built on.

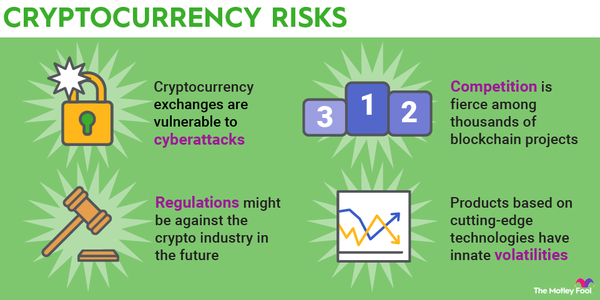

That's important, because so far cryptocurrency has been a very boom-or-bust market. There's potential for big gains, if you invest in the right coin at the right time. But the wild volatility means there's also potential for huge losses.

By investing in a crypto ETF, you can build a diverse portfolio of digital assets, which gives you a better chance of finding successful investments.

7 top cryptocurrency ETFs

| ETF | Assets Under Management | Description |

|---|---|---|

| Amplify Transformational Data Sharing ETF (NYSEMKT:BLOK) | $419.2 million | An ETF focused on companies involved with crypto or that offer indirect crypto price exposure. |

| Bitwise 10 Crypto Index Fund (OTC:BITW) | $499.0 million | A means of easily investing in the top 10 largest cryptocurrencies. |

| Siren Nasdaq NexGen Economy ETF (NASDAQ:BLCN) | $76.3 million | An ETF investing in companies developing and using blockchain technology. |

| First Trust Indxx Innovative Transaction & Process ETF (NASDAQ:LEGR) | $114.3 million | A diversified fund containing crypto, tech, banking, and international stocks. |

| Bitwise Crypto Industry Innovators ETF (NYSEMKT:BITQ) | $53.5 million | An ETF focused on innovative companies in the crypto economy. |

| Global X Blockchain ETF (NASDAQ:BKCH) | $53.6 million | A fund betting on blockchain technology and its wider applications beyond crypto. |

| Global X Blockchain & Bitcoin Strategy ETF (NASDAQ:BITS) | $10.2 million | This ETF is half-invested in the affiliated Global X Blockchain ETF, supplemented with Bitcoin futures. |

Investing in cryptocurrency ETFs

To be clear, ETF options that invest directly in cryptocurrencies aren't available for U.S.-based investors yet. The Securities and Exchange Commission (SEC) has yet to approve any of the attempts at a Bitcoin (BTC 0.57%) ETF. The same goes for other cryptocurrencies, such as Ethereum (ETH 0.18%) and smaller altcoins.

There are alternatives that invest in Bitcoin futures contracts, such as the Grayscale Bitcoin Trust (OTC:GBTC), but there are special risks to consider with this type of investment vehicle. Fortunately, more cryptocurrency ETFs have emerged in recent years to meet the growing demand for crypto and more general blockchain technology investing.

What is a cryptocurrency ETF?

What is a cryptocurrency ETF?

An ETF is a type of investment fund that can be bought just like a stock. Investing in one is a quick and easy way to build a diversified portfolio since most ETFs invest in a group of stocks, bonds, and/or other assets -- in this case, cryptocurrencies and companies involved in their development.

Here's a list of seven cryptocurrency ETFs to consider for 2023:

1. Amplify Transformational Data Sharing ETF

1. Amplify Transformational Data Sharing ETF

With more than $400 million in assets, the Amplify Transformational Data Sharing ETF is one of the largest funds focused on the cryptocurrency and digital asset economy. It's a good choice to begin a search for the best crypto industry ETFs, although it doesn't directly invest in cryptocurrencies.

Instead, it contains 45 company stocks. Top holdings in the fund include:

- MicroStrategy (MSTR -2.82%)

- Riot Platforms (RIOT 10.13%)

- Coinbase Global (COIN -3.24%)

- Overstock (NASDAQ:OSTK)

- Hut 8 Mining (NASDAQ:HUT)

The Amplify Transformational Data Sharing ETF was launched in January 2018, making it one of the longest-tenured ETFs on this list. It has a 0.75% annual expense ratio, meaning $7.50 in fees is deducted each year for a $1,000 investment.

2. Bitwise 10 Crypto Index Fund

2. Bitwise 10 Crypto Index Fund

The Bitwise 10 Crypto Index Fund is a unique offering on this list. It was originally a private placement fund, but shares can now be bought and sold over the counter. The fund is actively managed, so it has a hefty expense ratio of 2.5% (or $25 in annualized deducted fees from fund performance per $1,000 invested).

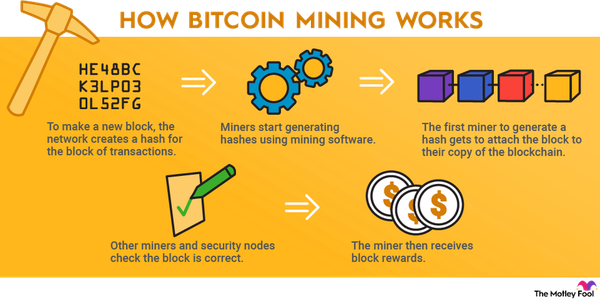

The Bitwise 10 Crypto Index Fund invests in the top 10 cryptocurrencies (as measured by market cap) and is rebalanced monthly to account for changes in crypto prices. Bitcoin and Ethereum are far and away the largest cryptocurrencies by size, so they make up over 90% of the underlying portfolio. Other holdings include:

Because this fund trades over the counter, it can trade at a severe discount or premium to the underlying crypto prices it owns at times, depending on the demand for shares. Investors should tread cautiously. However, if you want to invest in the largest cryptocurrencies, this fund is worth a look.

3. Siren Nasdaq NexGen Economy ETF

3. Siren Nasdaq NexGen Economy ETF

The Siren Nasdaq NexGen Economy ETF is another fund that focuses on companies developing and using blockchain technology. Its assets under management are far smaller than Amplify's similar ETF product, but it does provide a slightly different take on this space.

For one thing, the ETF is composed of more than 60 stocks. It includes some general technology businesses with a crypto or blockchain segment, such as IBM (IBM 0.06%), which is a top holding.

It also includes shares of traditional lenders and digital payments networks such as Block (SQ -2.28%) and Visa (V -0.59%) that have started dabbling in the world of crypto. It's a far more diversified means of betting on the growth of the crypto industry. It has an expense ratio of 0.68%.

4. First Trust Indxx Innovative Transaction & Process ETF

4. First Trust Indxx Innovative Transaction & Process ETF

The First Trust Indxx Innovative Transaction & Process ETF is another broad bet on crypto. The fund contains more than 100 stocks, making it the most diversified crypto ETF listed here.

First Trust is also a large and well-established company that has created all sorts of investment products, which might check the box for some investors worried about track record and fund manager reputation. The First Trust Indxx Innovative Transaction & Process ETF has an annual expense ratio of 0.65%, making it one of the more affordable options on the market.

The fact that this ETF is more diversified has its pros and cons. It provides sweeping exposure to the crypto space, including many international tech companies that might be harder to come by for U.S.-based investors (Chinese companies comprise 12% of the portfolio).

It's also less volatile than many of its crypto-fund peers. That means its value normally doesn't increase as much as the values of other funds when the crypto market is doing well, but it also doesn't lose as much value during bear markets.

5. Bitwise Crypto Industry Innovators ETF

5. Bitwise Crypto Industry Innovators ETF

The Bitwise Crypto Industry Innovators ETF was launched in May 2021, making it a relative newcomer to the crypto fund party. It contains fewer than 30 stocks, with holdings focused on innovators and crypto pioneers.

As a result, it's likely this ETF will exhibit some of the wild swings in value inherent in crypto prices. It also has a relatively high annual expense ratio of 0.85%.

Many of the underlying stocks in this fund are Bitcoin miners and owners. Top holdings include:

- Coinbase

- MicroStrategy

- Galaxy Digital (GLXY 1.13%)

Since the market has largely been down since this crypto-focused ETF launched, it hasn't performed well so far. But it's still young, meaning it's too soon to tell how it will fare over the long term.

6. Global X Blockchain ETF

6. Global X Blockchain ETF

The Global X Blockchain ETF believes blockchain technology has uses far beyond cryptocurrency alone. It invests accordingly into more than 20 tech and Bitcoin mining stocks that are leading the charge in the world of crypto and the underlying blockchain technology.

This is another fresh ETF product launch, though, having just started in July 2021. The fund has an affordable annual expense ratio of only 0.5%. If you're interested in focused investment exposure to crypto miners and tech companies instrumental to the development of blockchain such as Coinbase, this new fund is worth a close look.

7. Global X Blockchain & Bitcoin Strategy ETF

7. Global X Blockchain & Bitcoin Strategy ETF

The Global X Blockchain & Bitcoin Strategy ETF, launched in November 2021, is closely affiliated with the Global X Blockchain fund, which comprises almost half of the underlying holdings. But what makes the new ETF investment different is that the other half of the portfolio is invested in Bitcoin futures.

Bitcoin futures mimic the daily moves in value of an asset, in this case Bitcoin. However, because the futures contracts will need to be rolled over monthly, they will likely underperform Bitcoin's price moves over the long term.

This is a problem other funds that invest in Bitcoin futures have experienced in recent years. However, if you want some extra indirect Bitcoin investment in the mix, Global X's recent ETF launch might be what you're looking for. The annual expense ratio for this ETF is 0.65%.

Related cryptocurrency topics

Cryptocurrency ETFs will be a volatile investment

Cryptocurrencies are still a very new asset class, and ETFs focused on them are even younger. As with any emerging asset class, expect lots of volatility -- both in cryptos themselves and in the companies focused on their development. If you want more stability, consider long-term ETFs in other assets, such as stocks or real estate.

If you decide to invest, bear two important points in mind. Keep any bet small, and stay focused on the long-term potential for cryptocurrency and blockchain technology overall.