This article was co-authored by Stacey Curtis.

When Gavin Wood, the co-founder of Ethereum, coined the term “Web3” in 2014, he described it as a “decentralized online ecosystem based on blockchain.” Although his description identifies Web3 in a technical way, the term also carries visions of the revolutionary forms of online interactions that such decentralized apps can bring. Web3 can mean something precise and technical, but it can also be used in a philosophical way.

The first generation of web applications mostly just allowed users to read content, and the second generation has offered us more interaction in reading and writing. Web3, as a third generation, can allow users to read, write, produce, and own the content they contribute.

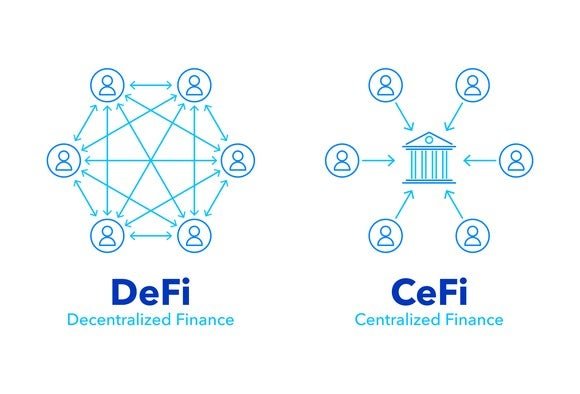

How is Web3 revolutionary? Some people describe Web3 as bringing social equality to web applications. Web3 applications also allow users to directly interact with each other, offering users more control and the option to sidestep big tech companies. By decentralizing the design of applications, Web3 also decentralizes social control of those ecosystems. Web3 applications achieve this by leveraging blockchain networks and smart contracts.

Blockchains, dApps, and Web3

Blockchains, dApps, and Web3

Blockchain, decentralized applications (dApps), and user empowerment go hand in hand. For users to interact with peers without a company collecting and sometimes limiting information along the way, users need to be able to directly communicate. But how can an application work without relying on a company to run it? dApps achieve this by existing as smart contracts on a public blockchain such as Ethereum (ETH 0.8%) instead of on a corporate server. Public blockchain networks allow dApps to provide services to anyone without the need for any company to participate.

Here is a simplified image that demonstrates how a Web3 decentralized finance (DeFi) app connects people to one another as opposed to a traditional financial application that connects each user to a banking institution.

Theoretically, now freed from centralized control, users can directly collaborate to build digital ecosystems, earn crypto tokens, and maybe even reap some of the rewards of building a successful online world.

There is a catch, though. Someone still needs to design the applications, write the code, and organize the community efforts. In other words, someone has to manage the project and sometimes pay salaries. Where is that money going to come from?

Who is building Web3?

Who is building Web3?

Web3 applications can be built by any person or any organization. Some Web3 project volunteers even contribute time and effort without pay. However, money to fund large Web3 efforts is often raised through a public or private Initial Coin Offering (ICO) , which is a sale of project crypto tokens that can be worth a lot more in the future if the initiative is successful.

Venture capital (VC) firms have been eager to provide funding for Web3 projects. They are a natural fit as investors since many of them already understand how to evaluate and build software and how to identify successful project roadmaps.

Additionally, Gavin Wood established the Switzerland-based Web3 Foundation, which supports funding and education related to Web3 projects. So far, the foundation has funded grants for more than 300 projects in more than 50 countries.

Web3 and the individual

Web3 and the individual

Philosophically, Web3 encourages the empowerment of individual users. Most Web3 projects are careful to describe in their introductory white paper how a significant proportion of their tokens (and the potential profit and control that come with token ownership) are available for the public to purchase. Sometimes companies even “airdrop” free tokens to selected audiences to generate interest.

Acquiring (buying, earning, or being gifted) Web3 project tokens is the most direct path to investing in Web3 technologies. Tokens work differently for each blockchain project; these characteristics are sometimes called its “tokenomics.” Tokens may be sold or traded on exchanges. They may also allow access to application services or they could be used to qualify to vote on proposals. Some Web3 tokens can be leveraged to earn passive income through network-supporting uses such as staking. To understand a Web3 project's tokens, you have to research the project. Almost all projects offer a white paper describing their purpose and how their tokens work.

Does Web3 already exist?

Does Web3 already exist?

Yes. Two popular Web3 applications that currently allow peer-to-peer users to trade crypto tokens are Uniswap (UNI 2.34%), which runs on Ethereum, and PancakeSwap (CAKE -4.22%), which runs on Binance Smart Chain (BSC). There are many smaller, up-and-coming decentralized Web3 dApps which can be browsed at portals like DappRadar.

There are still some limitations in building full Web3 applications, partially due to high compute costs and high storage costs for blockchain-stored data. For this reason, hybrid Web2-Web3 application ecosystems may be more common in the short term than pure Web3 ecosystems. Soon, though, we will see more Web3 dApps follow, with corresponding progress in decentralized file storage capabilities such as Filecoin (FIL -1.32%) and the Interplanetary File System.

Web3 for DeFi

Web3 for DeFi

Decentralized finance applications can leverage Web3 technology to provide payment and cross-user transaction services, even to people without bank accounts. For people with financial accounts, DeFi can be integrated with traditional accounts and offer advanced additional capabilities such as futures and leveraged trading.

Web3 for the metaverse

Web3 for the metaverse

Metaverses, or virtual worlds, can also leverage Web3. In fact, they are a natural fit for Web3 because metaverse users primarily interact directly with other users, and metaverse community members are often motivated to help with ecosystem planning and governance.

What else does Web3 promise?

What else does Web3 promise?

As a style of application architecture more than a rigidly defined standard, Web3 can take an almost unlimited variety of forms. Besides finance and metaverse dApps, other candidates for Web3 include social networks, games, direct publishing, and all kinds of marketplaces.

The degree to which Web3 will empower users will depend on user participation levels. The most successful Web3 projects will be those where user-members are eager to be part of the community, motivated to contribute content, and willing to provide feedback.

From an investment perspective, it makes sense to keep an open mind about Web3 and an awareness of the maturation of the dApp marketplace. It’s still early days for Web3 projects, and potential profits in such new technologies are high if you choose winning projects. However, it’s important to keep in mind that the regulatory landscape for all cryptos could shift and affect how crypto-based ecosystems are funded or governed, which could have an unpredictable impact on Web3 dApp token demand and prices. Be cautious, and consider how much risk your portfolio can accommodate.