Decred (CRYPTO:DCR) is an early cryptocurrency designed for community input, open governance, and sustainable funding for development. The founders copied the code for Bitcoin (BTC 0.9%) and then modified it, so there are several similarities between these two cryptocurrencies.

The project takes a unique approach, especially its hybrid mining system. Read on for a full guide to Decred, including how it works and if it's worth buying.

Uniqueness

What makes Decred unique?

Most cryptocurrencies validate transactions using either a proof-of-work or a proof-of-stake system. In proof of work, cryptocurrency miners must solve complex equations for the right to confirm a block (group) of transactions. In proof of stake, validators must lock up their own cryptocurrency to participate in the process.

Decred employs a hybrid solution. Miners verify blocks of transactions, and voters who have staked DCR coins then check their work. When a block is approved, it's added to the Decred blockchain. The hybrid consensus mechanism makes the network more resistant to attacks than a single mechanism, Decred claims.

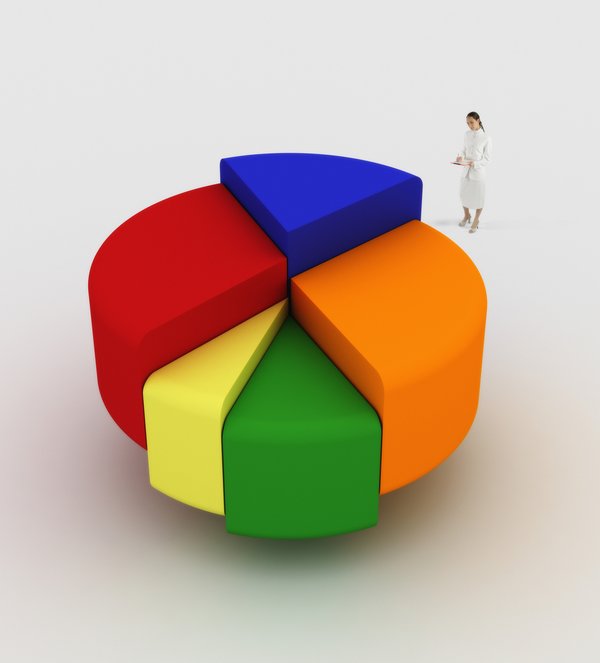

Like other cryptocurrencies, Decred incentivizes validators by providing a block reward paid in DCR coins. It splits the reward as follows:

- 10% to proof-of-work miners

- 80% to proof-of-stake voters

- 10% to the Decred treasury

The portion that goes to the Decred treasury is intended to make it sustainable. It ensures that Decred has the funding necessary to continue developing. Although the project spends some of its treasury funds to pay developers, its balance has climbed, and it now holds more than $30 million in DCR tokens.

Decred is also designed to make users an important part of its governance process. Those who stake their coins aren't just allowed to approve blocks of transactions. They're also able to vote on proposals and policies regarding the project through the cryptocurrency's governance platform, Politeia.

Where it came from

Where Decred came from

The idea for Decred came from a user, tacotime, on the Bitcointalk forum. They proposed a hybrid proof-of-work, proof-of-stake cryptocurrency called Memcoin2. They then started working with another user, _ingsoc, and Jake Yocom-Piatt on the project, which they called Decred.

Company 0 began developing Decred in February 2014 and launched the Decred mainnet in February 2016. When the blockchain launched, the team conducted a premine of 1.68 million DCR coins (8% of the total supply). Half went to Company 0 and its developers, and the other half were airdropped (distributed for free) for participants who signed up for the airdrop.

How it works

How Decred works

Decred is a digital currency based on Bitcoin's code, and it has the same maximum supply of 21 million coins. New coins are released into circulation through its mining process, which is also how transactions are confirmed and added to the blockchain.

Since Decred has a hybrid system, the mining process is separated into a proof-of-work stage and a proof-of-stake stage.

Miners handle the proof-of-work process by using ASICs (specialized mining hardware) to solve computational equations. The first miner to solve the equation gets to validate a block of transactions. They also receive the fees from all the transactions included in the block and the block reward of newly minted DCR coins.

Voters who have locked up their DCR coins handle the proof-of-stake process. In return for staking DCR, voters receive tickets. Stakeholders can also purchase more tickets, and each ticket owned is one vote.

The DCR protocol mines 20 fresh tickets into each block of transactions. It then calls on five of those tickets to vote on whether the block is valid. A block needs to receive at least three out of five votes to be considered valid and added to the blockchain.

The block reward is split between the miners (who receive 10%), the voters (80%), and the Decred treasury (10%).

Partnerships

Partnerships

In part because of how it's set up, this project hasn't established many partnerships. It's run by the Decred DAO (decentralized autonomous organization) and its Politeia web platform, so all decisions effectively go through Decred's stakeholders.

There has been one interesting example of Decred in action. During Brazil's 2020 municipal elections, 11 mayoral candidates partnered with Voto Legal and used Decred to timestamp and record their political donations. Because the Decred blockchain is immutable, it provided a transparent way to track fundraising.

Should I invest?

Can I make passive income with Decred?

You can make passive income with Decred through its staking/voting process. Since proof of stake is half of Decred's hybrid protocol, people who stake DCR coins earn rewards.

There are two ways to stake Decred: Solo Voting and a Voting Service Provider (VSP). Solo Voting is more advanced and requires that you run your own always-online crypto wallet.

A VSP is the easier option and doesn't require keeping a wallet online 24/7. You delegate your DCR coins to a VSP of your choosing, and it handles the rest. By doing this, you're granting your voting rights to the VSP, but it doesn't have access to your funds.

Risks

Unique risks

Decred's primary issue is that it doesn't have a compelling use case or any areas where it excels compared to other types of cryptocurrency.

According to the Decred website, its most powerful differentiators are its governance mechanisms. The founders created it because of their experiences with Bitcoin's governance model, which gave core developers and miners the bulk of the control. Decred addresses those perceived shortcomings through its decentralized, staking-based governance.

This was an innovative idea in 2013, and the Decred team deserves credit for implementing it, but it's also nothing special anymore. There are many cryptocurrencies that are used as governance tokens, giving stakeholders the right to make and vote on proposals.

Decred has struggled with user adoption, likely due to the lack of advantages or selling points. As we covered earlier, it hasn't done much in the way of partnerships, building an ecosystem of projects, or getting media coverage.

Related investing topics

Is Decred a good investment?

Decred has some interesting features, particularly its hybrid mining system, but it's not the best choice as a cryptocurrency investment.

When you look at the cryptocurrencies at the top of the market, they typically have a clearly defined use case. Bitcoin was the first cryptocurrency and has become a digital store of value. Smart contract blockchains, including Ethereum (ETH 0.82%), Solana (SOL -0.42%), and Cardano (ADA -0.57%), give developers a platform to build on.

On the other hand, Decred is essentially "Bitcoin but with better governance." Competing directly with Bitcoin is difficult, which is why most successful cryptocurrencies offer something different.

It's not that Decred is a bad project, but it's hard to see how it will stand out, and that's extremely important when investing in cryptocurrency. You can at least earn DCR coins by staking it, but there are plenty of other cryptocurrencies that offer staking as well.

How to buy Decred

If you're a U.S. investor, you can buy Decred on the Bittrex exchange. People outside the United States have access to more platforms that list Decred, including Binance.

Decred has been around a long time, and it was at the forefront of some important blockchain developments. Its value tends to follow the overall trend of the crypto market, so it's volatile and can go through significant price changes in a short span of time. Investors most likely to put money into Decred currently are technically inclined people who want to help participate in the governance of a rigorously decentralized blockchain project.

Keep that in mind if you decide to invest in Decred -- or any cryptocurrency. Look at it as a long-term investment that you'll keep for several years, and avoid putting in more money than you can afford to lose.