PancakeSwap (CAKE 0.11%) is a decentralized crypto exchange known for low fees and fast transactions. On PancakeSwap, anyone with a crypto wallet can swap tokens or stake them, meaning they let the exchange use their tokens in exchange for rewards.

Thanks to extremely high reward rates, PancakeSwap became one of the most popular decentralized finance (DeFi) platforms in 2021. At times it was offering rates of more than 100% to those who staked its native crypto token, CAKE.

On the downside, this exchange also quickly became popular with scammers and has a reputation as being a haven for pump-and-dump schemes. In this guide, you'll learn about the good and the bad of PancakeSwap.

What makes PancakeSwap unique?

What makes PancakeSwap unique?

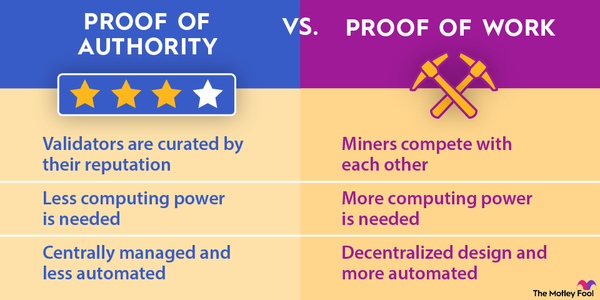

As a decentralized exchange, PancakeSwap is a crypto trading platform that doesn't have a central authority in charge. It's specifically considered an automated market maker (AMM). An AMM is a decentralized exchange that uses smart contracts -- programs running on a blockchain -- to offer crypto trading.

There are four main features on PancakeSwap:

- Trade: Swap different types of crypto tokens. There's no account required; you only need to connect a crypto wallet.

- Earn: Deposit crypto tokens to PancakeSwap and earn rewards. PancakeSwap offers trading through pools of funds, called liquidity pools, contributed by users.

- Win: Participate in lotteries and trading competitions. PancakeSwap regularly offers competitions like these with crypto prizes.

- NFTs: Buy and sell non-fungible tokens (NFTs). In addition to a crypto exchange, the platform also has an NFT marketplace.

There are more AMMs out there. Two other popular platforms, Uniswap (UNI -3.15%) and SushiSwap (SUSHI -2.63%), came out even before PancakeSwap.

PancakeSwap has a key advantage, though -- it's built on the BNB Smart Chain (previously known as the Binance Smart Chain). This blockchain, created by the Binance crypto exchange, keeps fees low and processes transactions very quickly.

Uniswap and SushiSwap are both built on Ethereum (ETH -0.14%), which has dealt with heavy network congestion. When Ethereum's network is congested, it increases gas fees (transaction fees) and slows down transactions.

Where PancakeSwap came from

Where PancakeSwap came from

An anonymous group of developers created PancakeSwap in September 2020. In a departure from other AMMs that were available at the time, the developers chose to build PancakeSwap on the BNB Smart Chain instead of Ethereum.

PancakeSwap didn't take long to become successful. By February 2021, it had become one of the largest decentralized crypto exchanges in terms of total value locked (TVL), or the amount of funds users had deposited.

How PancakeSwap works

How PancakeSwap works

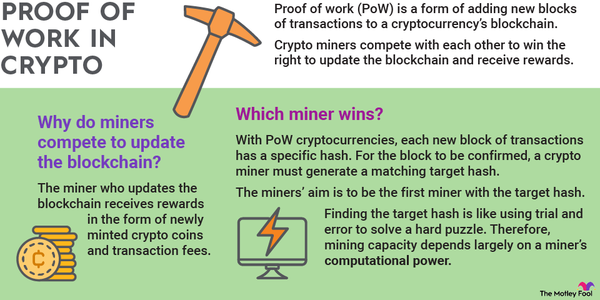

PancakeSwap allows users to trade any BEP20 crypto tokens (tokens built on the BNB Chain). Since it's decentralized, it offers crypto trading through liquidity pools.

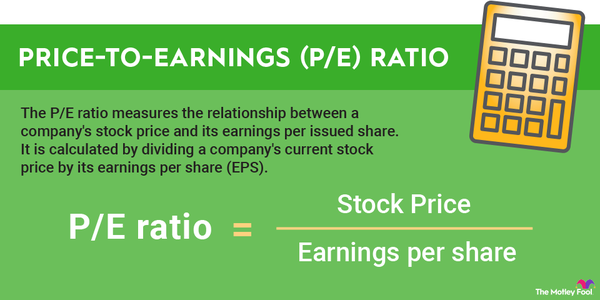

Each liquidity pool contains two different types of cryptocurrency and has a variable annual percentage rate (APR) paid in CAKE tokens. PancakeSwap pays that APR to depositors who lock up (stake) their funds in the pool. This incentivizes users to stake crypto, which is needed for other users to be able to trade.

Here's an example of how it works: Two of the cryptocurrencies you can trade on PancakeSwap are its native CAKE tokens and BNB (BNB 0.53%), the native token for the BNB Chain. To offer this, PancakeSwap has a CAKE-BNB liquidity pool containing both tokens. If you have those two tokens, you can deposit an equal amount of each one to the CAKE-BNB pool. You'll then earn CAKE tokens on the amount you've staked.

There's a massive number of liquidity pools on PancakeSwap. APRs are determined based on the cryptocurrencies in a pool and the pool's size (meaning its amount of funds). They're typically higher to start and then decrease as a pool grows.

Partnerships

PancakeSwap announced a partnership with Binance in March 2022. The two exchanges launched a PancakeSwap Mini Program in the Binance mobile app, so users of the app can also conveniently trade using PancakeSwap. The deal made PancakeSwap the first DeFi project to launch a Mini Program in the Binance ecosystem.

Although the Binance partnership is its biggest, PancakeSwap has also worked with other blockchain projects and companies. It launched a perpetual trading service with crypto exchange ApolloX and collaborated with Keystone, a company that designs hardware wallets for storing crypto.

Can I make passive income with PancakeSwap?

You can make passive income with PancakeSwap by staking cryptocurrency, and it's one of the reasons the platform became so popular.

There are two ways to stake on PancakeSwap. The first is through Syrup Pools, which only require that you stake CAKE tokens. Each pool earns a different type of crypto token. You can choose to stake and earn CAKE tokens or you can stake CAKE and get paid in something else.

The other option is through PancakeSwap's Farms. These are liquidity pools containing two cryptocurrencies, and you must deposit equal amounts of each one. Farms all pay CAKE tokens as rewards.

Although it previously hadn’t capped its token supply, PancakeSwap announced in mid-2022 that it would limit the number of CAKE tokens to 750 million and would add more utility to locked tokens to reduce the supply and raise value.

It's worth noting that staking on PancakeSwap is far from risk-free. If the value drops for any cryptocurrencies you've staked, you could end up losing money despite the rewards you're earning.

Unique risks

Unique risks

PancakeSwap has developed a reputation for being home to a large number of scams. It's easy and cheap to create crypto tokens and launch them on PancakeSwap. Unfortunately, this also means just about anyone can start their own crypto pump-and-dump scam.

Perhaps the most common scam is the rug pull. Scammers create a crypto token, promote it heavily on social media, and wait for people to trade for it. Once it has increased in value, they sell all their own tokens, causing the price to plummet.

In addition to rug pulls, PancakeSwap users are frequent targets of phishing scams, leading the platform to issue a warning in November 2021. A DNS hijacking of the PancakeSwap website in March 2021 was a reminder that blockchains can still be attacked via internet infrastructure, even when the blockchain code itself is not exploited.

These scams are all avoidable, and they happen on other decentralized exchanges as well. But PancakeSwap users have complained that it hasn't done much about the problem either. For its part, the exchange has published five security reviews, including a Certik audit.

Is PancakeSwap a good investment?

Is PancakeSwap a good investment?

With its position in the DeFi ecosystem and all the staking options it has, PancakeSwap offers a good crypto investment opportunity.

PancakeSwap is normally the second-most-active decentralized exchange in terms of trading volume, only behind Uniswap. It's also one of the largest DeFi protocols in terms of TVL. There are several reasons to like it compared to the competition:

- It has low fees. That makes it much more usable than platforms built on Ethereum, especially for those who want to make smaller transactions and would be priced out by expensive fees.

- It makes staking easy and straightforward. The entire staking process can be completed in minutes. Unlike some other AMMs, PancakeSwap provides APRs with all its pools, so you know how much you'll earn with each one.

- It has a massive variety of pools and farms. No matter what BEP20 tokens you have, you'll likely be able to stake them on PancakeSwap.

Even with those advantages, PancakeSwap is still very risky. DeFi hasn't been around long, and it's hard to predict where it will go in the future. There's a lot to like about PancakeSwap, but you should still be cautious about how much you invest and be prepared for its volatility.

Related investing topics

How to buy PancakeSwap

How to buy PancakeSwap

The challenging part of investing in PancakeSwap is finding a place to buy it, at least for U.S. residents. Although it's available on Binance, the exchange is prohibited in the U.S.

Instead of buying CAKE outright, it's more common to trade for it using another BEP20 token. The best option is BNB, which you can find on Binance.US. After you buy BNB, transfer it to a crypto wallet, connect your wallet to PancakeSwap, and swap your BNB for CAKE.

It's a little bit of a process to trade for CAKE, but if you're going to invest in this cryptocurrency, it makes sense to learn how the PancakeSwap platform works. This will also be helpful if you want to stake your CAKE tokens, which is recommended to earn rewards on them.