Index funds are a great way to invest. They're affordable, it's easy to invest in them, and they typically generate solid returns. Considering the benefits that index funds offer, cryptocurrency index funds are an interesting investment opportunity. In this guide, we'll cover how cryptocurrency index funds work, what makes them different, and whether they're a good choice in 2022.

What is a cryptocurrency index fund?

A cryptocurrency index fund is a financial vehicle that invests in a group of cryptocurrencies. It contains a pool of funds from investors who put their money in the index fund for a diversified portfolio.

The easiest way to understand cryptocurrency index funds is to start with the concept of index funds as a whole. An index fund is a type of mutual fund, which is a pool of investor funds that the fund manager invests in securities.

While a mutual fund has a fund manager, an index fund doesn't. Instead, it invests in a specific stock market index. These market indexes are groups of securities that represent parts of the overall market. For example, the S&P 500 is a market index of 500 large U.S. companies.

Because index funds have passive management, they tend to have lower fees than mutual funds. The fee for each type of fund is called the expense ratio, which the fund charges as a percentage of the assets under management.

To put it all together, a cryptocurrency index fund is a fund that invests in a specific index of cryptocurrencies. For now, crypto index funds are mostly theoretical. There haven't been many successful attempts to build traditional investment vehicles that track multiple types of cryptocurrency.

Cryptocurrency vs. stock vs. bond index funds

You can invest in cryptocurrency, stock, or bond index funds. The difference between them is simply the type of asset each one invests in:

- Cryptocurrency index funds invest in cryptocurrencies.

- Stock index funds invest in stocks.

- Bond index funds invest in bonds.

Because of the differences in those types of investments, your level of risk and potential returns heavily depend on which one you choose.

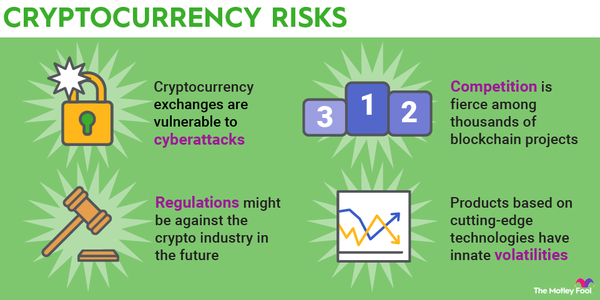

Cryptocurrency is much more volatile than stocks and bonds. An investment in an index fund for cryptocurrency will have much greater price movements than a stock or bond index fund. You could make much bigger profits, but there's also the possibility of much greater losses.

Although that could be good or bad, it's more of a negative for an index fund. One reason to invest in an index fund, after all, is to diversify and reduce risk. Even if you're able to invest in a variety of cryptocurrencies with a crypto index fund, you're still putting your money into a very risky market.

Another big difference between these types of funds is the selection you'll have available. There are hardly any cryptocurrency index funds at the moment, while there are hundreds of stock and bond index funds.

Is there a cryptocurrency index fund?

There's currently one publicly traded cryptocurrency index fund -- the Bitwise 10 Crypto Index Fund (BITW 1.17%). Launched in 2017, it was originally only available to accredited investors, but it's now open to everyone. Bitwise also has several cryptocurrency index funds that are available exclusively to accredited investors.

The Bitwise 10 Crypto Index Fund attempts to follow the 10 largest cryptocurrencies by market cap, not including stablecoins (cryptocurrencies designed to follow the value of another asset such as the U.S. dollar). Although the number of cryptos it follows is a plus, this fund has a costly 2.5% expense ratio.

To be fair, most exchanges charge fees for cryptocurrency trading, so it's understandable why a crypto index fund would have a higher expense ratio. But 2.5% is on the high side. One benefit of the best index funds is that they normally have low fees, and we generally recommend sticking to funds that charge no more than 1%.

So, why aren't there more publicly traded cryptocurrency index funds widely available? Although there have been attempts to launch crypto funds over the years, the SEC hasn't approved the vast majority.

It's worth mentioning that the S&P Dow Jones Indices have created cryptocurrency indices. The S&P Cryptocurrency Index Series includes several different indexes designed to track the performance of major digital assets. You can't invest in these indexes, but we could see index funds that follow them in the future.

How to invest in cryptocurrency index funds

If you're looking to invest in cryptocurrency index funds today through a brokerage account or retirement plan, options are limited. The only fund that fits the bill is the Bitwise 10 Crypto Index Fund. Since it's publicly traded, it's available to purchase for anyone with a brokerage account.

While there aren't any other traditional index funds available that track cryptocurrencies, there is an alternative for more advanced crypto traders. Some developers have launched index fund tokens. These are cryptocurrencies that act as index funds by tracking a group of cryptocurrencies.

Here are a few examples:

- CRYPTO20 (CRYPTO:C20) is designed to track the top 20 cryptocurrencies by market capitalization.

- DeFi Pulse Index (CRYPTO:DPI) is designed to track the performance of major tokens in the decentralized finance (DeFi) industry.

- NFT Index (CRYPTO:NFTI) is designed to track digital assets that are part of the non-fungible token (NFT) industry.

These are smaller tokens, so they're harder to find than major cryptocurrencies. Investors typically buy one of the larger cryptocurrencies on an exchange first and transfer it to a blockchain wallet.

Then they go to a decentralized exchange (an exchange without a central governing body) that has a wider selection of tokens available. They trade the larger crypto they bought earlier for the tokenized cryptocurrency index fund. It's a more complex process, which is why it's primarily done by advanced traders.

How to build your own cryptocurrency "index fund"

There's also the DIY option. You could buy the cryptocurrencies you want and effectively make your own version of a cryptocurrency index fund. Here's how to do this:

- Sign up for an account with a cryptocurrency exchange.

- Pick out the types of cryptocurrency that will make up your index fund.

- Decide how much you're going to invest in each of them.

- Make the purchases.

The main advantages of building your own crypto index fund are the cost and that you have full control over it. Since you're buying the cryptocurrencies yourself, you don't pay any sort of expense ratio. However, exchanges do charge trading fees, so it's important to compare top cryptocurrency exchanges and pick one that's affordable.

If there's one big drawback with this method, it's the time involved. It takes more time when you're buying multiple cryptocurrencies, especially if you plan to rebalance your portfolio based on their price movements. The time commitment makes it very difficult to do this with a large number of cryptocurrencies.

Considering how popular cryptocurrencies are, we'll likely see more cryptocurrency index funds in the near future. For the time being, most investors will likely find there are better ways to invest in crypto, including buying individual cryptocurrencies or shares of cryptocurrency stocks.