During the market exuberance of 2020 and 2021, the term “to the moon” was frequently used when referring to cryptocurrencies, digital assets, and high-growth stocks. After a rough start to 2022, the phrase and accompanying emojis of rocket ships are in much shorter supply. Investors still have high hopes for their digital investments, though. Here’s what “to the moon” means in the world of crypto.

What does it mean?

What does “to the moon” mean?

Investors who hope for a big increase in their cryptocurrency or other asset’s value will use the phrase “to the moon.” Since the moon sits high in the sky, the term is a play on other terms such as “sky-high valuation,” “soaring prices,” and the like. On social media sites, investors will sometimes tout the strong performance of a crypto or a stock and use a phrase such as “mooning” accompanied with rocket ship emojis.

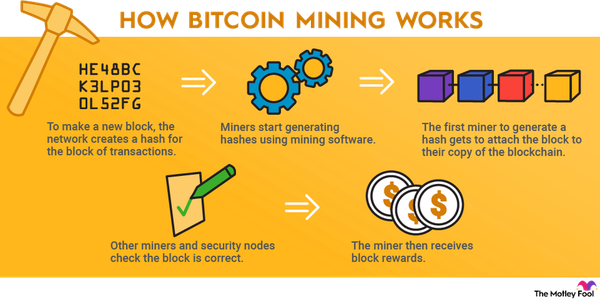

These terms can be traced to the crypto market. Bitcoin (BTC 3.35%) in particular, the first cryptocurrency, had an epic run in 2017. It was worth about $1,000 at the start of the year but climbed to nearly $20,000 by December 2017. 2018 was a rough patch for the crypto market as prices pulled back from highs, but they came roaring back after that.

Crypto “mooning” on social media reached a crescendo in 2020 and 2021. During the early pandemic, the Federal Reserve cut interest rates to near zero while the federal government started sending economic aid to households and businesses. With all of that cheap money sloshing around the economy, quite a bit of it found its way into the crypto industry and stock market.

Bitcoin reached an all-time high of nearly $69,000 in late 2021. The second largest crypto, Ethereum (ETH 2.39%), topped $4,800 at one point.

Additionally, new cryptocurrencies were being created daily. Digital art, such as non-fungible tokens (NFTs), was making headlines with sale prices reaching into the millions of dollars. As asset prices climbed higher, many retail investors took to the internet to pump their winning streak as investments seemingly flew “to the moon.”

A cautionary tale

A cautionary tale

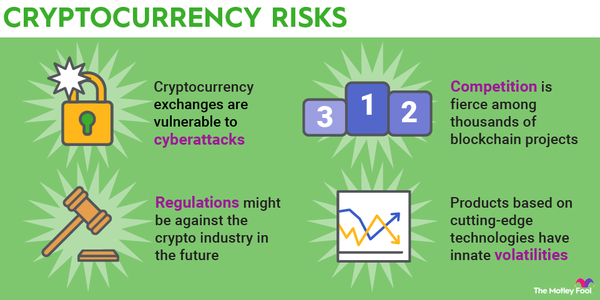

2022 has been a very different story for crypto. Rather than soaring “to the moon,” crypto prices have been hit hard. Inflation has forced an end to the easy money and easy investing period of the early pandemic. Higher interest rates are putting downward pressure on asset prices, especially high-growth, highly volatile assets such as cryptocurrencies that are still relatively new in the investment world.

Related Investing Topics

That isn’t to say crypto is dead. It’s likely to have another heyday at some point in the future. “Mooning” could make a comeback. But remember to keep a level head when that time comes. Investments don’t skyrocket to the moon forever. Eventually gravity injects some reality back into the mix, and prices normalize -- or even crash and completely reverse soaring investment gains.

Don’t pile all-in when others trumpet “to the moon.” Even when crypto seems to be the best game in town, it’s important to maintain discipline and have a diversified investment portfolio that features multiple investment classes such as stocks and bonds.